• Resurgence of the pandemic in the EU

• Gold hits all-time high

• The busiest week of earnings season is here

European indices finished today's session mostly in red amid rising number of coronavirus cases on the old continent. Spain, Sweden, Luxembourg, Romania and Bulgaria have registered the highest number of cumulative infections over the last 14 days. Travel stocks were particularly hard hit. TUI (TUI.UK) decided to cancel all holidays to Spain through August 9th while Ryanair (RYA.UK) is expecting a challenging year amid coronavirus uncertainty. CAC 40 dropped 0.2 % and FTSE100 finished 0.3% lower. Only DAX 30 managed to finish today's session higher, adding 0.2%, after SAP (SAP.DE) announced plans to spin off and float Qualtrics, the US specialist in measuring online customer sentiment. Also recent German business morale figures came in above analysts' expectations.

US indices are trading higher as investors digest surge in global coronavirus infections and simmering tensions between the US and China. During the weekend, American authorities arrested a Chinese researcher accused of hiding her military ties in San Francisco’s consulate. This week all eyes will be on another big round of corporate earnings, as major companies like McDonald’s, Facebook, Amazon, Pfizer, Alphabet, Apple, Starbucks, Boeing, GE, GM and AMD will publish their quarterly results. Also markets will pay attention to the stimulus negotiations and Fed's monetary policy decision on Wednesday. U. S. Senate Republicans are expected to unveil their $ 1 trillion coronavirus aid package which now have to be approved by the Democrats. During today’s session Dow Jones gain 0.48%, S&P500 rose 0.47% and Nasdaq is trading 1% higher.

Gold prices hit an all-time high of $1945 /oz amid a weaker US Dollar and as concerns about the global economic outlook and rising geopolitical tensions between US-China increased demand for a safe haven assets. Silver prices jumped almost 7%, a level last seen in August 2013 and are now up more than double from March’s multi-year lows. Meanwhile, the dollar index is falling for the 6th session in a row to 93.6, the lowest level since September 2018.

Oil erased earlier gains and is trading 1.4 % lower. Baker Hughes data showed that US producers added 1 rig last week for the first time in 4 months which might be a sign that US production is increasing. Meantime Russian oil exports are expected to rise 36% next month.

Economic calendar for Tuesday does not seem to be particularly interesting. Spanish Unemployment Rate will be the key release of the European session while US CB Consumer Confidence figures and API Crude Oil Stock Change report will be on watch during US trading hours. On earnings front, Visa Inc., Pfizer Inc., McDonald's, Starbucks, S&P Global Inc, AMD, Canon, eBay will report their quarterly results.

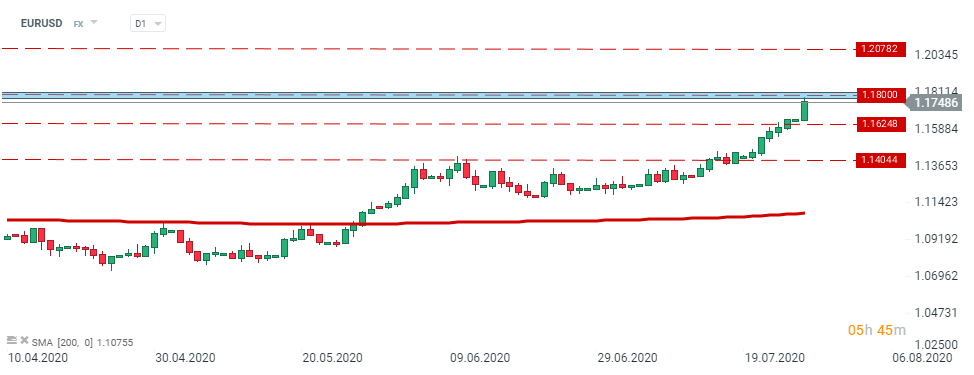

EURUSD - Euro is the strongest currency among majors during today's session. Currently price is approaching the key resistance level at 1.18. Should a break above occur, buyers should focus on next resistance at 1.2078. On the other hand, once sellers regain control, the support at 1.1624 may be at risk. Source: xStation5

EURUSD - Euro is the strongest currency among majors during today's session. Currently price is approaching the key resistance level at 1.18. Should a break above occur, buyers should focus on next resistance at 1.2078. On the other hand, once sellers regain control, the support at 1.1624 may be at risk. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.