• Ripple announced possible relocation from the United States

• Powell suggested that Fed is in no rush to issue its own CBDC

Bitcoin broke above the psychological level of $13,000 on Thursday, its highest level since June 2019, after PayPal said it would allow its US customers to buy, sell and hold cryptocurrencies in their PayPal wallets over the coming weeks, and expand the service to other countries in 2021. Users will also be allowed to purchase goods and services from 26 million merchants using these cryptocurrencies. The move is expected to encourage global use of virtual coins and prepare its network for new digital currencies that may be developed by central banks and corporations, President and Chief Executive Dan Schulman said in an interview.

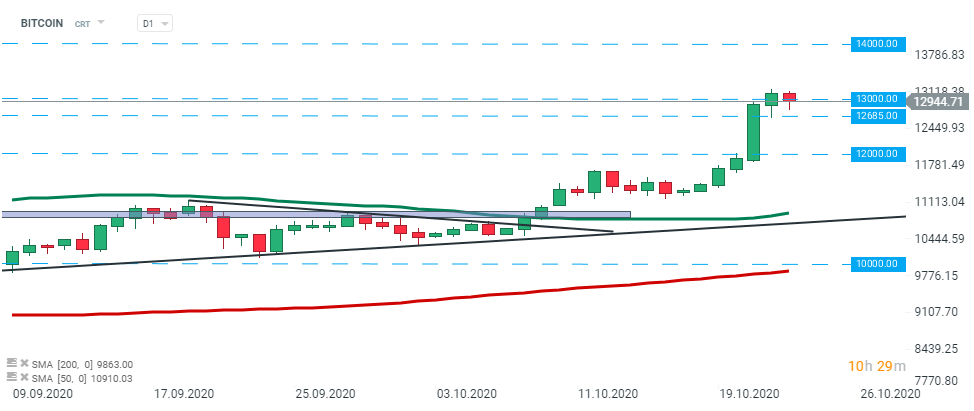

BITCOIN – price bounced off the local support level at $12 685 during yesterday’s session and today is testing the $13 000 level. Should buyers manage to uphold recent momentum, then the upward move could be extended to the $14 000 handle. However should sellers manage to regain control then support at $12000 could be at risk. Source: xStation5

BITCOIN – price bounced off the local support level at $12 685 during yesterday’s session and today is testing the $13 000 level. Should buyers manage to uphold recent momentum, then the upward move could be extended to the $14 000 handle. However should sellers manage to regain control then support at $12000 could be at risk. Source: xStation5CEO of Ripple Labs Brad Garlinghouse told Bloomberg on Wednesday, that his company has identified Singapore and Japan as the most crypto-friendly countries, followed by Switzerland, the United Kingdom, and the United Arab Emirates. Garlinghouse said that Ripple would like to stay in the US, however pointed out the lack of clear regulations and government hostility towards cryptocurrencies as a key challenges that compels the firm to leave the country. Ripple Labs is currently facing a legal battle with the U.S Securities and Exchange Commission (SEC) concerning the sale of its native token XRP that the agency said that was an unregistered security offering. The lawsuit is still ongoing. Meanwhile Japan, which is know for its crypto-friendly jurisdictions, is one of the potential destinations where Ripple could settle its business. “Japan has been one of our strongest markets. We have a very successful partnership there with a group called SBI. They are actually our largest outside investor, and the CEO there, Kitao-san, has been an innovator and pioneer in a lot things around finance and technology (of fintech)” said Garlinghouse.

RIPPLE – price managed to break above the major resistance at $0.25 during yesterday’s session and this level was re-tested again today. As long as the price sits above it, continuation of a upward trend seems more probable. The nearest resistance to watch lies at $0.2681. However if sellers manage to halt advances here and push the price below the $0.25 handle, then downward impulse towards $0.23 could be launched Source: xStation5

RIPPLE – price managed to break above the major resistance at $0.25 during yesterday’s session and this level was re-tested again today. As long as the price sits above it, continuation of a upward trend seems more probable. The nearest resistance to watch lies at $0.2681. However if sellers manage to halt advances here and push the price below the $0.25 handle, then downward impulse towards $0.23 could be launched Source: xStation5Fed's Powell: More important for U.S. to get digital currency right than be first

Many central banks across the world are exploring CBDC concepts. Until recently, most projects were in the early stages of development, but work accelerated after Facebook announced that will create its own virtual token and the ongoing pandemic increased dramatically digital payments. China, whose work on the development of its own digital currency is at a much higher level compared to other major economies, confirmed that it plans to become the first country to issue one to reduce its dependence on the global dollar payment system. In order to catch up with China, seven major central banks last week laid out key principles for issuing central bank digital currencies (CBDC). During a panel discussion on cross-border payments hosted by the International Monetary Fund (IMF) on Monday, FED Chair Jerome Powell, has acknowledged that a CBDC could lead to improvements in the broader payment system in the U.S. However in any development of a cross-border digital currency, it is more important for the United States "to get it right than be first and getting it right means that we not only look at the potential benefits of a CBDC, but also the potential risks, and also recognize the important trade offs that have to be thought through carefully," Powell said. He also told that while the Fed has made no decision yet on issuing a digital currency, it is an active participant in research into the prospect in partnership with other central banks and the Bank for International Settlements. Moreover, it is conducting research on its own.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.