Bitcoin started the week in a weaker sentiment and the price of the largest cryptocurrency is once again losing nearly 2%, approaching $65,000. Comments from BlackRock indicate that despite a high-profile debut in January, very few investment advisors have chosen to recommend ETFs to their clients. This suggests mostly 'organic' demand to date and the potential for upside in the long term, supported by the slow adoption of BTC as a 'mainstream' asset. However, there are many indications that investors have begun to weigh the risks of a downward scenario.

Driven by seasonality and uncertainty around the sustainability of the Wall Street rally, the market has decided to realize gains, and at this point the appetite for BTC has fallen. Also, the situation of bond yields still seems uncertain in the short term. As seasonality patterns show, summer has typically been a period during which Bitcoin has underperformed, which may further lead investors to realize gains. We are also seeing declines in smaller cryptocurrencies today, with GRAPH, indirectly related to artificial intelligence in the blockchain world, losing more than 8%, Ethereum held above $3500.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appAs we can see, US spot ETFs saw net outflow of funds in the end of the previous week, which may be a signal that sentiments around BTC are weakening. Source: XTB Research, Bloomberg Finance L.P.

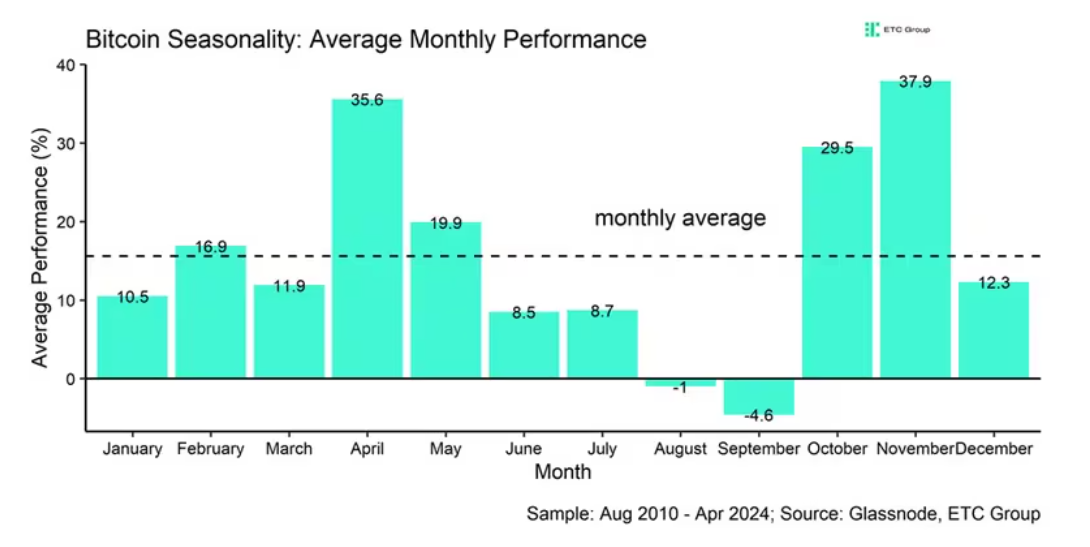

Bitcoin's average monthly returns (data August 2010 - April 2024)

Often tracked by cryptocurrency traders, seasonality suggests that we may have a weaker summer period, after some great months in the spring, where March was particularly strong - and perversely weak April. A potential recovery of BTC in such a scenario could come in late August/early September, this year. Source: ETC Group

