-

European stocks flat or slightly lower

-

US markets advance, small caps outperform

-

US dollar recovers against most major currencies

-

NZD soared after RBNZ signalled a rate hike

Wednesday was a mixed day for European equities. Major stock indices from the region finished the session flat or slightly lower. Stocks from Switzerland and Portugal outperformed and managed to post some minor gains. However, equities from the US move higher while Wall Street CEOs are finishing their first day of testimony. The Nasdaq100 (US100) is gaining 0.50%. Russell 2000 (US2000) is a top gainer today as small caps are adding 1.30%

In the afternoon, the US dollar is recovering against all major currencies with the exception of NZD. Gold prices climbed slightly above $1912 an ounce, but most gains have already been erased. Nevertheless, gold bulls still managed to defend the $1900 zone and the precious metal is trading slightly higher on the day. On the other hand, silver prices dropped below $28 level.

There were only 2 major market-moving events in today’s calendar. Firstly, the RBNZ announced its interest rate decision. The Bank held its official cash rate at a record low of 0.25%, but signalled a 25 basis points rate hike by September 2022 - the message sent NZD significantly higher. In the afternoon, oil prices jumped on DOE’s oil inventories data. The weekly report showed that oil inventories fell by 1.662 mb, more than expected.

Tomorrow markets will focus primarily on US economic data, including Q1 GDP print, durable goods orders for April and jobless claims (all at 1:30 pm BST). Pending home sales figures from the US will be released at 3 pm BST.

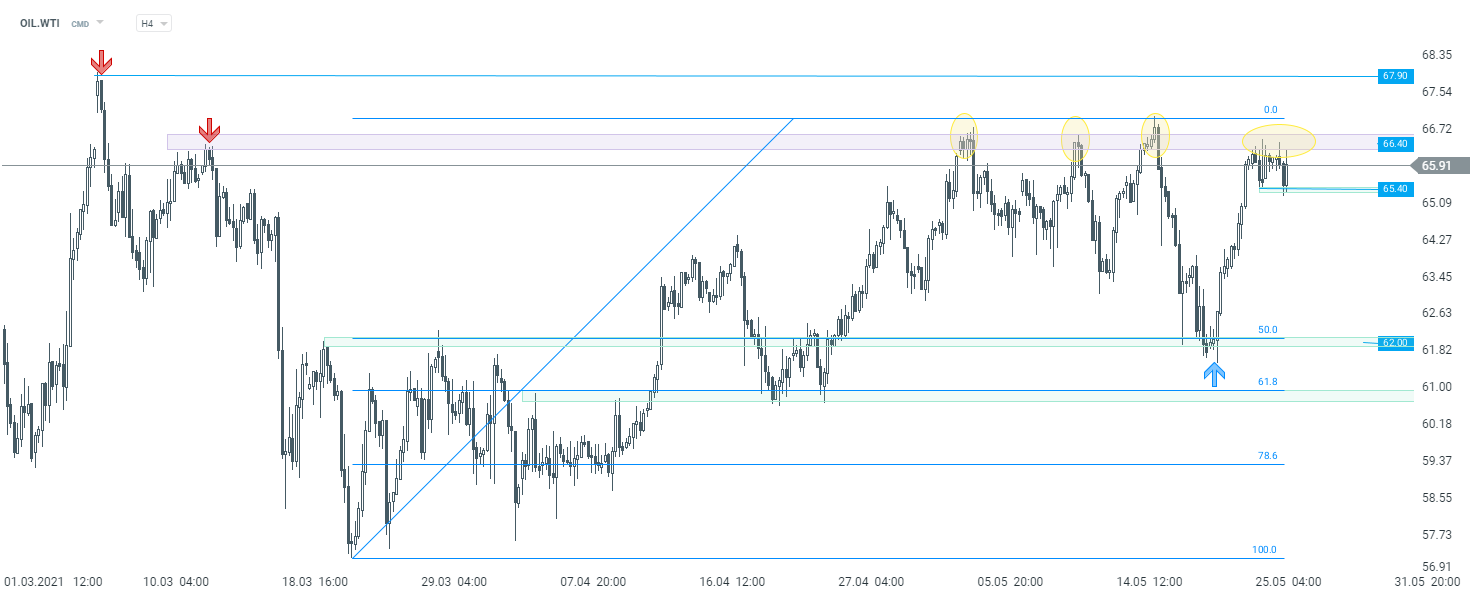

OIL.WTI started the session lower, but bulls gained advantage near $65.40 a barrel - it remains key short-term support level. A rebound in the second part of the day can be ascribed to the DOE’s weekly report on oil inventories. Taking a look at H4 interval, oil prices clearly struggle with resistance area near $66.40. However, breaking above it could potentially pave the way towards 2021-highs near $67.90 a barrel. Source: xStation5

OIL.WTI started the session lower, but bulls gained advantage near $65.40 a barrel - it remains key short-term support level. A rebound in the second part of the day can be ascribed to the DOE’s weekly report on oil inventories. Taking a look at H4 interval, oil prices clearly struggle with resistance area near $66.40. However, breaking above it could potentially pave the way towards 2021-highs near $67.90 a barrel. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.