-

Wall Street indices dropped to monthly lows today as banking concerns were reignited by Q1 earnings release from First Republic Bank

-

First Republic Bank slumped to a record low today, dropping over 40%, after company's Q1 earnings report showed depositors withdrawing over $100 billion in the aftermath of SVB collapse

-

First Republic Bank is said to weigh up asset sales of up to $100 billion in order to repay emergency loans

-

European stock market indices traded lower today following a disappointing earnings release from UBS. Italian, Polish and Spanish indices dropped more than 1% while German DAX managed to buck the trend and finish 0.05% higher

-

USD and JPY are the best performing major currencies while AUD and CAD lag the most

-

Risk-off moods can also be spotted on commodity markets as well with oil, natural gas and industrial metals dropping over 2%

-

Gold jumps 0.5% in spite of a stronger USD

-

Bank of England, Bank of Japan, European Central Bank, Swiss National Bank and Fed have jointly agreed to switch back to conducting 7-day operations once per week instead of daily

-

ECB's Villeroy said that it is likely that eurozone is experiencing inflation peak now

-

ECB's Lane said that current data suggests another rate hike will be needed at the upcoming meeting

-

BoE's Pill sees change for UK inflation to drop below 2% within the next two years

-

US President Joe Biden officially announced that he will run for re-election in 2024

-

Republican senators are urging Biden administration to impose sanctions on Chinese cloud companies

-

Financial Times reports that EU will launch joint gas purchases for 80 companies

-

McDonald's and PepsiCo hit fresh all-time highs after better-than-expected Q1 earnings

-

Microsoft, Alphabet and Visa are set to report earnings after close of Wall Street session today

-

Conference Board consumer confidence dropped from 104.2 to 101.3 in April (exp. 104.0)

-

US new home sales jumped 9.6% MoM in March, to 683k (exp. 630k)

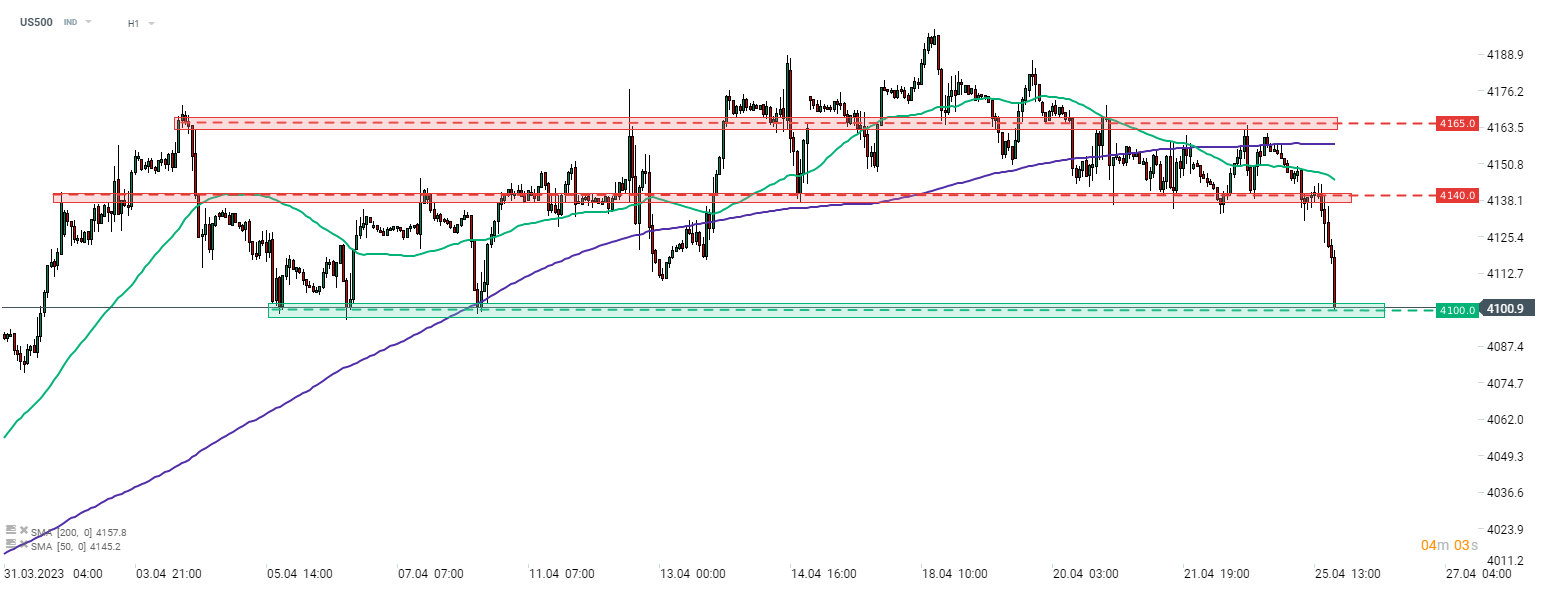

US500 slumped below 4,140 pts support and the downward move accelerated later on. Index is now testing monthly lows in the 4,100 pts area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.