- European stocks closed sharply lower

- Wall Street extends declines

- Energy commodities prices rose sharply

- Bitcoin tested $ 45,000 level

European indices finished today's session sharply lower, with Germany’s DAX down 3.5% to a 1-year low below the 14,000 level, as the war in Ukraine escalates. Despite heroic resistance, Russian actions are becoming more aggressive and bloody. There are reports of Russian attacks on hospitals, schools and other civilian buildings. Many observers believe that what is happening now in some Ukrainian cities should be treated as war crimes. Such escalation has a very negative effect on investors who are selling off riskier assets around the world. The stock market in Russia has not been opened yet, but it is worth remembering that Russian companies that are also listed in London have suffered further heavy losses today. In addition, the ruble is not traded on the international market. Meanwhile, the sanctions are starting to take effect as more large foreign entities such as BP, Shell, Total are making decisions to cut off all ties with Russia. Maersk introduced a stoppage of almost all container ships sailing to Russia (except for those with food and medical supplies). Maersk owns approximately 1/3 of the shares in the Russian port operator that manages 6 terminals in that country. All this causes traders have problems with making payments for Russian oil. An increasing number of ships also do not want to transport Russian oil, and some ports prohibit the entry of Russian ships. Fees for the transport of Russian oil are rising to astronomical levels, which makes trade less profitable, despite the fact that the price per barrel in global markets has exceeded $ 100. Meanwhile, Ukraine asked the European Union to join its ranks as soon as possible, although it is known that even in an accelerated form it will take many years. Nevertheless, thanks to the community's efforts, Ukraine will likely be provided with combat aircraft to help further repel the Russian regime.

Negative moods prevail on Wall Street as well, with the Dow Jones tumbling more than 2.0% and the S&P 500 and the Nasdaq down more than 1.6% as the situation in Ukraine is becoming more difficult by the hour with Russian troops bombing cities and enclosing the capital city of Kyiv. Financial stocks which may be the most impacted by sanctions took the biggest hit during today's session. Bank of America, JP Morgan, Wells Fargo and Visa fell over 4%.

Upbeat moods prevail today in commodity markets despite a stronger dollar. US 10-year Treasury fell below 1.69%, while gold jumped to $1942 level. Silver also recorded strong gains and is approaching resistance at $25.40. WTI jumped above the psychological $100.00 level while US natural gas futures rose more than 4% to almost reach $4.6 per million British thermal units. Major cryptocurrencies also moved higher today. Bitcoin rose at one point over 4.0% and tested $ 45,000 level while Ethereum bounced off psychological resistance at $3000.

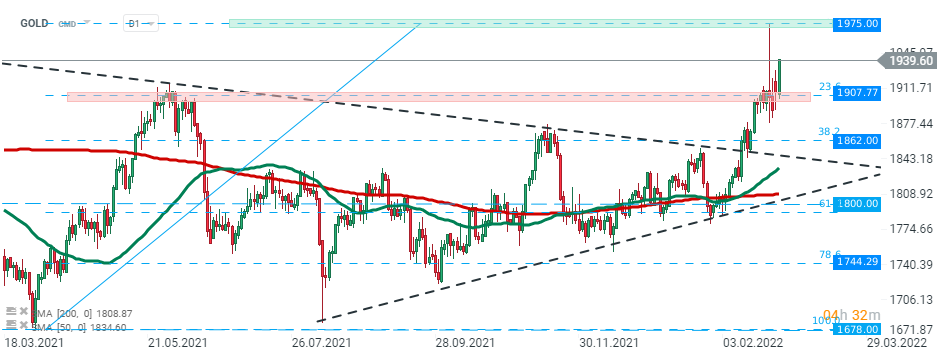

Gold price managed to stay above local support at $1907 yesterday and resumed upward move during today's session. If current sentiment prevails, the resistance zone around $1975 may be at risk. Source: xStation5

Gold price managed to stay above local support at $1907 yesterday and resumed upward move during today's session. If current sentiment prevails, the resistance zone around $1975 may be at risk. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.