The price of Bitcoin has unexpectedly risen above $20,500 in the last 7 hours. Ethereum also made gains, rising above $1,700 amid The Merge, which is coming up in just 5 days:

- US indices yesterday scored a successful session amid a weakening dollar. Today's session in Europe is also in a better mood, which is helping to maintain the demand sentiment in the crypto market;

- Analysts at investment firm Alliance Bernstein pointed to the change in Ethereum consensus as a key 'market driver' for the cryptocurrency market. Provided, of course, that it is successful;

- A report prepared at the request of Joe Biden in March of this year indicates that cryptocurrency mining could hinder the White House's fight against climate change. According to analysts in the report, we can learn, among other things, that cryptocurrencies now consume about as much energy as all private computers or all residential lighting;

- Coinbase investors are suing the Treasury Department for overstepping its authority in connection with sanctions issued on the Tornado Cash smart contract built on the Ethereum blockchain, which helped maintain the anonymity of transaction participants. Civil and criminal sanctions have been in effect in the US since August 8 for failing to comply with the ban on Tornado Cash.

According to WenMerge, which analyzes Ethereum's on-chain data in real time, there are only four days left before the difficulty bomb goes off. Merge is expected to take place a day later. Source: WenMerge

According to WenMerge, which analyzes Ethereum's on-chain data in real time, there are only four days left before the difficulty bomb goes off. Merge is expected to take place a day later. Source: WenMerge The Fear and Greed Index, a sort of component barometer of cryptocurrency market sentiment prior to the start of Bitcoin's rally that night, indicated 'Extreme fear,' which potentially still gives plenty of room for upward movement in the event of a prolonged improvement in risk sentiment. Source: alternative.me

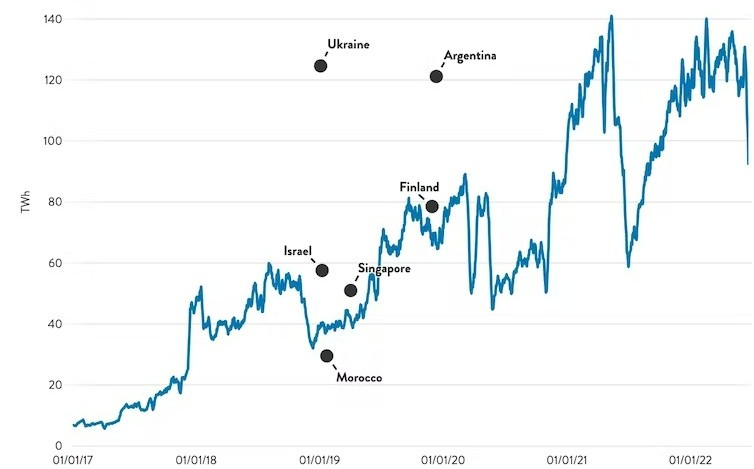

The Fear and Greed Index, a sort of component barometer of cryptocurrency market sentiment prior to the start of Bitcoin's rally that night, indicated 'Extreme fear,' which potentially still gives plenty of room for upward movement in the event of a prolonged improvement in risk sentiment. Source: alternative.me Bitcoin's consumption has dropped noticeably which is directly related to the declining activity of miners. At the same time, it still remains at a very high level, tokens using the Proof of Work consensus (diggers and miners approving a transaction as a result of computing power competition) may find themselves subject to strict regulation in the future, however, they do not fit into the organic institutional narrative of ESG (Enviromental, Social and Governance) by which institutional demand may decline. Source: CoinShares

Bitcoin's consumption has dropped noticeably which is directly related to the declining activity of miners. At the same time, it still remains at a very high level, tokens using the Proof of Work consensus (diggers and miners approving a transaction as a result of computing power competition) may find themselves subject to strict regulation in the future, however, they do not fit into the organic institutional narrative of ESG (Enviromental, Social and Governance) by which institutional demand may decline. Source: CoinShares Ethereum chart, H4 interval. The 200-session average, the SMA 200, may prove to be the most significant element on the chart. The previous ascent above this average, on July 15, initiated a rally of nearly 100%. The rally in Ether's price after 'The merge' would indicate potentially growing institutional interest in the cryptocurrency, which will become a deflationary asset once the difficulty bomb is triggered. However, a worrying signal comes from the RSI, which indicates overbought, previously levels above 70 indicated an impending correction. On the other hand, however, analyzing the case of the breakthrough of the 200 SMA from mid-July, we see that an increase in the RSI is natural when demand breaks through key resistance zones and can hold at these levels for an extended period of time. The first significant resistance may turn out to be around the 23.6 Fibonacci retracement, which coincides with the local peak from the end of July this year. A potential drop below $1,600 could initiate another wave of panic even in the area of $1,300, where the entire trend initiated by the aforementioned ascent above the 200-session average on July 15 would be erased. Source: xStation5

Ethereum chart, H4 interval. The 200-session average, the SMA 200, may prove to be the most significant element on the chart. The previous ascent above this average, on July 15, initiated a rally of nearly 100%. The rally in Ether's price after 'The merge' would indicate potentially growing institutional interest in the cryptocurrency, which will become a deflationary asset once the difficulty bomb is triggered. However, a worrying signal comes from the RSI, which indicates overbought, previously levels above 70 indicated an impending correction. On the other hand, however, analyzing the case of the breakthrough of the 200 SMA from mid-July, we see that an increase in the RSI is natural when demand breaks through key resistance zones and can hold at these levels for an extended period of time. The first significant resistance may turn out to be around the 23.6 Fibonacci retracement, which coincides with the local peak from the end of July this year. A potential drop below $1,600 could initiate another wave of panic even in the area of $1,300, where the entire trend initiated by the aforementioned ascent above the 200-session average on July 15 would be erased. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.