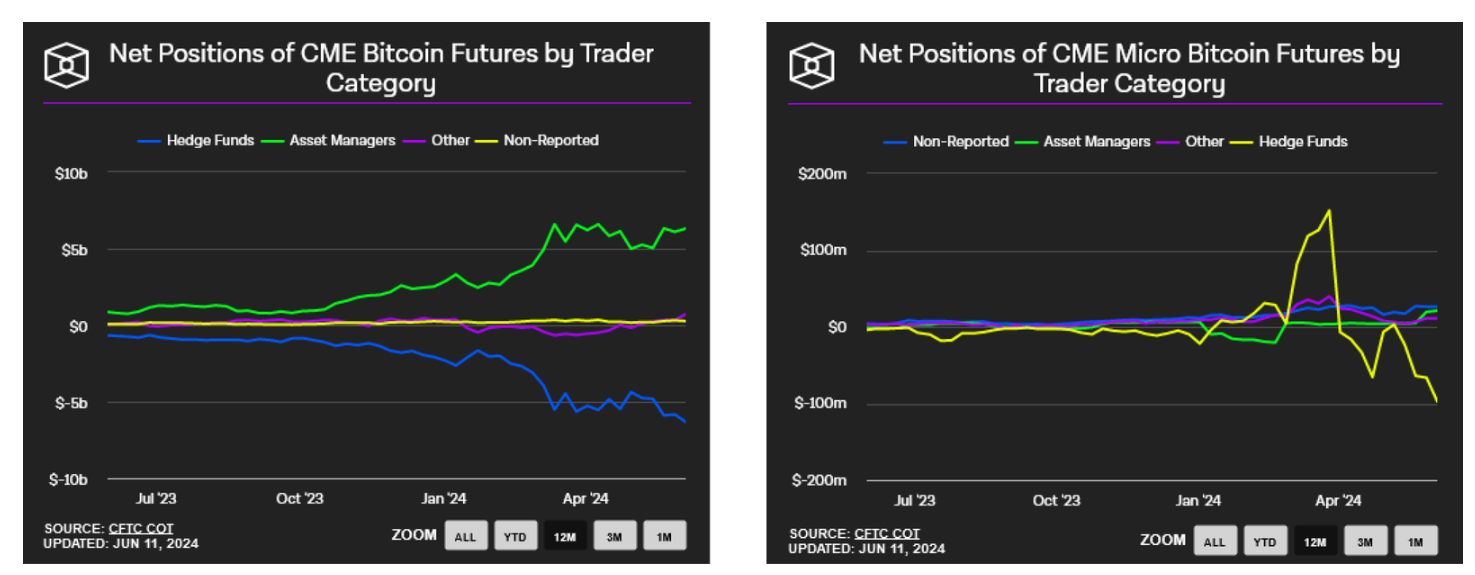

An updated Commitment of Traders report (dated June 11) from the CFTC suggests that high demand for exchange-traded funds (ETFs) in Q1 resulted in rising BTC short positions, on the CME commodity exchange where hedge funds currently hold short positions worth about $6.5 billion and hedge against underperformance in ETFs. Source: The Block, CFTC

