D.R. Horton (DHI.US) gains almost 11% after the largest home builder in America reported Q3 earnings. D.R. Horton operates in 121 markets across 33 states. It has built over 1.1 million homes in its 45-year history. The company constructs and sells single-family and multi-family homes, rental properties, and offers mortgage financing, title services, and insurance.

Q3 Fiscal 2024 Highlights:

- Earnings Per Share (EPS): Increased 5% to $4.10.

- Net Income: Up 1% to $1.35 billion.

- Revenues: Grew 2% to $10.0 billion.

- Homes Closed: Increased 5% to 24,155, valued at $9.2 billion.

- Net Sales Orders: Increased 1% to 23,001 homes, valued at $8.7 billion.

- Pre-Tax Income: Up 1% to $1.8 billion, with an 18.1% pre-tax profit margin.

- Rental Operations: Generated $64.2 million pre-tax income on $413.7 million revenue.

- Share Repurchases: 3.0 million shares for $441.4 million; new $4.0 billion repurchase authorization.

- Dividends: Declared a quarterly dividend of $0.30 per share.

Financial Position:

- Cash Balance: $3.0 billion.

- Total Liquidity: $5.8 billion.

- Debt: $5.7 billion, with $500 million maturing in the next twelve months.

- Return on Equity (ROE): 21.5%.

- Return on Inventory (ROI): 29.5%.

- Debt to Total Capital Ratio: 18.8%.

Guidance for Fiscal 2024:

- Revenue: $36.8 billion to $37.2 billion.

- Homes Closed: 90,000 to 90,500.

- Share Repurchases: Approximately $1.8 billion.

- Homebuilding Cash Flow: Approximately $3.0 billion.

Market View

The housing market continues to experience significant challenges, primarily due to elevated inflation and high mortgage interest rates. These factors have made home affordability a critical issue, with both new and existing home supplies at affordable price points remaining limited. Despite these challenges, the underlying demographics that support housing demand, such as population growth and household formation, continue to be favorable. This persistent demand, coupled with limited supply, has created a robust market for home builders. D.R. Horton remains optimistic as the company’s diverse product offerings and flexible lot supply position it well to capitalize on these market conditions.

Management Commentary

David Auld, Executive Chairman of D.R. Horton, highlighted the company's strong performance in the face of these market challenges. He emphasized that the company's strategic focus on affordable product offerings and flexible lot supply has been key to their success. Auld noted that D.R. Horton is well-positioned to maximize returns in each of its communities, thanks to its disciplined approach to capital allocation and financial flexibility. Auld also expressed confidence in the company's ability to generate increasing levels of consolidated operating cash flows

Housing prices

Despite high mortgage rates and inflation driving up construction costs, D.R. Horton anticipates stable home prices with moderate increases.

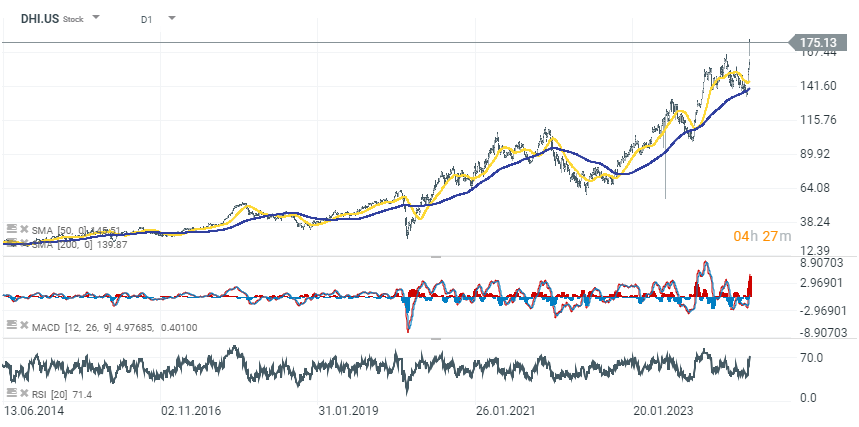

Price Chart (D1)

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.