Today’s session saw US Indices start with gains despite elevated inflation levels and as preliminary Michigan consumer sentiment data came in above expectations. The CPI data reading was in line with analysts' expectation but the most important thing for markets remains the FOMC’s decision on interest rates and the potential impact of the new Omicron variant. On the H4 chart, US500 managed to break above the 78.6% Fibonacci retracement and tested the zone of recent local tops near 4700 points before pulling back once again and hovering around 4680 points as sentiment worsened. Meanwhile, the German index (DE30) was able to rebound from a low of 15,531 and is currently testing a previous reaction area of 15,636 points in the last trading session of the week. European markets will also have an opportunity to react next week as the ECB is expected to announce its rate decision as well.

USD pulled back in the second part of the day after the greenback received a slight boost ahead of the US CPI data. EURUSD has managed to return above the 1,13 level after adding around 0,5% from the low, while GBPUSD was able to reach a high of 1.327 after briefly falling below the 1.32 level earlier today. Currency markets also await next week’s central bank decisions as recent developments may bring some unexpected surprises regarding interest rates or monetary policy.

The cryptocurrency market continues to struggle as Bitcoin failed to return above the $50,000 level and remains in the $47,500 area as the crypto fear and greed index indicates “extreme fear” conditions and while the total cryptocurrency market cap sits around $2,2 Trillion after dropping 3,6% in the last day.

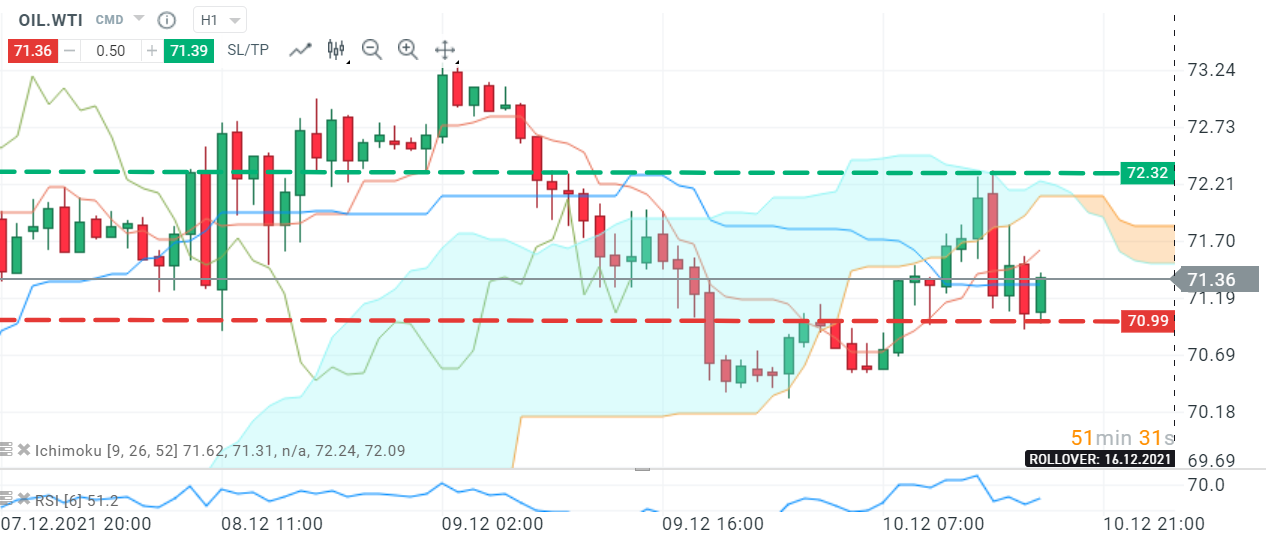

The price of Oil.WTI fell sharply yesterday as traders reassessed the demand outlook following recent mixed news regarding Omicron strain but has managed to rebound slightly with the commodity trading in the $71 area after pulling back from a daily high of $72,30 and as governments assess the potential measures needed to contend with the new variant while simultaneously facilitating economic activity. Source:xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.