- European equities extended gains on Friday

- US retail sales unexpectedly beat forecasts

- Bitcoin breaks above $60,000

European indices finished today's session higher and recorded their best week since March after a solid start to the Q3 earnings season lifted market sentiment. Investors also welcomed the news that next week European Union leaders are set to approve emergency measures to provide short-term relief to households and businesses amid an unprecedented energy crisis. DAX gained 2.5% this week and reached the highest level since the end of September and the biggest weekly rise since March.

Upbeat mood prevail on Wall Street after better-than-expected third-quarter earnings reports and surprisingly strong retail sales figures which rose 0.7%, while economists expected a 0.2% decline. Today’s data should help cement expectations for a taper announcement from the Federal Reserve during its November meeting. Earnings momentum continued on Friday as Goldman Sachs smashed analysts' forecasts. Yesterday, eight S&P 500 companies reported quarterly results with each topping estimates, led by financial giants Bank of America, Morgan Stanley and Citigroup. On the week, three major US indices are on track to book gains.

On the commodities markets, WTI crude price rose nearly 1% to the $82 a barrel level, while Brent is trading 0.70% higher around $84.50 as shortages of natural gas in Europe and Asia continue to boost demand for oil and supply tightness persists. Elsewhere, gold fell 1.8% and silver is trading 0.90% lower, subdued by a double whammy of higher US Treasury yields and a slightly stronger US dollar.

Prices of major cryptocurrencies rose sharply during today’s session after sources close to the Securities & Exchange Commission (SEC) have confirmed the launch of Bitcoin futures backed ETF soon, according to Bloomberg. Regulator did not officially confirm the news yet, and there are four applications lined up for approval. However Bloomberg's senior ETF analyst has given over 90% odds of SEC approving at least one futures-backed ETF. As a result Bitcoin price rose nearly 6% and is approaching $60,800 level, while most of the altcoins gain 2% on average.

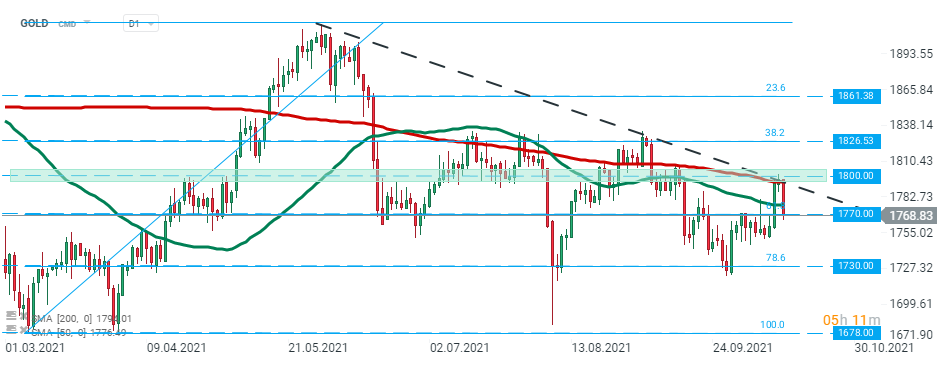

Gold prices rose sharply in the first part of the week, however buyers failed to break above the major resistance zone around $1800.00 and the price pulled back. Currently gold is testing local support at $1770.00 which coincides with 61.8% Fibonacci retracement of the last upward wave launched in March and 50 SMA (green line). Should break lower occur, downward move may accelerate towards major support at $1730 which is marked with previous price reactions and 78.6% retracement. Source: xStation5

Gold prices rose sharply in the first part of the week, however buyers failed to break above the major resistance zone around $1800.00 and the price pulled back. Currently gold is testing local support at $1770.00 which coincides with 61.8% Fibonacci retracement of the last upward wave launched in March and 50 SMA (green line). Should break lower occur, downward move may accelerate towards major support at $1730 which is marked with previous price reactions and 78.6% retracement. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.