- European indices finished today's session slightly higher as fresh PMI figures showed the Eurozone economic contraction eased in November and price pressures cooled.

-

ECB Centeno said 75 bp interest rate hikes cannot be the norm.

-

Mainland China has seen daily new Covid cases rising to more than 28,000, close to the levels from the Shanghai lockdown that began in April.

-

Moods improved on Wall Street after FOMC minutes showed that a substantial majority of Fed members believes that a slowing in the pace of the fed funds rate increase would likely soon be appropriate, as it would better allow the Committee to assess progress toward its goals of maximum employment and price stability. The Dow Jones erased early losses and is trading 0.305 higher, the S&P 500 rose 0.5% higher and the Nasdaq added 0.9%.

-

On the data front, US business activity contracted for a fifth straight month in November, with a measure for manufacturing dipping below the 50 mark for the first time since 2020. US weekly claims rose more than expected to a three-month high last week.

-

Oil prices fell nearly 4.0% on reports that the European Union is considering setting a price cap on Russian oil in the $65-70 per barrel range. Later in the session EIA data showed a much bigger-than-expected drop in US inventories last week.

-

NATGAS erased most of the early gains after the latest EIA data showed a smaller-than-expected draw in inventories. Still, prices remain at the highest level in two months.

-

Precious metals rebounded on Wednesday amid weaker dollar and dovish FED minutes. Gold bounced off major support at $1732.00 and is testing local resistance at $1750, while silver rose to $21.50 per ounce, rebounding from the two-week low of $20.8.

-

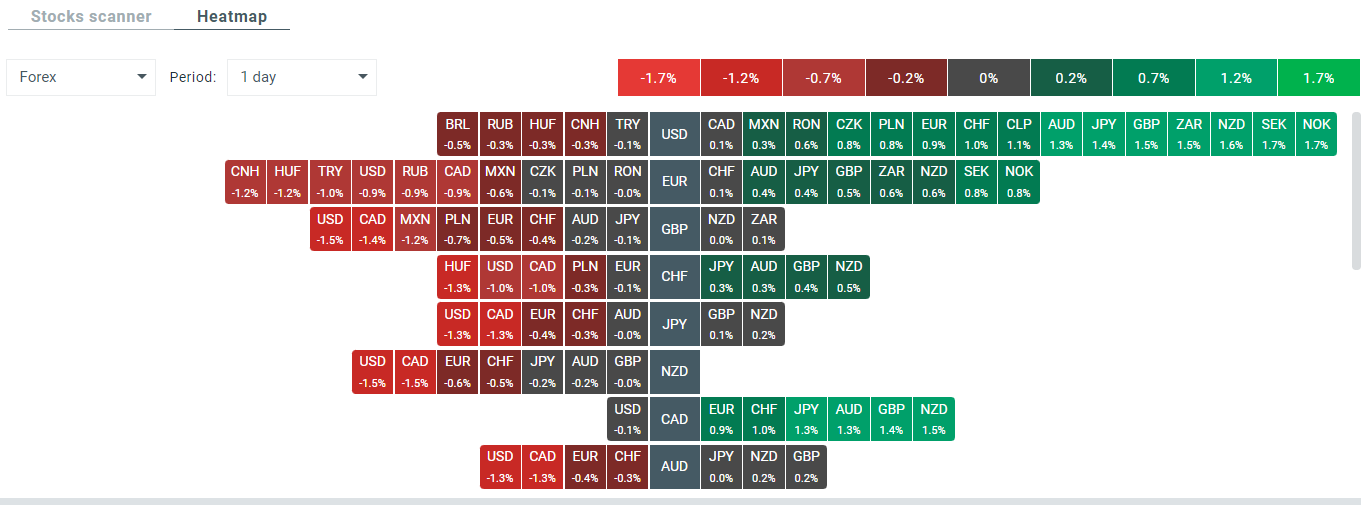

The dollar index fell below over 1.0% to 106.15, extending losses for a second session. The New Zealand dollar strengthened on Wednesday, after the RBNZ delivered a supersized 75 basis point rate hike and raised the forecast for its peak rate from 4.10 to 5.50%. Currently GBP and NZD are the best performing major currencies while USD and CAD lag the most.

-

Upbeat sentiment prevails on the cryptocurrency market, where Bitcoin jumped above $16,400 level, while Ethereum briefly tested local resistance at $1175 level.

USD weakened against the majority of currencies following the release of FOMC Minutes. Source: xStation5

NZDUSD again tests key resistance at 0.6240, which is marked with 61.8% Fibonacci retracement of the upward wave launched in March 2020. Should break higher occur, upward move may accelerate towards local downward trendline or even resistance at 0.6430. On the other hand, if sellers manage to regain control, retest of local lows at 0.6065 cannot be ruled out. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.