An avalanche of institutions applying to create a spot ETF for Bitcoin ultimately failed to cause a dynamic continuation of Bitcoin's rally above $30,000. Supply above this psychological barrier remains high but Glassnode data last week have indicated that nearly 88% of short-term traders are in profit making the distribution after the dynamic rebound from $25,000 and the realization of gains should not come as a surprise. Investors clearly see opportunities in spot ETFs, but there is still quite a long way to go before the regulators' final consideration.

- The major cryptocurrency is trading around $29,000 level and Ethereum is losing nearly 1,5% - it has retreated to $1,870, the entire cryptocurrency market has come under downward pressure

- The news of the proposal to create a Bitcoin ETF by GlobalX passed almost without an echo, which underscores that the market has 'tired' of the topic of ETFs for Bitcoin and needs another positive catalyst;

- According to Coinglass data, nearly 50,000 cryptocurrency speculators have been liquidated in the last 24 hours, with the value of liquidations exceeding $150 million.

- Cryptocurrency management funds registered their first week of outflows after 4 weeks of inflows worth more than $500 million per week on average;

- Sam Altman, CEO of OpenAI behind ChatGPT launched the crypto cryptocurrency he originated 'Worldcoin' on crypto exchanges - the price is up more than 1500%, but this has not translated into improved sentiments.

BITCOIN price freefall has stopped at the bottom line of the 'Andrews Fork' indicator- if $29,000 is maintained a dynamic return above $30,000 is not ruled out. On the other hand, a fall below the SMA200 (red line) may herald prolonged weakness, as has happened in previous such cases (the chart since the fall of 2022). Source: xStation5

BITCOIN price freefall has stopped at the bottom line of the 'Andrews Fork' indicator- if $29,000 is maintained a dynamic return above $30,000 is not ruled out. On the other hand, a fall below the SMA200 (red line) may herald prolonged weakness, as has happened in previous such cases (the chart since the fall of 2022). Source: xStation5 The dollar index (USDIDX) is gaining while the price of Bitcoin took another dive. The drop in BTC just before earnings releases by tech moguls could herald that sentiment will weaken further if Wall Street is also in a correction. Especially if the US dollar, which has been intensely oversold for more than six months, should continue to rebound. Source: xStation5

The dollar index (USDIDX) is gaining while the price of Bitcoin took another dive. The drop in BTC just before earnings releases by tech moguls could herald that sentiment will weaken further if Wall Street is also in a correction. Especially if the US dollar, which has been intensely oversold for more than six months, should continue to rebound. Source: xStation5

Start investing today or test a free demo

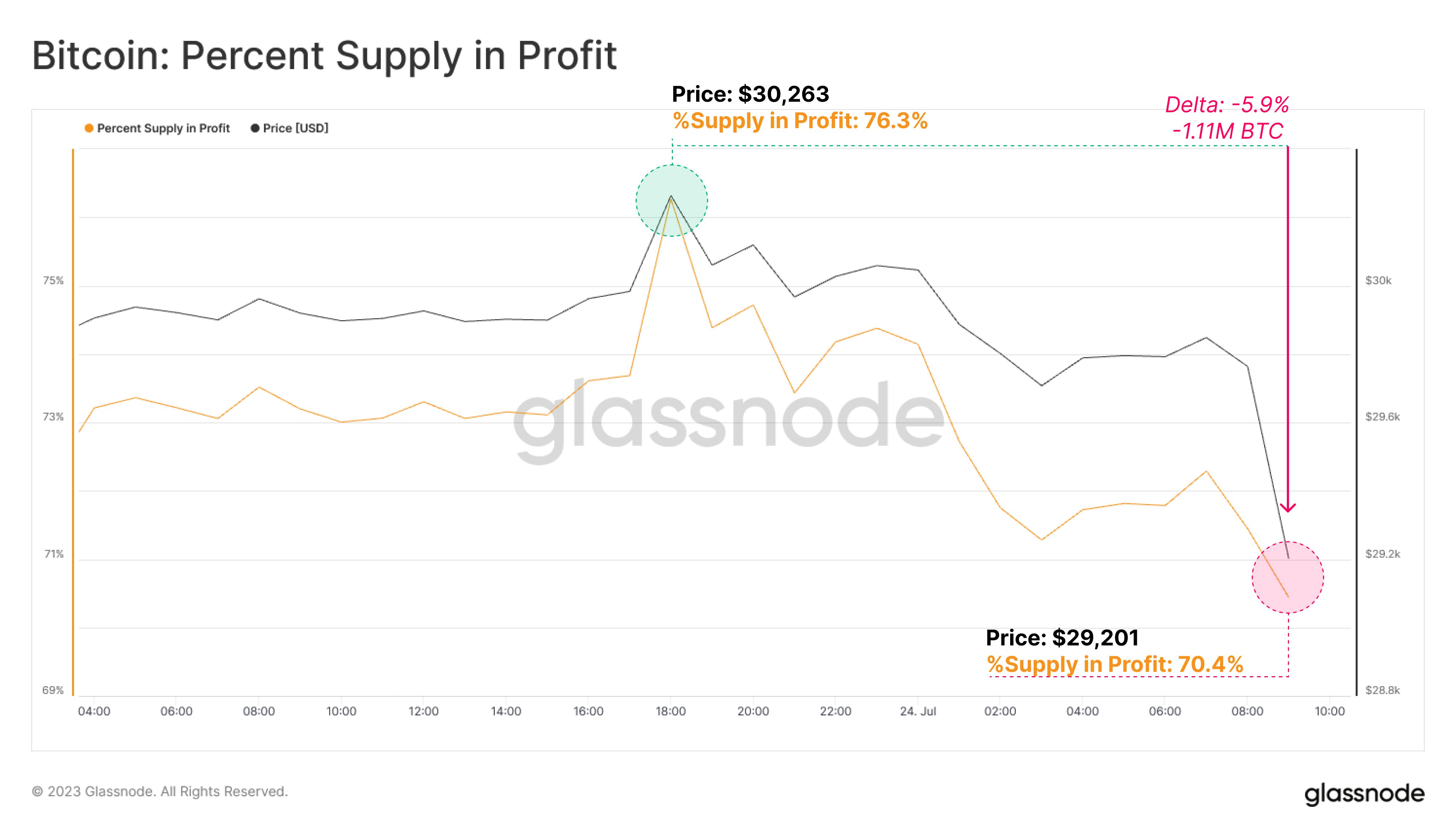

Open account Try demo Download mobile app Download mobile appThe current decline below 30,000 USD has put more than 1.11 million BTC into a loss of 5.9% on average. The supply in profit according to data from Glassnode today is about 70% (13.45 million BTC). Source: Glassnode

At the same time, the amount of BTC held by long-term investors has reached historic peaks and is about 14.52 million BTC i.e. 75% of the total available supply. This shows that most investors are choosing not to sell Bitcoin, which is conducive to declining selling pressure. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.