Crptocurrencies erased some of the euphoric gains amid a mixed end to the US cash session. U.S. indices traded without spectacular price swings today, however Bitcoin and Ethereum continued their southward movement:

- The end of the week's trading could result in risk averse investors looking to exit risk-free positions before the stock markets open next week. Investors will learn today about consumer sentiment readings according to the University of Michigan, inflation expectations, and import/export data;

- Ethereum developers have postponed the date of 'the merge' to September 15, which means that the transition to Proof of Stake will take place 4 days sooner. The news is positive for investors because it shows the Ethereum team's 'confidence' in the correct change to the consensus method;

- Leon Li, the main holder of shares in one of the largest cryptocurrency exchanges, Huobi Global is considering selling them for a sum hovering around $3 billion. Bloomberg named Justin Sun, creator of the Tron cryptocurrency, and Sam Bankman Fried, head of the FTX exchange, as potential buyers. The information has so far not been confirmed by either of them. Such a huge acquisition would be one of the largest in the history of the cryptocurrency industry.

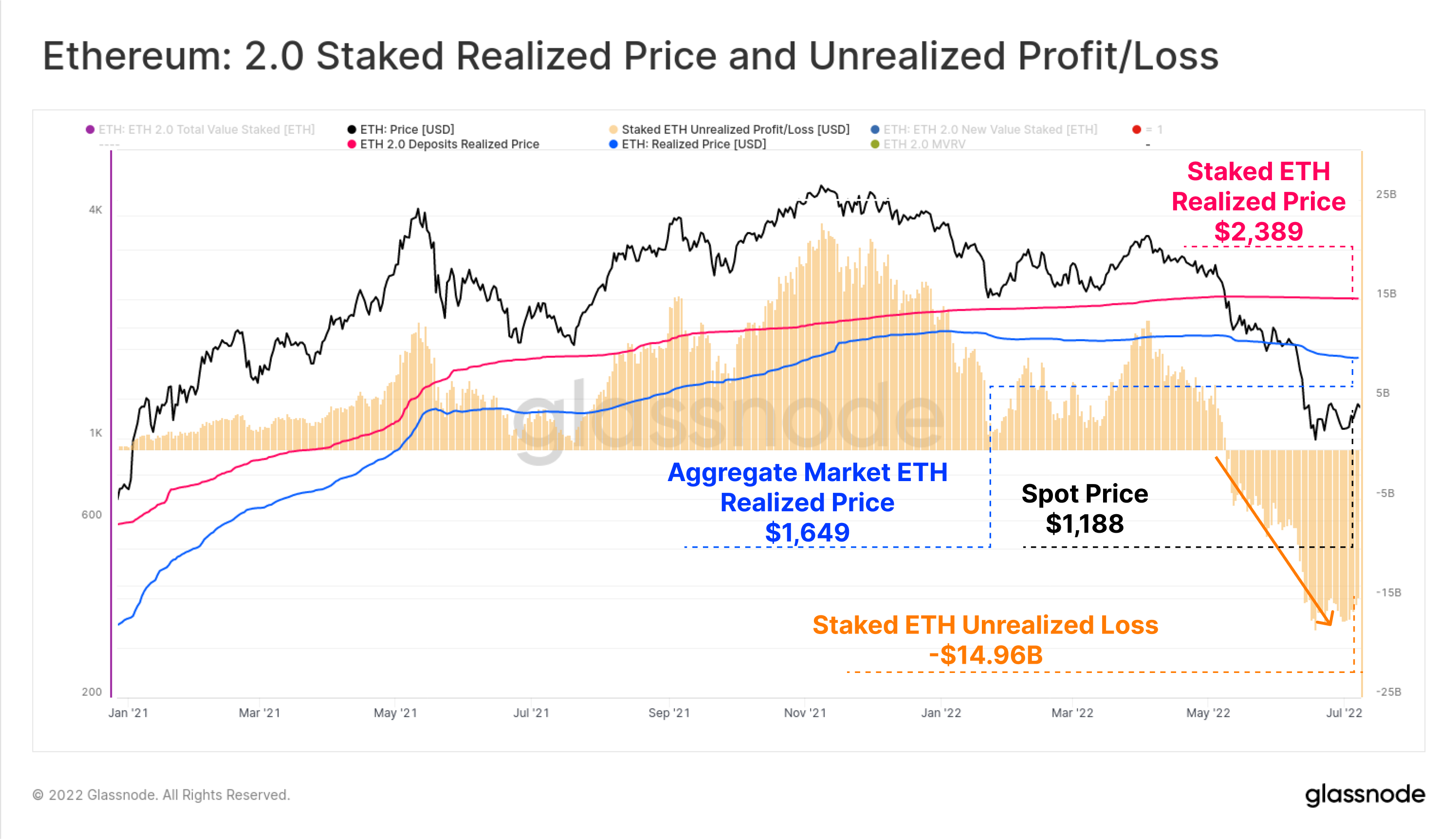

Since 2021, investors have been depositing Ethereum in the stETH version waiting for the ETH 'merge', which would allow them to become so-called 'validators', approving the blockchain transaction through the new Proof of Stake consensus method. The average 'Realized price' of deposited ETH was around $2,400, which is almost 45% higher than the market 'Realized Price' of Ethereum tokens. This means that the unrealized loss of stETH in the deposit contract awaiting merge is almost $15 billion. Potentially, investors opting for so-called staking will not want to dispose of ETH tokens at a loss which may support a limited supply scenario. Source: Glassnode

Since 2021, investors have been depositing Ethereum in the stETH version waiting for the ETH 'merge', which would allow them to become so-called 'validators', approving the blockchain transaction through the new Proof of Stake consensus method. The average 'Realized price' of deposited ETH was around $2,400, which is almost 45% higher than the market 'Realized Price' of Ethereum tokens. This means that the unrealized loss of stETH in the deposit contract awaiting merge is almost $15 billion. Potentially, investors opting for so-called staking will not want to dispose of ETH tokens at a loss which may support a limited supply scenario. Source: Glassnode

Ethereum chart, D1 interval. From a technical point of view, Ethereum recently bounced off the lower limit of the upward channel and broke through the main resistance at the level of $1820, which is marked by previous price reactions and the 23.6% Fibonacci retracement of the last downward wave. As long as the price is above the mentioned level, a continuation of the upward movement is possible. Source: xStation5

Ethereum chart, D1 interval. From a technical point of view, Ethereum recently bounced off the lower limit of the upward channel and broke through the main resistance at the level of $1820, which is marked by previous price reactions and the 23.6% Fibonacci retracement of the last downward wave. As long as the price is above the mentioned level, a continuation of the upward movement is possible. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.