- European indexes recorded monstrous rebound

- Upbeat moods on Wall Street

- Commodities under pressure, crypto surges

European indices finished today's session sharply higher, with Germany’s Dax jumped over 7% to close above 13,700, which is the biggest daily percentage gain since March 2020 as investors welcomed signs that the conflict between Ukraine and Russia could be resolved in a diplomatic way. President Zelensky said Ukraine is prepared for certain compromises but other sides also need to be willing to do the same. The Kremlin announced that it will take necessary steps to ensure Ukraine's neutral status and would prefer to do that through negotiations. Moscow announced a new ceasefire in Ukraine to let civilians flee besieged cities, however this once again turned out to be empty words. Also Putin spoke to German Chancellor Scholz to discuss diplomatic efforts aimed at ending hostilities in Ukraine and the creation of humanitarian corridors, the Interfax news agency reported. Earlier news emerged that Germany is opposing measures against Russian oil imports and port access. Berlin is also against banning Sberbank from SWIFT. This Russian bank accounts for a large portion of Russian oil and gas transactions. It seems that despite all the horrors of the last few days, the ties between Berlin and Moscow remain strong. Investors now await the highly-anticipated ECB meeting on Thursday for clues about the path of crisis-era stimulus.

On Wall Street sentiment was lifted by a fall in oil prices and easing geopolitical tensions. Beaten-down financial stocks regained significant ground while consumer-related shares bounced back as investors rushed to buy the dips. The Dow Jones rose 1.95%, while the S&P 500 and the Nasdaq 100 jumped 2.4% and 3.2% respectively. Tomorrow all eyes turn to the US inflation report for February, which might influence the pace of Federal Reserve tightening.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appThe commodity market witnessed increased volatility during today's session. Energy commodities and precious metals recorded significant declines. Brent and WTI crude oil prices fell by more than 12%, as we are dealing with information chaos. Declines were boosted by the possibility of lifting the Venezuelan sanctions and UAE call to increase production by the OPEC cartel. Still embargoes on Russian fuels introduced by the US and Great Britain, uncertainty regarding Russian counter-sanctions and progress of talks with Iran, bigger than expected decline of US crude stockpiles, China's order to halt exporting gasoline and diesel in April and ongoing uncertainty regarding war in Ukraine still supports the bulls. Sell-off also affected agricultural commodities and precious metals markets. Wheat fell more than 7.0%, while gold plunged nearly 3.5% below the psychological $2,000 level.

Bitcoin and other major projects also recorded sharp gains after President Biden issued executive order on cryptocurrencies. Many investors believe that the introduction of regulations will enable the creation of a long-awaited ETF based on the Bitcoin spot price. Currently major cryptocurrency is approaching 42,000 level, however Ethereum failed to break above resistance at $2800.

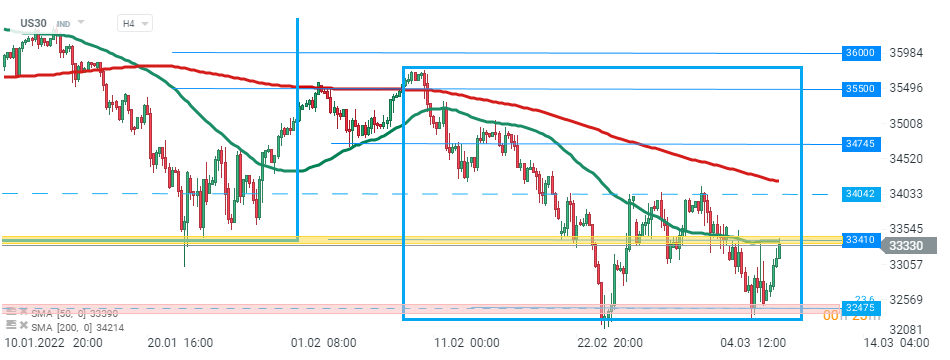

US30 fell sharply in recent weeks , however buyers once again managed to halt declines around the major support zone at 32475 pts, which is marked with lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the upward wave launched in March 2020. Today the index rebounded sharply and is currently testing local resistance at 33410 pts. Source: xStation5

US30 fell sharply in recent weeks , however buyers once again managed to halt declines around the major support zone at 32475 pts, which is marked with lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the upward wave launched in March 2020. Today the index rebounded sharply and is currently testing local resistance at 33410 pts. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.