- Monday brings mixed stock market sentiment - a pullback in Europe and gains in the US

-

No key macro data was known today, so volatility on the main markets was moderate

-

The main stock indices from the Old Continent closed lower. The Dax lost 0.23%, London's FTSE 100 depreciated by 0.38%, while France's CAC40 fell by as much as 1.12%.

-

Looking at Wall Street, the best performer today was the Russell 2000, which added over 1%, with the Nasdaq rising 0.7%, and the Dow Jones and S&P500 adding 0.24% and 0.3% respectively.

-

The NY Empire State index from the US showed a drop from 6.6 points to 1.1 points, with expectations of a drop to -4.3 points.

-

The quarterly earnings release season is gathering pace, with a number of reports from key US companies coming out this week, as we wrote about in today's US Open. The results will be closely watched by investors and could shape equity market sentiment in the coming days

-

The Canadian dollar performed best on Monday, while the New Zealand dollar lost the most heavily.

-

The main currency pair EURUSD is trading close to last week's set maximums

-

The oil market experienced a pullback, with WTI and BRENT crude oil quotations retreating more than 1.5%.

-

The cryptocurrency market remains in consolidation. Bitcoin quotes are stuck in a range between resistance at $31 400 and support at $29 600.

-

Chinese economic indicators showed industrial production and retail sales growth below forecasts, while unemployment remained stable. China's Bureau of Statistics acknowledged that domestic economic conditions are improving, but cited complex global political and economic factors as challenges.

-

China's year-on-year (YoY) industrial production growth was 4.4%, higher than the 2.5% forecast and the 3.5% previously forecast.

-

China's unemployment rate remained at 5.2%, in line with the forecast and the previous rate.

-

China's year-on-year GDP growth was 6.3%, less than the 7.1% forecast but higher than the previous rate of 4.5%.

-

China's year-on-year retail sales growth was 3.1%, slightly below the forecast of 3.3% and well below the previous rate of 12.7%.

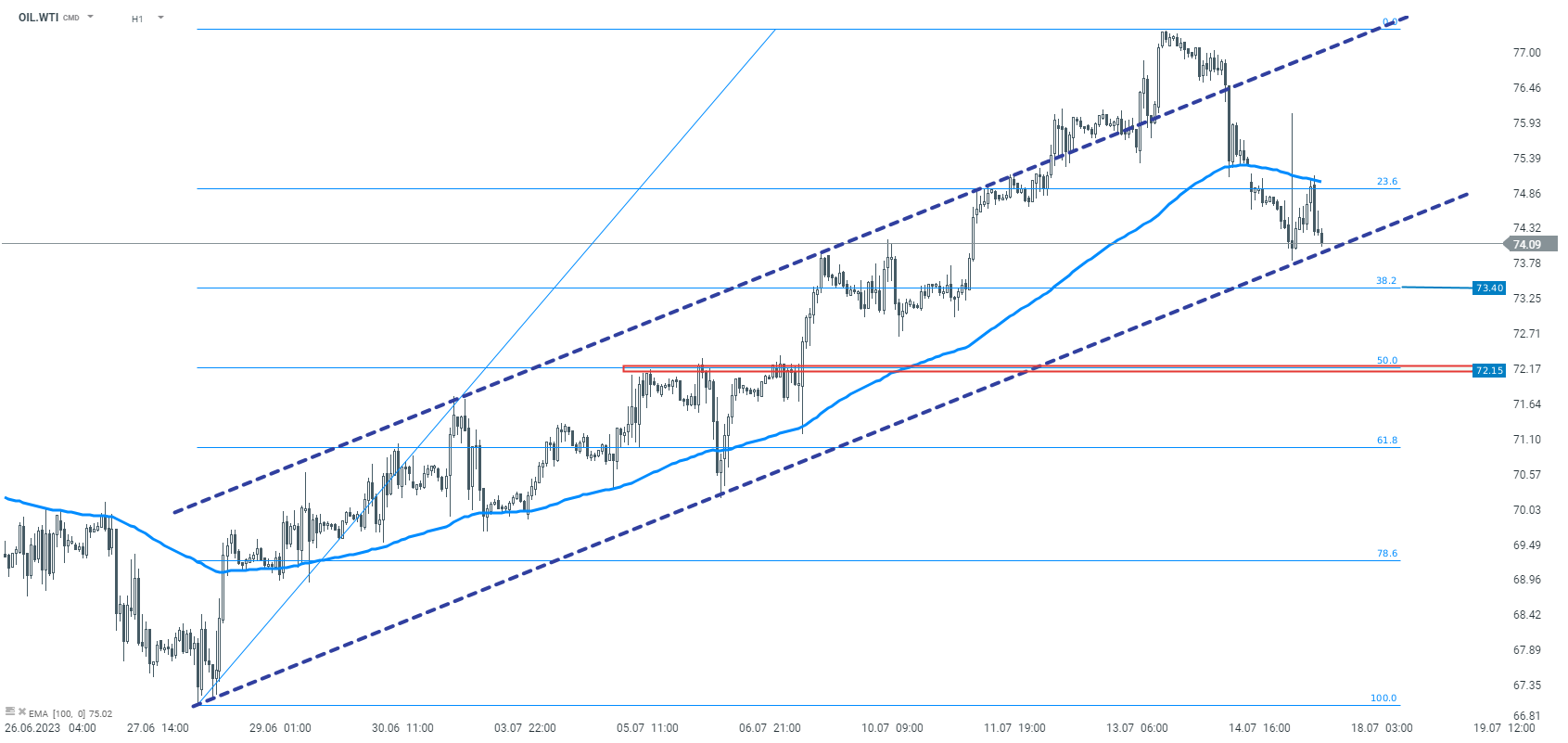

OIL.WTI quotations are testing the lower limit of the upward channel. If the bottom is broken out, declines towards the 38.2% or 50% Fibo measures are possible. Source: xStation5

OIL.WTI quotations are testing the lower limit of the upward channel. If the bottom is broken out, declines towards the 38.2% or 50% Fibo measures are possible. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.