Bitcoin price briefly jumped to a four-week high early in the session as accountant giant KPMG Canada joined a growing trend of institutional investors adding crypto to their treasuries, including MicroStrategy, Square and Tesla. The Canadian branch of the audit firm has added Bitcoin and Ethereum to its balance sheet as company believes that cryptocurrencies are “maturing asset class” and this investment reflected their belief that “institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix. "

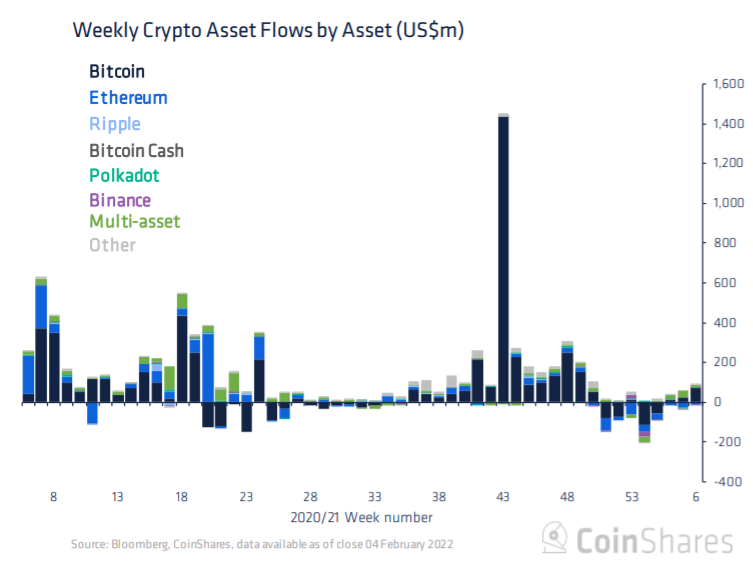

Also the latest report from CoinShares inidcates that institutional investors are slowly returning to the market. Cryptocurrency investment funds recorded inflows totaling $85million, which is over four times higher compared to last week.

Digital asset investment products saw inflows totaling $85.00m, marking the third week of inflows totalling $108.00m. Source: CoinShares.

Digital asset investment products saw inflows totaling $85.00m, marking the third week of inflows totalling $108.00m. Source: CoinShares.

BTC investment products generated inflows of $ 71 million, comprising a significant majority of the total. However volumes in Bitcoin investment products remained low last week at $1.8bn compared to $3.4b in the previous week. Meanwhile Ethereum witnessed 9th straight weeks of outflows, which indicates worsening sentiment towards second most popular cryptocurrency and declining market share. On the other hand, smaller projects like such as Polkadot and Cardano recorded inflows of $2.2m and $1.1m respectively.

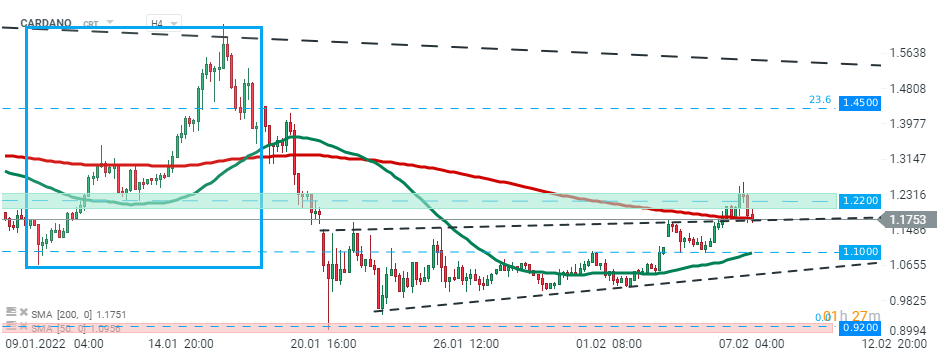

Cardano price recorded double digit gains this week, however buyers failed to keep the price above major resistance at $1.22 and pull- back occurred. Currently coin is testing earlier broken upper limit of the wedge formation which is strengthened by 200 SMA (red line). Should break lower occur, downward move may accelerate towards support at $1.10 which is marked with previous price reactions and 50 SMA (green line). Source: xStation5

Cardano price recorded double digit gains this week, however buyers failed to keep the price above major resistance at $1.22 and pull- back occurred. Currently coin is testing earlier broken upper limit of the wedge formation which is strengthened by 200 SMA (red line). Should break lower occur, downward move may accelerate towards support at $1.10 which is marked with previous price reactions and 50 SMA (green line). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.