- Europe indices closed Friday's session with mixed sentiments. France's CAC40 gained the most (+1.31%), mainly due to the rejection of proposals for new taxes for companies with the overthrow of Prime Minister Barnier's government (and thus budget). Germany's DAX added 0.13%, but British FTSE lagged

- Wall Street optimism is still very solid, supported by NFP labor market report, and rising expectations of a 25bp interest rate cut in December. The Nasdaq (+0.7%) leads the gains, followed by the Russell 2000 (+0.4%), and the S&P500 adds 0.22%. The Dow Jones is the exception, currently losing 0.2%.

- The IT and software sector is doing great (Palantir, Adobe, AppLovin); among BigTech companies, Meta Platforms and Alphabet lead gains. Lululemon shares gain more than 18%, after successful quarterly results; gun maker Smith & Wesson loses 17% after disappointing guidance and comments on weakening demand

- Despite a little 'softer' NFP report, Fed member such as Goolsbee, Daly and Hammack signalled today that progress on lowering US inflation have stalled, and Fed may stop rate cuts in 2025. US dollar (USDIDX) gains 0.3% against a basket of foreign currencies

- The US labor market report showed a strong rebound in non-farm payrollsin November (227k new jobs; forecast: 202k; previous: 36k, revised to 12k) and a 0.1 pp increase in unemployment to 4.2%. Wage growth turned out to be slightly higher on both a monthly and annual basis. Also UoM sentiments came in stronger than expected, with little higher inflation expectations

University of Michigan consumer sentiments report (prelim) came in 74 vs 73.2 and 71.8 previously

- Expectations: Actual 71.6 (Forecast 77.7, Previous 76.9)

- Condition Prelim: 77.7 (Forecast 65.2, Previous 63.9)

University Michigan 1 Yr Inflation Prelim Actual 2.9% (Forecast 2.7%, Previous 2.6%)

- University Michigan 5 Yr Inflation Prelim Actual 3.1% (Forecast 3.1%, Previous 3.2%)

- Crude oil contracts lose almost 1%, while natural gas contracts gain slightly. Coffee contracts rose more than 5%. Platinum and palladium posted nearly 1% declines; gold rose slightly.

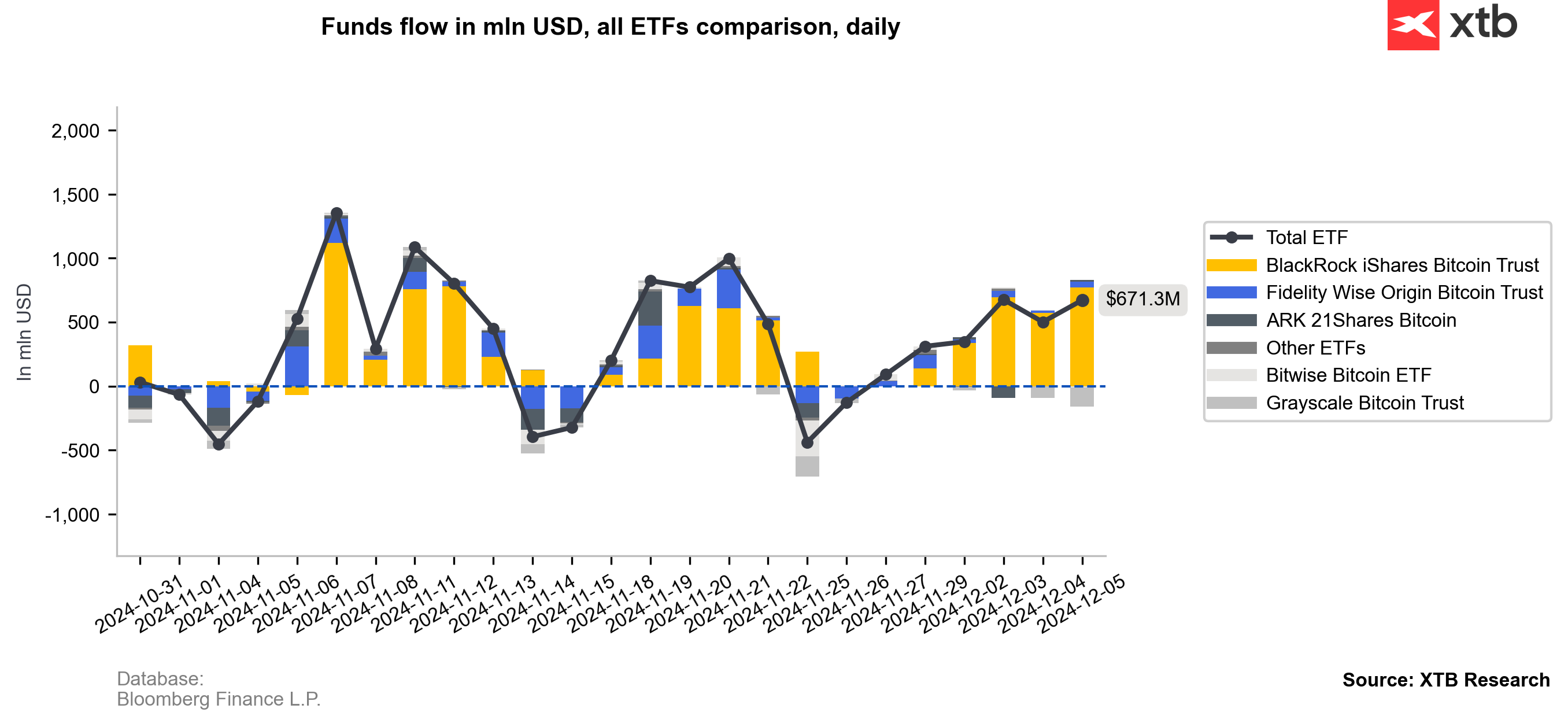

- Cryptocurrencies are gaining, with Bitcoin trading up nearly 5% to $101,500, recovering from yesterday's declines that pulled the price down from the $104,000 level to $95,000 on the night of December 5-6. Smaller cryptocurrencies like Uniswap are also gaining, rising 16% today. Data for yesterday show $671 million net inflows to Bitcoin ETFs; a very solid streak.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.