- AstraZeneca releases positive Phase 2 COVID-19 vaccine results

- US COVID-19 death toll surpassed 250,000

- US stocks swing between gains and losses

US indices are trading mixed as soaring COVID-19 infections an unexpected rise in weekly jobless claims sparked fears of a slower-than-expected economic recovery. Yesterday US reported more than 173 768 new infections, which is the second-highest number since the pandemic began. Death toll from COVID-19 surpassed 250k on Wednesday. Also hospitalizations reached record number of 79 410. Due to worsening pandemic situation all public schools in New York will be closed. Also new restrictions will be imposed in Kentucky, Minnesota and Wisconsin. On the data front, initial jobless claims rose for the first time since October to a higher-than-expected 742K.

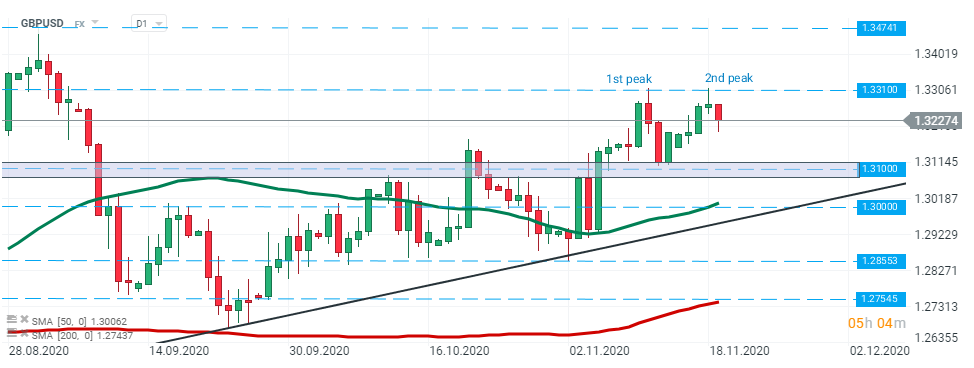

GBPUSD – pair has been trading in an upward trend recently. However, price did not manage to break above the high from 11th November and a double top pattern may be on the cards. The 1.3100 handle is a key support for now. If sellers manage to break below, a bigger downward correction may start. On the other hand, bouncing off the support may trigger another upward impulse. Source: xStation5

GBPUSD – pair has been trading in an upward trend recently. However, price did not manage to break above the high from 11th November and a double top pattern may be on the cards. The 1.3100 handle is a key support for now. If sellers manage to break below, a bigger downward correction may start. On the other hand, bouncing off the support may trigger another upward impulse. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.