Despite a fairly good opening on the European stock market, shortly after 8:00 BST the main indices started to fall. The dynamics of the depreciation was very high, but as it later turned out, the declines were only temporary and most stock market indices managed to end the day on a positive note. At one point, the German stock index dived over 200 points. Eventually, however, DAX gained 0.5%, while French CAC40 added 0.7% and London's FTSE100 closed 0.28% higher.

Today's session has been particularly kind to technology companies, which are gaining thanks to Elon Musk revealing his position on Twitter shares. Social media companies have fueled gains on the US500 and US100 indices. The reaction to the reported statement was a nearly 25% rally in Twitter shares. The technology index is up more than 1.6% today, with the US500 adding 0.6%. The industrial US30 also trades slightly higher, gaining 0.1%. Although the hawkish comments from Fed members have not faded, the markets are resuming robust gains despite the decision to raise US interest rates 3 weeks ago. On the front, investors are currently focusing their attention on reports of war crimes that could weigh on the next packages of sanctions imposed by the West. As early as next week, the US companies' Q1 2022 earnings release cycle will begin.

Oil prices have regained some ground, although black gold is still under pressure from plans to release strategic reserves and reduced demand due to lockdown in Chinese cities, 10-year yields jumped to 2.406% today from 2.374% recorded on Friday.

In the cryptocurrency market, we are seeing a deceleration of the upward movement that we have been experiencing since mid-March. Bitcoin quotes retreated today from the $47,000 level below $45,500. The other cryptocurrencies also went under today, with Ethereum losing around 3% and Ripple dropping 4.4%.

Monday's forex session was rather quiet. The dollar weakened about 0.5% against AUD and NZD, as well as 0.15% against CAD. However, the American currency managed to strengthen as much as 0.7% against the EUR. The major currency pair lost steadily throughout the day and fell below the $1.10 level.

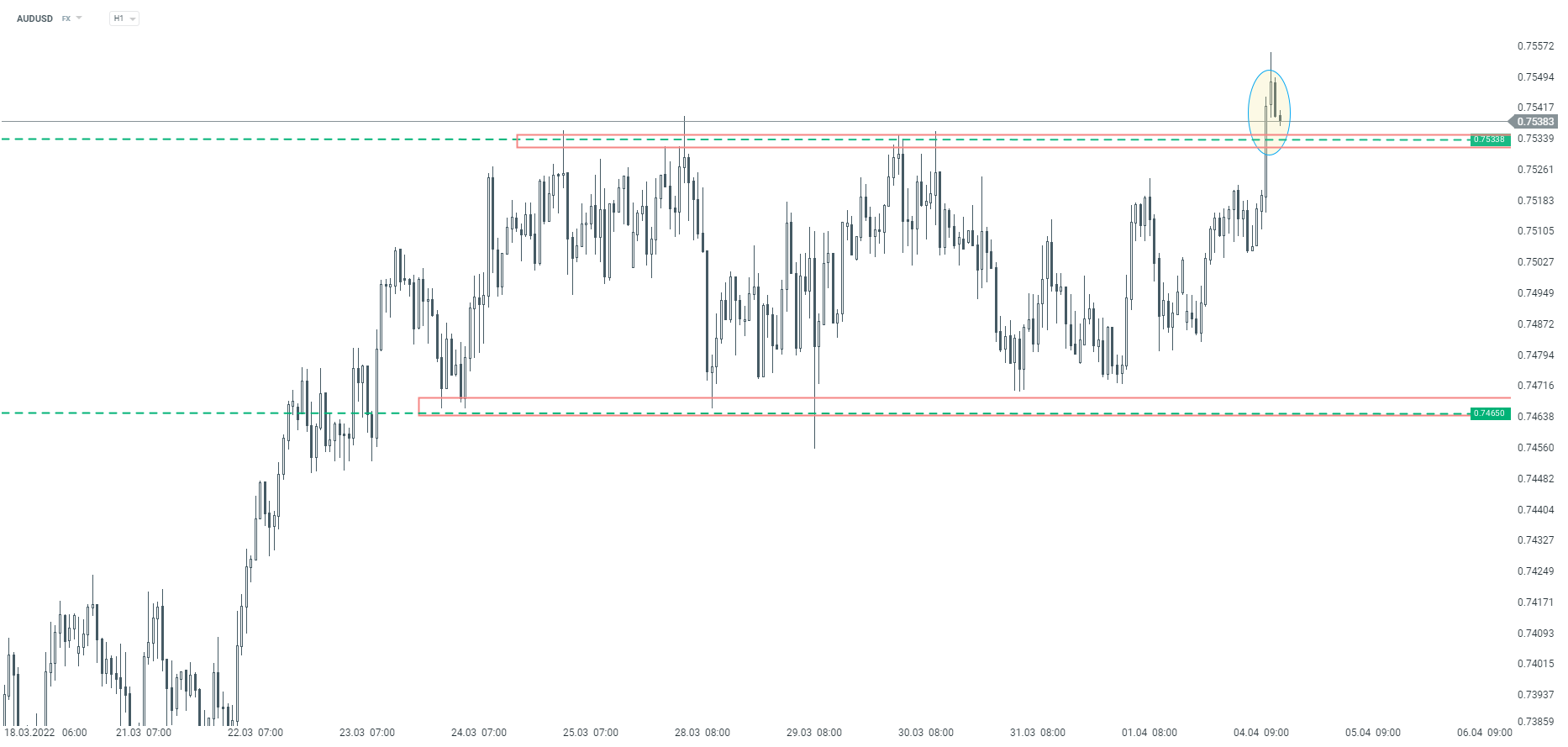

AUDUSD quotations broke out the upper resistance at the level of 0.7533 and left the local consolidation. Currently, we are seeing a pullback, but the mentioned resistance at 0.7533 should be treated as support. If the price manages to stay above, there is a chance for the continuation of the upward movement. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.