- Rising inflation in Europe

- Wall Street retreats for 3rd session

- The Fed may start talking about a tightening of QE in the upcoming meetings

- Cryptocurrency sell-off

European indices joined a global selloff and finished today's session sharply lower amid ongoing inflation concerns, increasing number of coronavirus cases in Asia and lower commodity prices. On the data front, UK inflation rate jumped to 1.5% in April which is a 1-year high and producer prices rose much more than expected with the output index soaring 3.9%, the most since October 2018. Meanwhile consumer price inflation in the Euro Area was confirmed at a 2-year high of 1.6%. DAX fell more than 1.7%, CAC40 lost 1.43% and FTSE100 finished 1.19% lower.

US indices also came under pressure as massive selling returned to the tech sector amid a plunge in cryptocurrencies. Bitcoin price dropped at one point to $30.000 which prompted a fall in cryptocurrency-linked stocks. Crypto-currency sell-off intensified after Chinese regulators signaled a crackdown on the use of such assets. However US stocks managed to partly erase early losses in the afternoon as cryptocurrencies prices came off their lows, but the negative sentiment is still persistent. Minutes from the last FOMC meeting showed that Some Fed officials consider that if the economy continues to pick up strongly, it might be appropriate at some point in upcoming meetings to begin discussing a plan for tapering.

WTI crude fell more than 3.3 % and is trading around $63.30 a barrel, while Brent is trading 3.1% lower around $66.57 a barrel. Elsewhere gold rose 0.65% to $ 1,880.00 / oz, while silver is trading 1.0% lower, below $ 28.00 / oz amid weaker dollar, slightly higher Treasury yields.

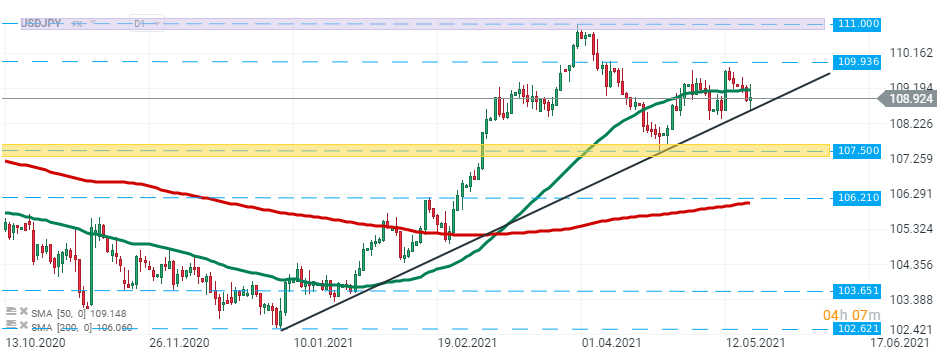

USDJPY - dollar managed to regain some ground after FOMC Minutes. Pair once again failed to break below the long-term trendline, however upward move is halted by the 50 SMA ( green line). Only breaking one of the above-mentioned obstacles should lead to bigger price movements. Source: xStation5

USDJPY - dollar managed to regain some ground after FOMC Minutes. Pair once again failed to break below the long-term trendline, however upward move is halted by the 50 SMA ( green line). Only breaking one of the above-mentioned obstacles should lead to bigger price movements. Source: xStation5

Copper fell sharply today partially due to the supply concerns. Major mining company Glencore will restart operations at the currently idled Mutanda copper mine in the Democratic Republic of Congo in 2022 to offset worries over the threat of a strike at mines in the biggest producer Chile. At the moment buyers managed to defend the major support at $10000 and price is approaching local resistance at $10220. Source: xStation5

Copper fell sharply today partially due to the supply concerns. Major mining company Glencore will restart operations at the currently idled Mutanda copper mine in the Democratic Republic of Congo in 2022 to offset worries over the threat of a strike at mines in the biggest producer Chile. At the moment buyers managed to defend the major support at $10000 and price is approaching local resistance at $10220. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.