- Wall Street erased much of the gains from the beginning of the session. The S&P500 gained 0.19%, the Dow Jones traded flat, and the Nadsaq rose 0.53%. Bank stocks failed to maintain their initial gains and resumed their downward movement, dampening investor sentiment overseas;

- The U.S. GDP reading was revised slightly downward to 2.6% versus 2.7% in the first release. Unemployment claims came in higher than expected at 198k vs. 195k expected. Core PCE inflation was revised slightly upward, to 4.4% vs. 4.3% previously;

- Comments by Susan Collins and Tom Barkin of the Fed put pressure on the USD. Barkin stressed that not every bank collapse is a 'second Lehman Brothers' although the impact of the current crisis on inflation and the economy is difficult to predict. Collins did not rule out that a possible extension of the banking crisis could have an impact on the Fed's monetary policy, which currently does not expect rate cuts in 2023;

- Rating agencies Moody's, S&P Global and Fitch Ratigns have stressed that the banking crisis will affect tighter credit conditions. S&P warned of a possible hard landing for many economies;

- Gold quotations approached the $2,000 barrier. A weakening dollar and weaker macro readings, coupled with the uncertainty of US banks, supported a rebound in precious metals prices;

- Major stock indices from Europe had a solid session. Germany's DAX tested 2023 year's highs today. The German index gained 1.26% today, while France's CAC40 added 1.06% and London's FTSE100 closed 0.74 higher. German inflation fell sharply from 8.7% to 7.4%, missing expectations by just 0.1%;

- Sentiment in Europe was supported by a disinflationary trend, easing concerns around Deutsche Bank and excellent financial results from textile giant H&M. The company posted a profit against a loss expected by analysts. The financial report signaled that the condition of consumers in Europe is healthy. Shares of Adidas, Puma and Spanish clothing holding company Inditex gained on the report's wave;

- Looking at the forex market, US Dollare weakened during Thursday's session. The EURUSD tested March peaks,.The overall sentiment remains upward, and if will be maintained, an attack on the February high at 1,10 zone could be a possible scenario;

- Cryptocurrencies started the session with increases, which weren't maintained. In the evening hours, all major digital currencies are trading lower. Bitcoin slightly corrected this year's maximums, but after reaching new peaks, it quickly retreated. The BTC price created a bearish 'Shooting star' candlestick formation on the D1 interval.

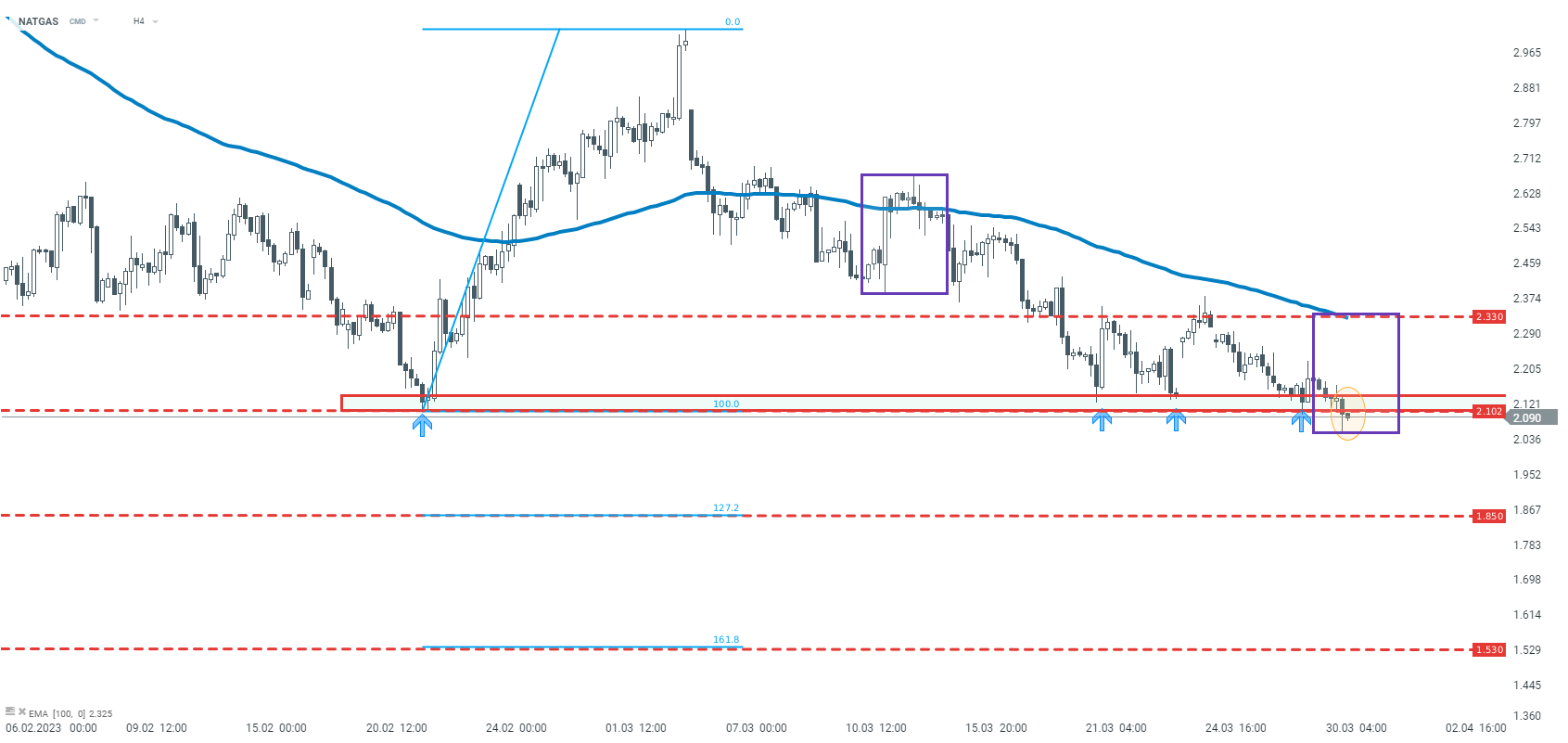

NATGAS is trading at the lowest levels this year. The price has broken below the key support at $2.1, stemming from recent lows. If the breakout is sustained, the downward movement could extend toward FIbonacci's levels, determined by the recent upward correction. In case of a pullback, the key resistance is the $2.33 level, where the upper limit of the 1:1 geometry and the EMA100 average fall. Source: xStation5

NATGAS is trading at the lowest levels this year. The price has broken below the key support at $2.1, stemming from recent lows. If the breakout is sustained, the downward movement could extend toward FIbonacci's levels, determined by the recent upward correction. In case of a pullback, the key resistance is the $2.33 level, where the upper limit of the 1:1 geometry and the EMA100 average fall. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.