-

Sell-off on global stock markets

-

US bond yields tumble

-

Jobless claims unexpectedly rise

-

Oil moves higher after EIA data

Global equities fell sharply on Thursday amid a broad-based sell-off. Some major European indices tanked more than 2%. Risk-off mood is seen on Wall Street as well, but stocks are currently trying to recoup some losses. At press time the S&P 500 (US500) is down by 0.80% while the Nasdaq100 (US100) is trading 0.50% lower.

Investors might have been spooked by some headlines on the Delta variant of Covid-19, which is now the dominant strain in the US. This might raise concerns about the economic recovery around the world. Apart from that, Tokyo banned Olympic spectators as Japan declared state of emergency - another sign that the combat with the virus is not over yet.

Bond yields plunged today as investors rushed to buy debt securities. US 10-year Treasury yield fell to 1.25%, lowest levels since February. The ECB set its inflation target at 2% after its policy review, allowing consumer prices to overshoot when deemed necessary. From the data front, US jobless claims unexpectedly rose to 373k (vs exp. 350k). The EIA data showed that US oil inventories fell more than expected - oil prices jumped after the release.

Gold prices jumped above $1,800 an ounce amid elevated uncertainty, but the precious metal gave up most gains. The situation on the FX market is rather mixed - despite risk-off mood the USD is not gaining across the board. EURUSD was trading higher, climbing to session highs near 1.1867 and the greenback was also weakening against the JPY.

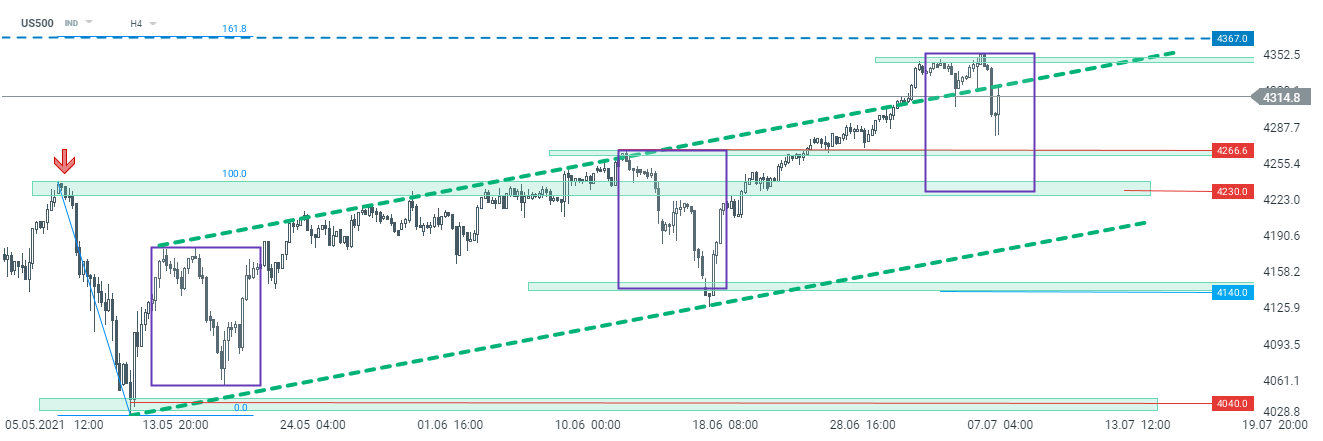

US500 rebounded from session lows and the index tested the upper limit of the upward channel (seen on H4 interval). As a result, the index climbed back above the 4,300 pts mark. Some traders probably just waited to “buy the dip” and such opportunity occurred indeed. Anyway, the area near 4,266 pts may be perceived as the first important support should the sell-off resume. Source: xStation5

US500 rebounded from session lows and the index tested the upper limit of the upward channel (seen on H4 interval). As a result, the index climbed back above the 4,300 pts mark. Some traders probably just waited to “buy the dip” and such opportunity occurred indeed. Anyway, the area near 4,266 pts may be perceived as the first important support should the sell-off resume. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.