Amid mixed sentiment on exchanges, cryptocurrencies are losing today. Bitcoin has retreated below $28,000. The Bitcoin network now has nearly 450,000 transactions still outstanding, and sentiment among risky assets was also weighed down by last Friday's surprisingly strong NFP report, which increased the chance of possible further Fed hikes and more difficult-to-manage inflation in the US. Along with Bitcoin, smaller cryptocurrencies like Ethereum, Cardano and Polygon also lost ground.

- Market sentiment weakened as the world's largest exchange, Binance, froze BTC withdrawals for the second consecutive time citing technical problems;

- Coinbase (COIN.US) exchange is considering moving operations to the United Arab Emirates due to regulatory hurdles in the US;

- The exchange's CEO stressed that the cryptocurrency market needs more capital investment to grow. The UAE is once again mentioned as a potential hub;

- According to Bloomberg reports, the Prime Minister of Liechtenstein has stated that he is open to investing state reserves in BTC.

Currently, the cost of a BTC transaction is about $19 although information from exchange users indicates that a significant portion of the routing is even several times more expensive. The reason for the nearly 450,000 transactions waiting to be processed on the network is probably due to the emergence of so-called Ordinals, which enable the creation of NFTs on the BTC blockchain. Due to this fact, network fees have risen to new peaks. Source: Ycharts

BTC addresses have recently taken a dive; both new and active addresses are approaching their annual average (365 DMA).

BTC addresses have recently taken a dive; both new and active addresses are approaching their annual average (365 DMA).

New addresses are now at their lowest levels since January 1, 2023, and active addresses are at 1-year lows. All this despite record volumes and transaction fees. This shows that the expansion of the BTC network is still in question. Source: Glassnode

