- Bitcoin price is aiming to retest the $60,000 psychological level

- Number of Ethereum unique addresses broke four million

- Cardano network activity is increasing

Cryptocurrencies took a hit on Friday as the detection of a new coronavirus variant in South Africa triggered a broad risk-off sentiment across financial markets. As a result Bitcoin price plunged 8% while Ether, the second biggest cryptocurrency by market capitalization, dropped briefly below $4,000. However today moods improved as some health officials said that Omicron coronavirus variant seems to cause only mild symptoms of infection. On Monday the Bitcoin price rose 4%. Ethereum and Ripple are promptly following major crypto and are also on the path to recovery.

Bitcoin:

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app- According to the recent orderbook data from analytics resource Material Scientist, a lot of buying orders are placed around $50,00 level, which provides strong support.

BTC/USD orderbook heatmap. Source: Material Scientist/ Twitter

- Bitcoin Fear and Greed Index, which measures market emotions, entered “extreme fear” territory on Saturday, the lowest level since the end of September.

The Crypto Fear & Greed Index fell sharply last week. Source: alternative.me

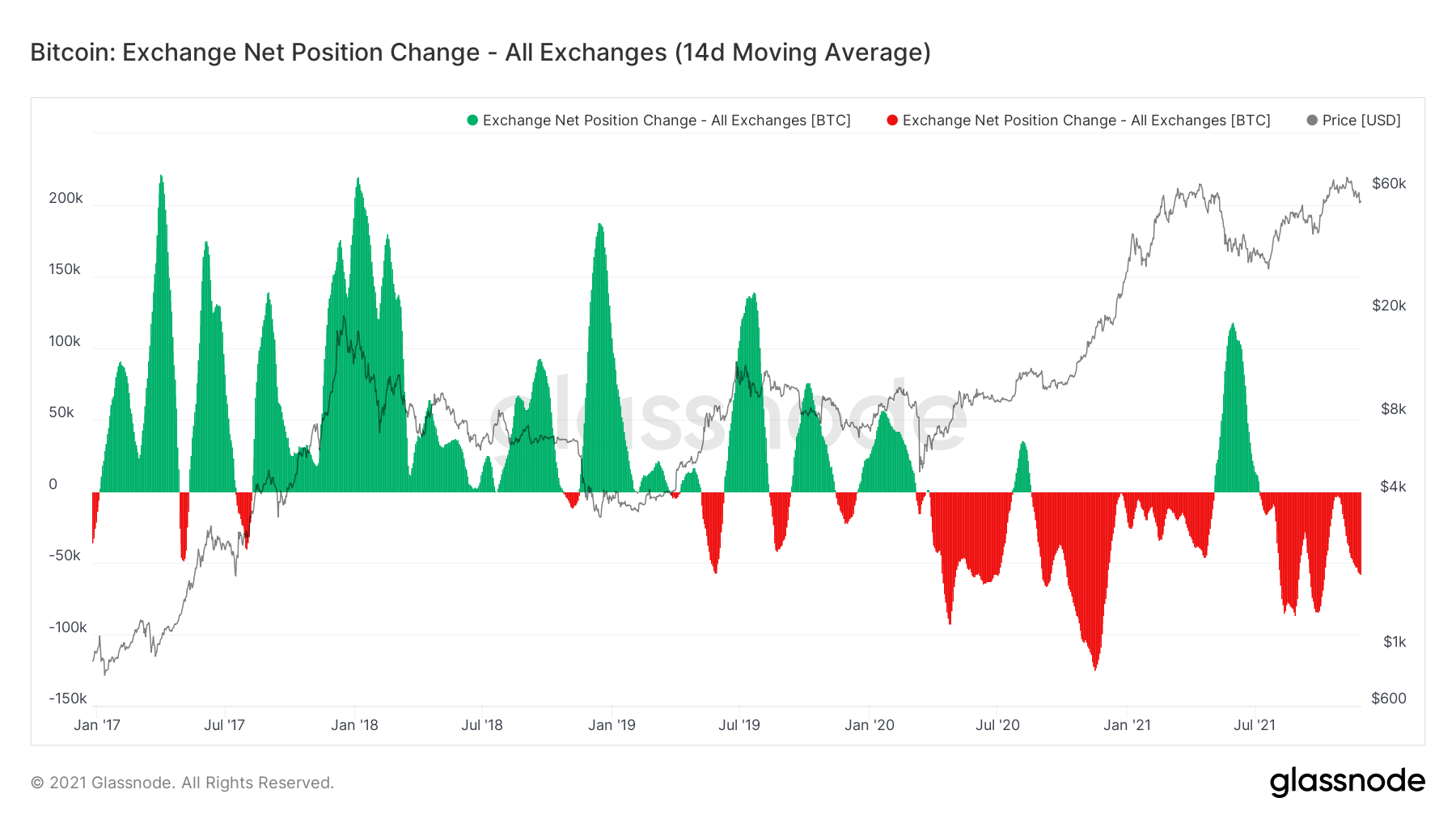

- Despite “Extreme Fear” on the “Fear and Greed Index,” buyers stocked up Bitcoin at $53,000. Bitcoin exchange balances continued to drop in recent months. More Bitcoins were removed from the exchanges during the recent sell-off, and this was in sharp contrast to the 2017 cycle, where BTC started flooding exchanges once the price rally started.

