Two cryptocurrencies, LITECOIN and BITCOINCASH have been gaining vigorously recently and continued their gains today as Bitcoin tries to climb above $31,000. Bitcoincash has risen with gains of nearly 100% over the past week and with Litecoin they are are practically the two oldest cryptocurrencies, which the SEC did not list in its filing in which it indicated which cryptocurrencies it considers 'securities'.

- Both Litecoin and Bitcoincash are built on Bitcoin's source code, and during the recent bull rallies have been unable to match the scale of growth of new projects, including Ethereum (which the SEC is also hesitant to designate as a commodity).

- Institutional exchange EDX Markets, backed by Citadel, Virtu Financials and Charles Schwab, has made cryptocurrency trading available on its platform - only 'old school' cryptocurrencies like Bitcoin, Ethereum, Litecoin and Bitcoincash are listed there.

- EDX CEO Jamil Nazarali conveyed that he is extremely comfortable with the fact that none of these four cryptocurrencies have been recognized as 'securities' by the SEC. The relatively low liquidity and depth of the market, as well as the lack of regulatory uncertainty around the projects, has helped the bulls

- According to DeCrypt data, the rally in Litecoin's spot price since June 15 has been supported mainly by retail investors as the value of trades in the $10 to $10,000 USD range has far exceeded the volume of larger trades in recent times.

LITCOIN is climbing to record levels since April 2022, the price has overcome the 23.6 Fibonacci retracement of upward wave from June 2022, and if the dynamic rally continues - the key for the bulls will be a decisive break of resistance at $100, which could open the way to new yearly peaks. Source: xStation5

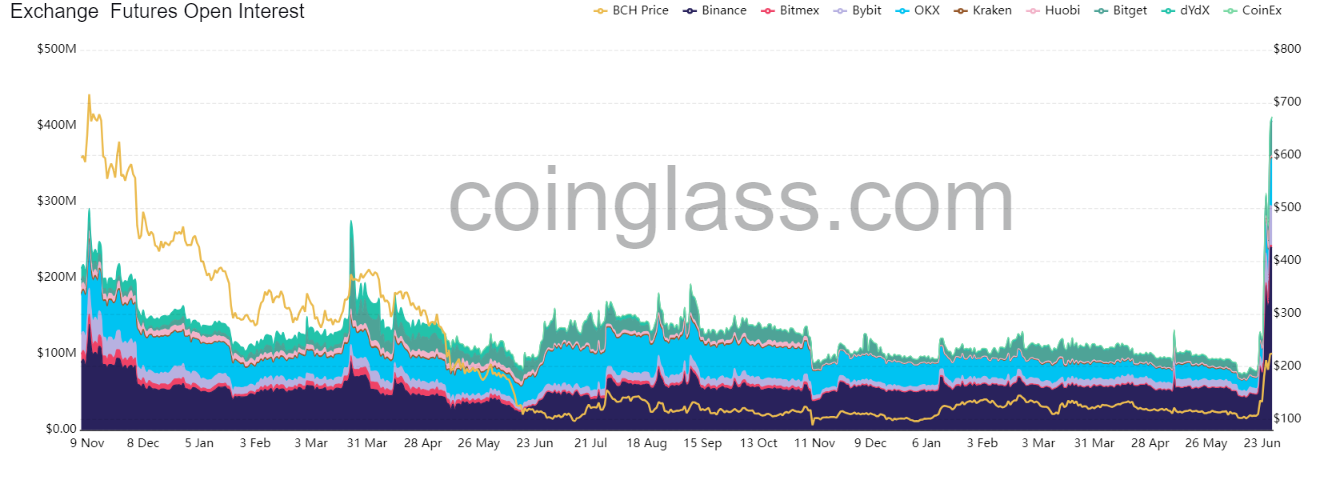

Following the opening of trading on EDX Markets, interest in Bitcoincash futures trading has increased to levels from the 2021 bull market. Source: Coinglass

Following the opening of trading on EDX Markets, interest in Bitcoincash futures trading has increased to levels from the 2021 bull market. Source: Coinglass

The price of BITCOINCASH is fighting a key resistance zone - the SMA200 on the W1 interval (red line). Overcoming it could mean a more permanent change in the downward trend. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.