- European stocks finished session lower

- Mixed moods on Wall Street

- US oil inventories fell more than expected

European indices broke the 5 session winning streak and closed mostly in the red amid low trading volumes. Frankfurt's DAX 30 fell 0.7% and Paris' CAC 40 dropped 0.27%, still trading near a recent record high, as a spike in coronavirus cases weighed on market sentiment. Meanwhile, London's FTSE 100 jumped to a fresh 22-month high, helped by the UK's health minister who said the government would not impose new restrictions this week, as it waits to see if health services can manage high infection rates.

Mixed moods prevail on Wall Street - Dow Jones rose 0.20% and is heading for its 6th straight day of gains. The S&P 500 is trading flat and the Nasdaq Composite shed 0.25% as investors continue to assess whether the omicron variant will derail the global recovery. Recent studies showed that new variant may not be as severe as initially expected, however the number of new daily cases reached record high yesterday according to data from Worldometers. The increase in new infections significantly exceeded 1 million, which at the moment seems to be an abstract number. It goes without saying that this is related to a new strain of the coronavirus that is also affecting countries where it seemed that the fight against the pandemic might already be won. We are talking about China and, above all, Australia, where the number of cases is growing astronomically every day. In addition, it is worth paying attention to the United States, which recorded a record of new cases at the level of over 300,000. Such a strong spike in cases may have contributed in some way to the weakness of the dollar, even despite rising yields. On the other hand, the large depreciation of the dollar is probably the effect of financial flows at the end of the year.

When it comes to commodities markets, oil prices rose slightly after a recent EIA report showed that US crude oil inventories dropped by 3.576 million barrels in the week ending December 24th, a fifth consecutive period of declines and compared with analysts’ estimates of a 3.143 million decline. Precious metals took a hit despite the weaker dollar, however managed to partially erase some of the losses later in the session. Bitcoin extended yesterday's downward move, however sellers failed to break below $46 500. Meanwhile, Ethereum price defended $3700 level.

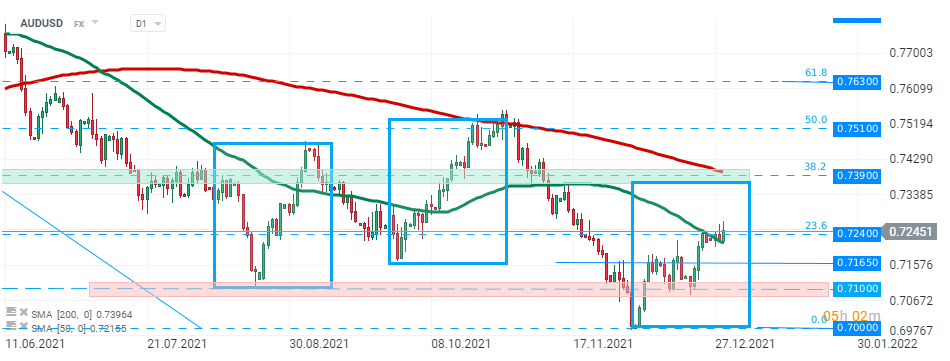

AUDUSD pair moved higher today, however buyers struggle to break above the major resistance at 0.7240 which is marked with previous price reactions and 23.6% Fibonacci retracement of the downward move launched in February 2021. Should a break higher occur, an upward move may accelerate towards the next resistance at 0.7390 which coincides with 200 SMA (red line) and 38.2% Fibonacci retracement. On the other hand , if sellers will manage to halt advances, then support l at 0.7165 may be at risk. Source: xStation5

AUDUSD pair moved higher today, however buyers struggle to break above the major resistance at 0.7240 which is marked with previous price reactions and 23.6% Fibonacci retracement of the downward move launched in February 2021. Should a break higher occur, an upward move may accelerate towards the next resistance at 0.7390 which coincides with 200 SMA (red line) and 38.2% Fibonacci retracement. On the other hand , if sellers will manage to halt advances, then support l at 0.7165 may be at risk. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.