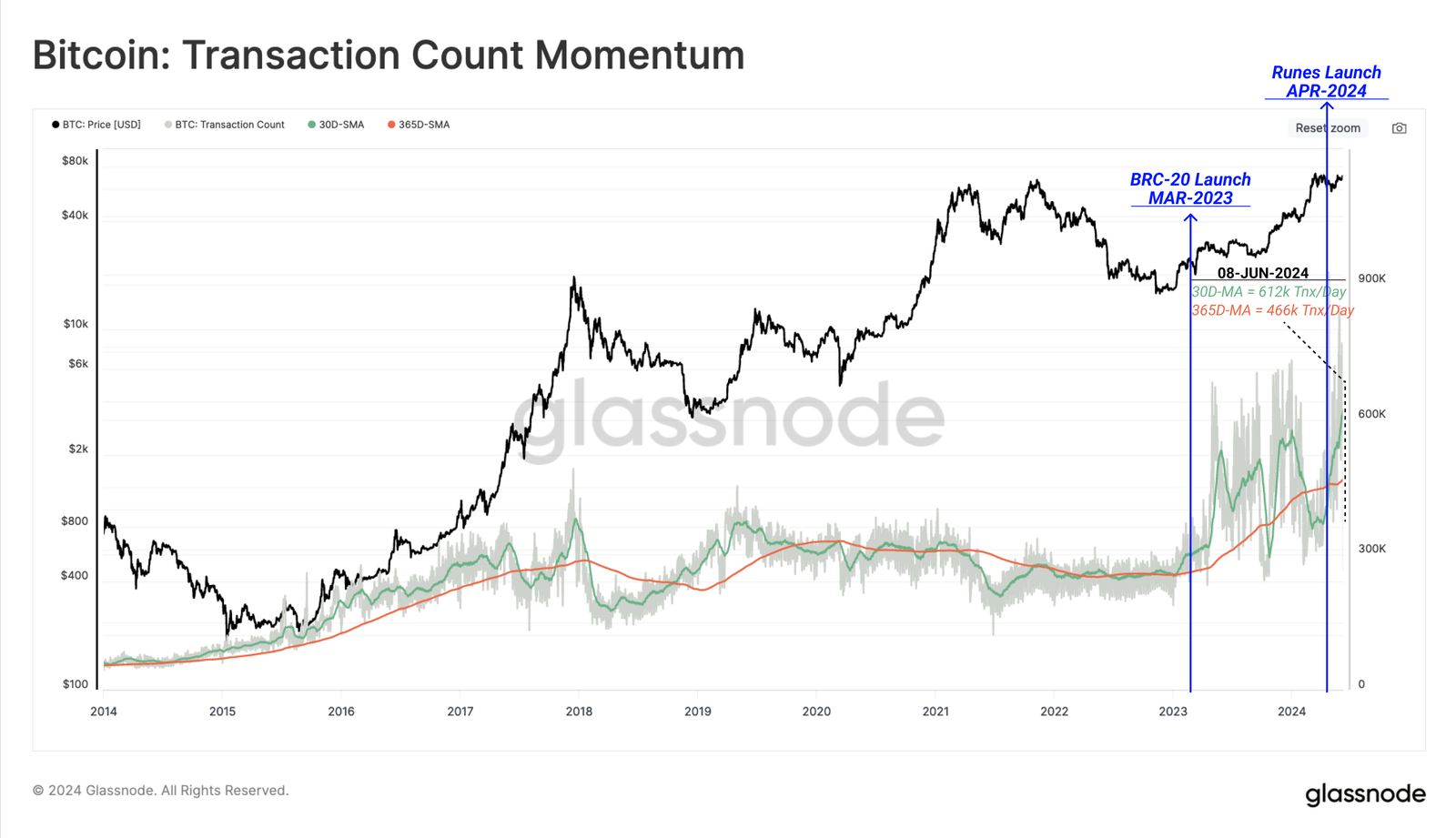

The number of transactions on the BTC network is growing, and on-chain data shows that so-called Inscriptions were responsible for only a few % of the recent increase. The monthly average number of transactions is about 620,000 per day; that's more than 30% above the annual average, and indicates relatively high demand for bitcoin blockchain space. Source: Glassnode

