- European equities higher despite rising yields

- The 10-year Treasury yield hit a 14-month high

- US jobless claims unexpectedly increase to a one-month high

European indices finished today's session higher despite rising Treasury yields. The German DAX reached new historic highs and is approaching 14,800 pts level, partially thanks to the superb performance of Volkswagen stock, which is planning to surpass the current leader in the electric car market, Tesla. It's also worth mentioning that the Dax index is largely composed of cyclical stocks that have been doing well recently. Meanwhile, ECB President Lagarde said that short-term inflation movement related to temporary factors of a transitory nature should not precipitate any particular move. Elsewhere, the BoE left interest rate on hold at a record low of 0.1 % and its bond-buying programme unchanged during its March meeting.

US indices are trading under pressure today. Nasdaq fell more than 2.5% and the S&P 500 lost nearly 0.7% as yields continue to soar which weighs on tech stocks. The 10-year Treasury yield rose to 1.75% , the highest level in 14 months, while the 30-year bond reached 2.50% level. Meanwhile, the Dow Jones pulled back after the index hit a fresh record high, early in the session led by the banking sector and cyclical stocks. It seems that FED Chair Powell failed to calm investors' nerves over runaway inflation and market measures of inflation expectations rose to multi year highs. On the data front, initial claims unexpectedly increased 45,000 to a seasonally adjusted 770k from 725k in the prior week, above analysts’ expectations of 700k. Philadelphia Federal Reserve’s manufacturing index jumped to 51.8, the highest reading since 1973 well above market consensus of 22.0.

WTI crude fell more than 7.0% and is trading slightly above $60.00 a barrel, while Brent is trading 6.90% lower around $63.30 a barrel. The International Energy Agency said in its monthly report that demand is not expected to return to pre-pandemic levels until 2023. Elsewhere gold fell 0.6 % to $ 1,733.00 / oz, while silver is trading 1.3 % lower near $ 26.00 / oz as both the dollar and Treasury yields soared on concerns over price pressures despite the Fed maintained its dovish stance.

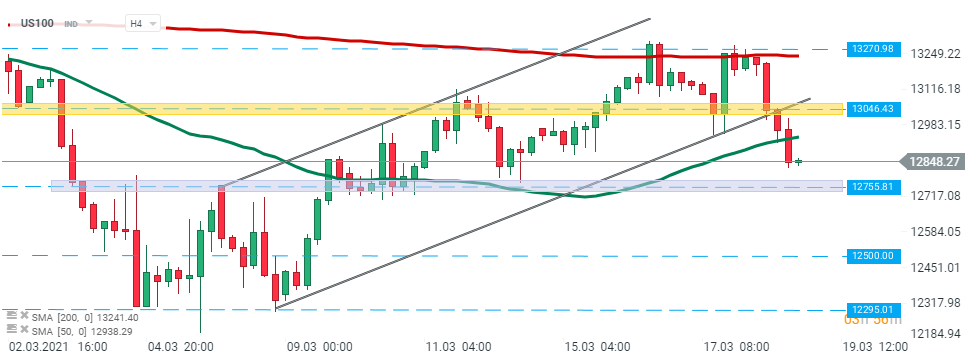

US100 fell more than 2.5% as a spike in US bond yields put pressure on tech stocks. Early in the session index broke below an important support zone which consists of the lower limit of the ascending channel and 13,046 pts level. Later sellers managed to break below 50 SMA (green line) which opened the way towards next support at 12,755 pts. Only, breaking above the aforementioned 13,046 pts level will invalidate the bearish scenario. Source: xStation5

US100 fell more than 2.5% as a spike in US bond yields put pressure on tech stocks. Early in the session index broke below an important support zone which consists of the lower limit of the ascending channel and 13,046 pts level. Later sellers managed to break below 50 SMA (green line) which opened the way towards next support at 12,755 pts. Only, breaking above the aforementioned 13,046 pts level will invalidate the bearish scenario. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.