-

The ZEW reading from Germany was published before midday, falling to -14.7 from 8.5 points previously (-10 points had been expected), with the country's June inflation data rising to 6.4% from 6.1%, confirming the preliminary reading.

-

The mood in global equity markets is upbeat following news yesterday afternoon that China plans to increase and extend its property support programme to boost the economy. At a time when Western central banks are pulling liquidity from the market, China is planning to add it, which in theory should be viewed positively by the equity market.

-

The main stock indices from the Old Continent ended the session higher, with the French CAC40 the best performer, gaining 1.07%. Germany's DAX ended the day at + 0.75%, while London's UK 100 added 0.12% and Spain's IBEX 35 gained 0.85%.

-

Nasdaq Inc plans to rebalance the Nasdaq-100 index to reduce the overconcentration of the benchmark against the largest companies. Details will be known on Friday.

-

Wall street is also seeing gains today, although the scale of the move is limited, with investors clearly looking ahead to tomorrow's US inflation data. The Dow Jones is the best performer, gaining 0.6%, with the S&P500 and Nasdaq rising 0.3% and 0.15% respectively.

-

The British pound gained against other currencies today in the face of pro-inflationary data from the UK and improved sentiment in the broad market. Deutsche Bank forecasts that the BoE will raise interest rates by a further 50 basis points at its August meeting.

-

The Japanese yen and Swiss franc performed best today, while the New Zealand dollar lagged behind.

-

A federal judge in San Francisco denied the Federal Trade Commission's (FTC) request for a preliminary injunction to stop Microsoft (MSFT.US) from finalising its acquisition of video game publisher Activision Blizzard (ATVI.US). In the face of this news, Activision-Blizzard shares climbed 11% higher, reaching their highest levels since late April.

-

Crude oil is benefiting from good market sentiment. WTI and Brent prices recorded gains of nearly 2% today.

-

Gold prices have been gaining during today's session. Quotations are currently gaining 0.3% and are testing the limit set by the 100-day exponential moving average (EMA100).

-

The EIA raised its forecasts for oil demand in 2023 and notified that, according to their models, prices of the BRENT variety will settle around $78 per barrel (for July) and $80 per barrel (in the fourth quarter of 2023). Production forecasts for 2023 have been revised downwards (now: 670 000 barrels per day; previously: 720 000 barrels per day).

-

The crypto market has mimicked the sentiment from the regulated markets and has seen moderate rallies. Bitcoin gains more than 1% and climbs to $30,600. Ethereum, on the other hand, dips below $1,880 and records moderate declines on a daily basis.

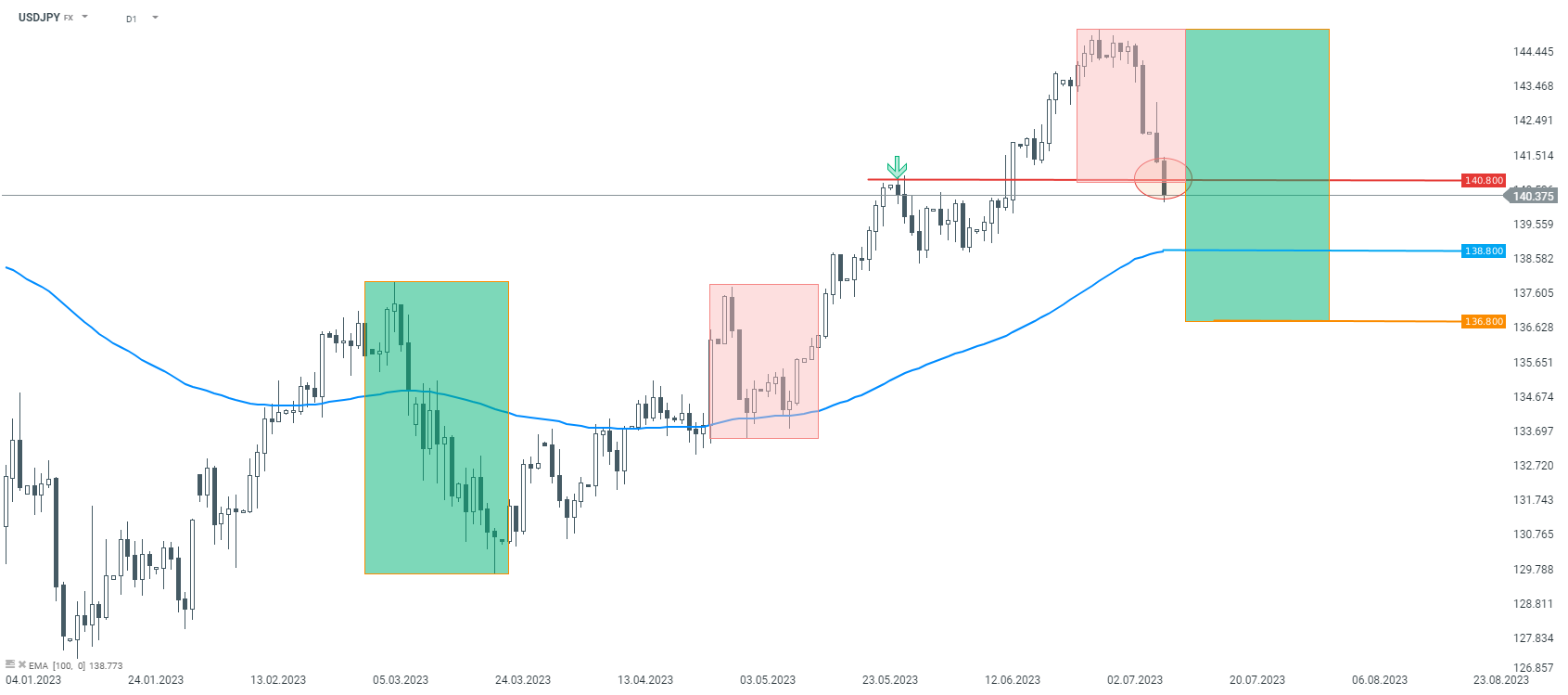

The correction on USDJPY is gaining momentum. If support at 140.80 is knocked down, a move towards the EMA100 (138.80) or the large 1:1 geometry highlighted in green at 136.80 is not out of the question. Source: xStation5

The correction on USDJPY is gaining momentum. If support at 140.80 is knocked down, a move towards the EMA100 (138.80) or the large 1:1 geometry highlighted in green at 136.80 is not out of the question. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.