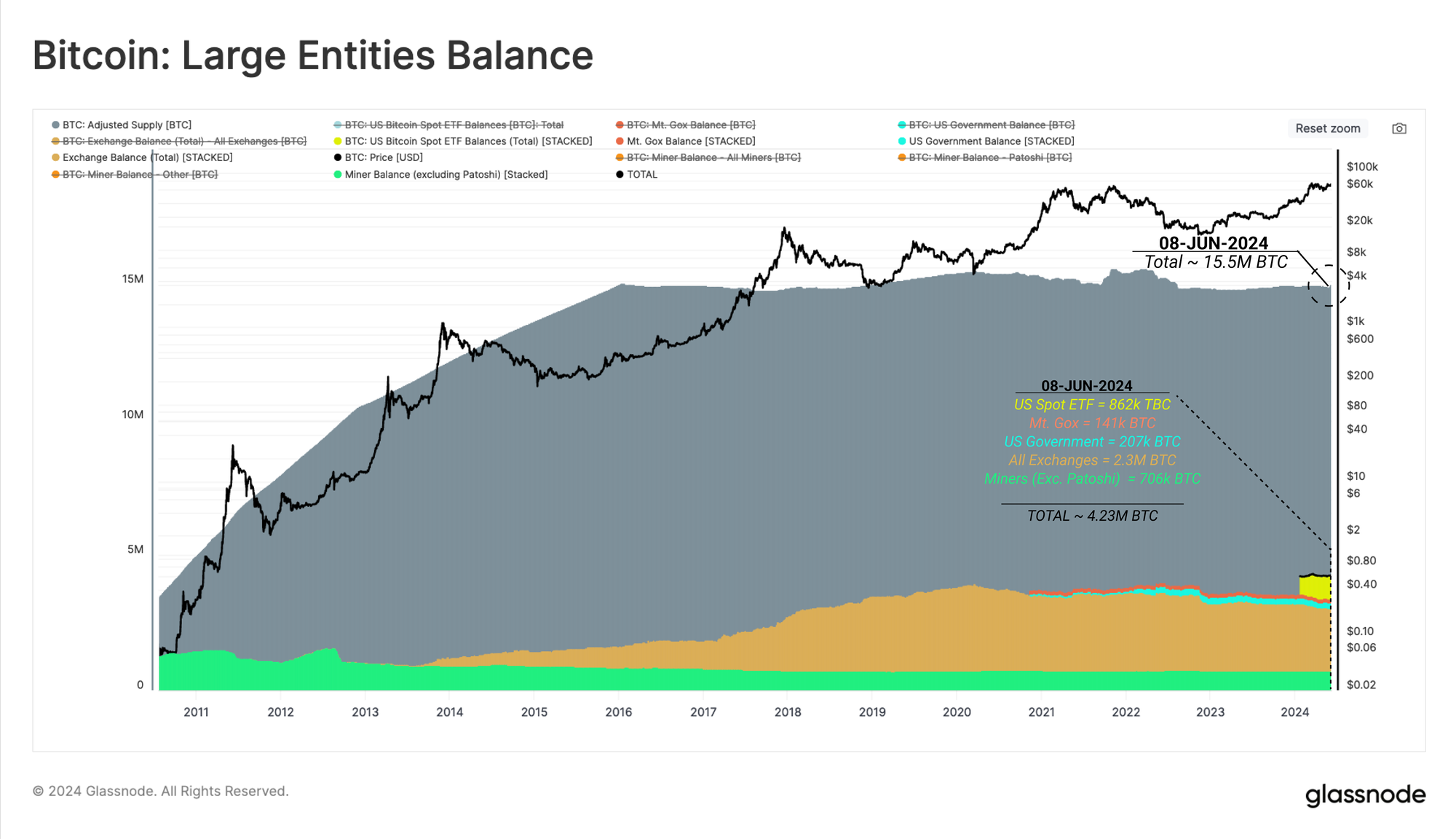

During recent 6 months, US spot ETFs have absorbed a huge amount of BTC (862 thousand), which is approaching 1 million and represents a significant chunk of the total current (19.7 million) as well as the target cryptocurrency supply of 21 million. Source: Glassnode

Bitcoin (D1 interval)

Looking at the daily interval, we see that the price has once again dipped below the SMA100 and SMA50 - two key momentum averages for BTC. The first time the price was below the SMA100 was in early May, but it quickly rebounded then from levels below $60,000. A renewed drop below it may suggest pressure, ultimately leading to a more violent sell-off. On the other hand, a counter-intuitive upward move could now take the BTC price as high as around $70K, but the bulls would have to overcome two important averages, which have turned from support into resistance. The average purchase price of short-term investors runs around $63.5 thousand and now appears to be an important momentum support. After potentially drop below $65k and $63,5k, where we can see located also 71.6 Fibonacci retracement wave, we may see catalysts, which may fuel BTC market capitulation. At the moment it's unclear, will Fibo, trend-line and on-chain provide enough support. Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.