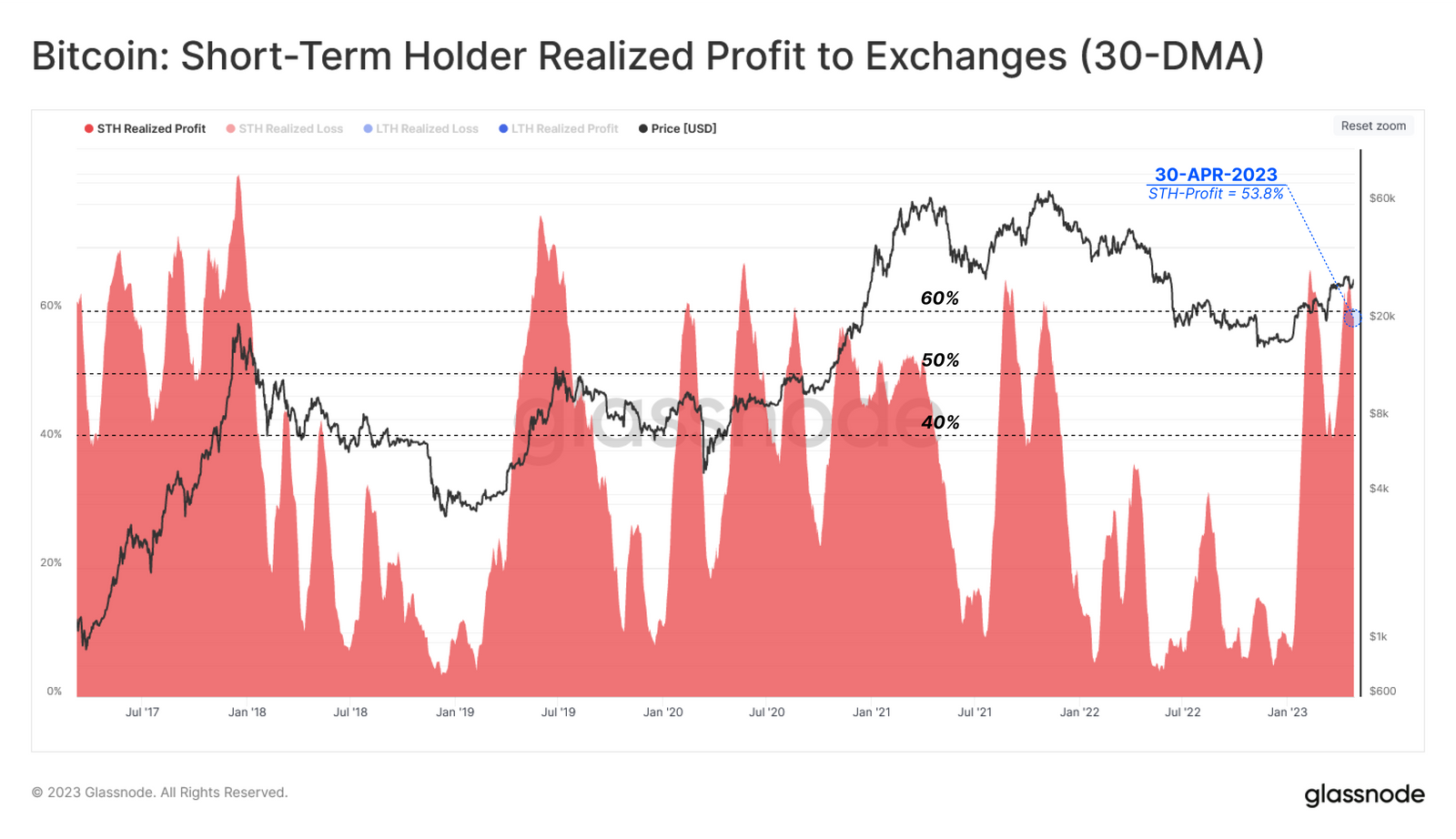

Among the group of long-term (blue) and short-term investors (red), BTC exchanges are mainly sent by short-term holders (about 90% to 95% of all receipts). What is noteworthy at the moment, of course, is the increase in profits of short-term investors in 2023, which makes the willingness to realize them even higher now. On the other hand, however, due to the limited supply in the hands of STH investors - the supply is naturally limited.... Source: Glassnode

Among the group of long-term (blue) and short-term investors (red), BTC exchanges are mainly sent by short-term holders (about 90% to 95% of all receipts). What is noteworthy at the moment, of course, is the increase in profits of short-term investors in 2023, which makes the willingness to realize them even higher now. On the other hand, however, due to the limited supply in the hands of STH investors - the supply is naturally limited.... Source: Glassnode

Isolating the share of profits of short-term investors (STH) from the total inflows to the exchanges, we see that since the beginning of January there have been two waves of profit realization by this group, peaking around the 60% level of the total. Within the current market, the second wave of profit realization by short-term holders coincides with the recent correction. Looking historically, a period of correction followed such heavy selling pressure in STH. Source: Glassnode

Isolating the share of profits of short-term investors (STH) from the total inflows to the exchanges, we see that since the beginning of January there have been two waves of profit realization by this group, peaking around the 60% level of the total. Within the current market, the second wave of profit realization by short-term holders coincides with the recent correction. Looking historically, a period of correction followed such heavy selling pressure in STH. Source: Glassnode

Sell-side levels

BITCOIN, H4 interval. The price has settled below the SMA200 and SMA100 signaling weakness, the first support level may be the 23.6 Fiboancci retracement, of the upward wave from the fall of 2022 - at $27,400. A deeper decline could herald a bearish reaction, toward the 38.2 Fibo retracement, at $25,000. In a situation of extremes, the $21,500 level appears to be the last bastion of the bulls - it coincides with the 61.8 Fibo retracement and the price level of November 2022, before the collapse of FTX. Source: xStation5

BITCOIN, H4 interval. The price has settled below the SMA200 and SMA100 signaling weakness, the first support level may be the 23.6 Fiboancci retracement, of the upward wave from the fall of 2022 - at $27,400. A deeper decline could herald a bearish reaction, toward the 38.2 Fibo retracement, at $25,000. In a situation of extremes, the $21,500 level appears to be the last bastion of the bulls - it coincides with the 61.8 Fibo retracement and the price level of November 2022, before the collapse of FTX. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.