- European bourses close higher

- US inflation highest since 1982

- US crude stocks fell more than expected

- Altcoins move higher

European indices finished today’s session higher and DAX 30 jumped above the 16,000 mark, supported by energy and raw materials stocks and strong corporate results. TeamViewer stock surged over 15% after the German tech firm reported billings growth of 20% YoY. Number of subscribers at the end of 2021 rose 7.3% YoY. Company said that it sees full-2021 billings at €548 million and adjusted EBITDA of €254-257 million. In addition, Sainsbury and JD Sports lifted full-year revenue guidance. On the downside, Philips stock tanked 15% after the company said it expects fourth-quarter core profit to drop around 40%.

US stocks move higher as investors digested US inflation figures. The US CPI increased 7% on the year during December, in line with expectations, however this level was last seen in 1982. Such high inflation level should meet with further actions from US central bank. Treasury yields edged lower, giving the tech sector some relief. On the corporate front, Biogen stock plunged over 6% after Medicare said it will only partially cover the Alzheimer’s drug Aduhelm. Investors will now focus on the earnings season with Wells Fargo, Citigroup, JPMorgan due to report Friday.

Upbeat moods prevail today in most commodity markets. Precious metals prices are appreciating amid a weaker dollar which hit an 8-week low. Gold is testing $1,827.00 level while silver jumped to $ 23.20. WTI oil surged over 2% and tested $83.00 level while Brent is trading around $85.00 after an EIA report confirmed crude stocks in the US fell for a 7th consecutive week, well above analysts’ estimates. Meanwhile, the US Energy Information Administration also raised its oil demand forecasts by 840,000 bpd in 2022, compared to an early increase of 700,000 bpd.

Cryptocurrencies extended yesterday gains and the total market cap has again surpassed $2 trillion. Bitcoin price bounced off $44 000 support and is currently trading around $43 500, while Ethereum is testing $3500 level. The crypto Fear and Greed Index rose by 1 point to 22, but looking at the rising altcoin prices we can see that investors took the recent sell-off as a buying opportunity.

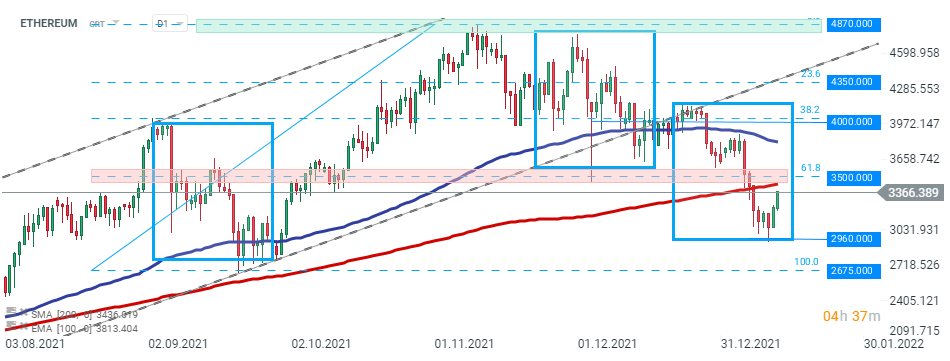

ETHEREUM price took a hit in the final quarter of 2021 and first days of January, however it seems that buyers managed to halt declines around $2960 which is marked with a lower limit of the 1:1 structure. Price bounced off this level yesterday and is currently approaching the major resistance zone around $3500 which coincides with 61.8% Fibonacci retracement of the last upward wave and 200 SMA (red line). Should a break higher occur, the next target for bulls is located at the psychological $4000 level. Source: xStation5

ETHEREUM price took a hit in the final quarter of 2021 and first days of January, however it seems that buyers managed to halt declines around $2960 which is marked with a lower limit of the 1:1 structure. Price bounced off this level yesterday and is currently approaching the major resistance zone around $3500 which coincides with 61.8% Fibonacci retracement of the last upward wave and 200 SMA (red line). Should a break higher occur, the next target for bulls is located at the psychological $4000 level. Source: xStation5

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.