- European indices finished today’s session higher, with DAX0 up 1.14% led by autos and healthcare stocks. Deutsche Bank stock rose over 6% amid mood improvement in the banking sector.

-

Latest solvency figures of other major banks turned out to be better compared to Credit Suisse, to be acquired by UBS

-

Germany's IFO survey rose to 93.3 in March, the highest level in a year.

-

Some of the fears of a broader threat to the global financial system eased somehow after US lender First Citizens BancShares said it would purchase the loans and deposits of Silicon Valley Bank.

-

In addition, the US authorities are considering increasing deposit guarantees for regional banks so that they have time to improve their balance sheets

-

On the other hand, sentiment on Wall Street is mixed. The S&P 500 is up about 0.8%, S%P500 rose 0.45% while the Nasdaq 100 is down almost 0.20%.

-

With less chance of banking collapse and a repeat of 2007-2009 scenario, crude oil rebounds 4% today end reached level not seen since March 15

-

On the other hand, NATGAS tumbles nearly 5% due to low consumption and high temperatures in the US

-

US 10 Year Treasury yield jumped above 3.50%,however EURUSD is testing resistance at 1.0800

-

The cryptocurrency market pulled back quite sharply on news that Binance and its CEO were sued by the CFTC over trading and derivatives violations.

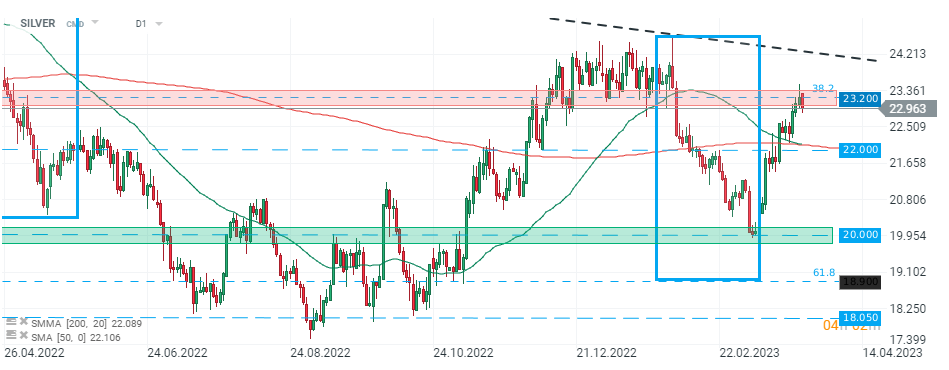

SILVER failed to stay above crucial resistance at $23.20. As long as price sits below the aforementioned level, downward impulse towards crucial support at $22.00 may be launched. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.