- Indexes on Wall Street are currently posting intraday declines. The Nasdaq is losing 0.43%, while the S&P500 is down 0.19%. Intel shares are currently losing nearly 12.5% on weak earnings forecasts for Q1 2024.

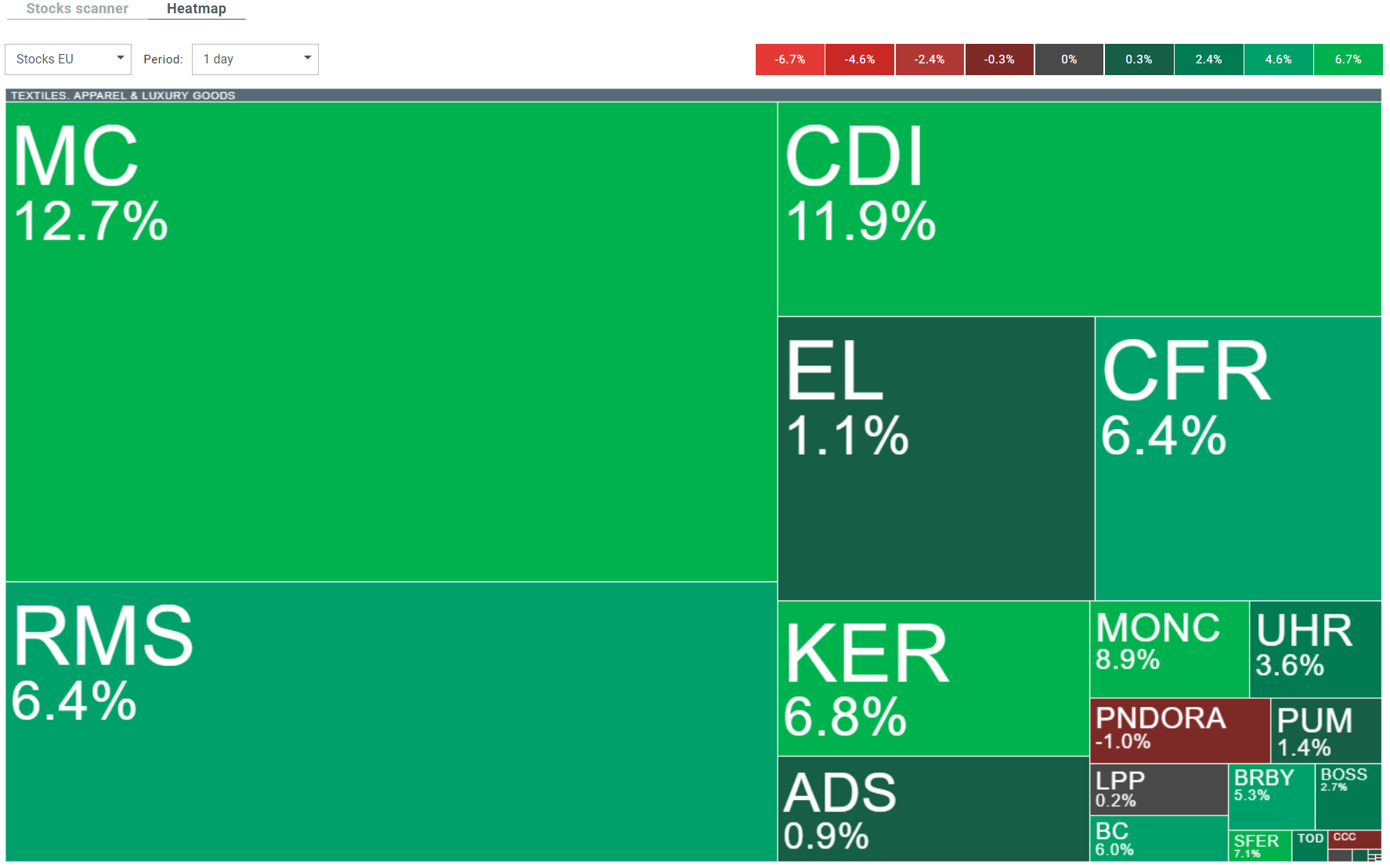

- In Europe, investors' attention was focused on the luxury goods sector, which saw powerful gains following the release of LVMH's better-than-expected quarterly results. Shares of the world's largest fashion company ended today's session nearly 13% higher. Also, another luxury companies stocks like Kering, Richemont and Hermes surged today

- The Fed's preferred measure of core PCE inflation, for December 2023, came in at 2.9% versus 3% forecast and 3.1% previously. The headline reading came in at 2.6%, in line with forecasts and coinciding with the previous reading. The monthly dynamics turned out to be in line with forecasts

- Americans' personal income in December rose 0.3% m/m and turned out to be in line with forecasts (previous reading of 0.4%). Spending rose 0.7% vs. 0.5% estimates and 0.4% previously. In real terms, they also turned out to be 0.2% higher than forecasts

- White House economic advisors Boushey and Brainard spoke optimistically about the U.S. economy, highlighting the limited risk of external shocks and solid readings suggesting higher productivity, despite lower inflation

- The reading of pending home sales data for January brought a big upward surprise. The number of pending home sales in the U.S. rose significantly, by 8.3% y/y vs. 2% forecast and 0% growth previously

- EURUSD is trading up a modest 0.15%, but the largest currency pair erased some of the initial gains. S&P analysts stressed that the risk of a recession in the US has declined, but remains elevated

- In the FX market, the Swiss franc is currently doing best. The largest declines are currently seen in the Japanese yen and the New Zealand dollar.

- Wheat contracts traded on the CBOT are trading down nearly 2% after traders reacted to higher inventory readings, and covering short positions failed to produce the expected wave of price rebound. As a result, wheat once again settled below $6 per bushel, with pressure intensified by higher ship activity at Ukrainian ports and declines in Russian grain prices

- The mood of the cryptocurrency market is positive, with Bitcoin gaining nearly 5% and trading near $42,000, after data indicated that selling pressure from Grayscale is beginning to ease.

- The SEC dismissed the iShares Ethereum Trust application from BlackRock in the current term, but the second largest cryptocurrency did not react to the news with a drop, as the decision did not disappoint analysts and investors. Ethereum is currently gaining 2%.

WHEAT (M15)

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.