Bitcoin net position change is an indicator that measures the total inflow/ outflow of BTC across exchanges as a moving average for the past two weeks. A net outflow is considered a bullish sign for Bitcoin price. Source: Glassnode

- According to the popular Twitter analyst TechDevThe next few weeks will be “very telling” for Bitcoin as it makes or breaks some significant correlation with gold. The most popular cryptocurrency continued to replicate precious metal price movements from the 1970s.

Similarities between Bitcoin in 2020-21 and Gold fifty years ago have endured despite some volatility anomalies in Bitcoin price action. If current trend prevails, then Bitcoin price may rise sharply in the near future. Source: TechDev/ Twitter

Bitcoin - recent sell-off was stopped at the major support area around $52,000. The green zone on the chart below is marked with previous price reactions and the 38.2% Fibonacci retracement of the upward move, started in June. In addition, the price returned above the lower limit of 1:1 structure (purple rectangle). According to the Overbalance methodology, it signals that the main sentiment remains bullish. Source: xStation5

Ethereum:

- Data from Dune Analytics showed that unique addresses on Ethereum – the total decentralized finance users on the blockchain – broke four million this past week (Note that one user may have multiple addresses).

- The introduction of the EIP 3554 protocol has been postponed from December 1, 2021 to the summer of 2022, but developers, including Vitalik Buterin, have already developed a short-term EIP 4488 solution that aims to solve the gas fee problem in the Ethereum network in the short term.

- Meanwhile, EIP 3554 is to make ETH virtually impossible to extract, the difficulty is to increase by 90% thanks to the so-called difficulty bomb. The miners are likely to go staking. This may cause a supply shock following the implementation of this protocol.

ETHEREUM price fell sharply last week, however sellers failed to stay below psychological $4000 level which coincides with lower limit of the 1:1 structure and 36.2% Fibonacci retracement of the last upward wave. Currently price is testing local resistance at $4366,00 which is strengthened by 23.6% Fibonacci retracement. Should break higher occur, upward move may accelerate towards all-time high at $4870.00. Source: xStation5

Cardano:

- Cardano price action has been very limited in recent months as the token continues to slide, creating lower lows.

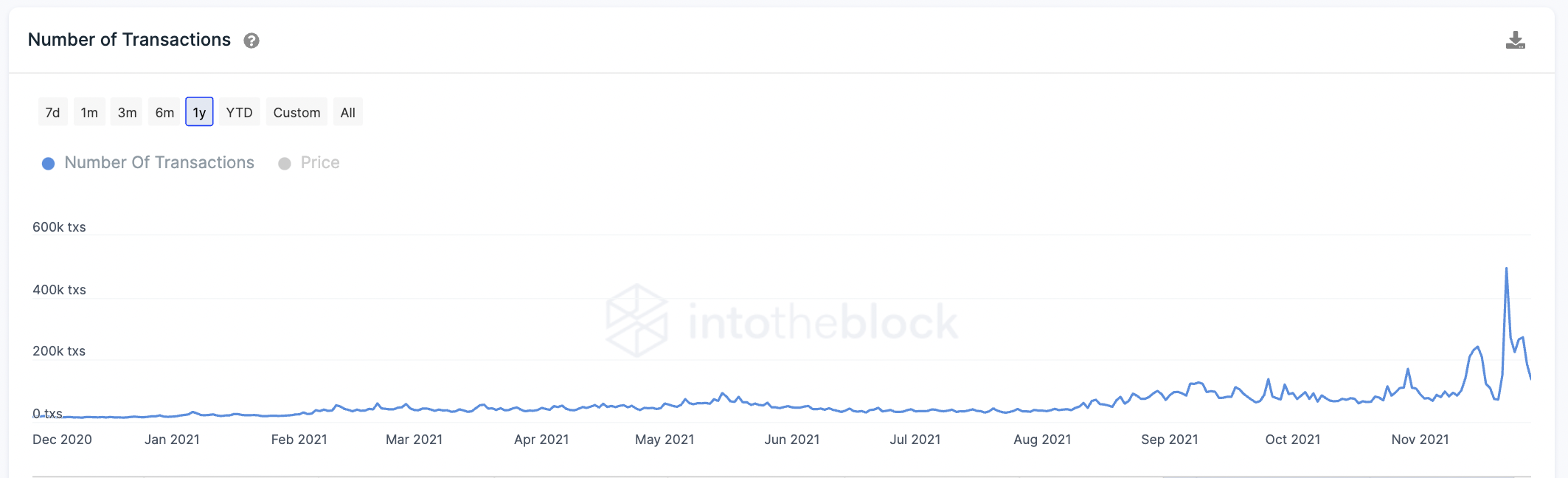

- However, the protocol’s network activity has increased as a flurry of Dapps joins the blockchain.

Cardano’s network activity has continued to increase as the blockchain has allowed users to create decentralized applications (Dapps) on its network. Source: intotheblock

Cardano’s network activity has continued to increase as the blockchain has allowed users to create decentralized applications (Dapps) on its network. Source: intotheblock

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.