- Despite weakness in tech giants Apple and Tesla, cryptocurrencies do not react with declines

- Bitcoin and Ethereum's correlation with the NASDAQ index still holds up

Better sentiment on the world's stock exchanges is helping the cryptocurrency market somewhat. Almost all major projects are trading up today. Ethereum is trading near $1,250, Bitcoin is struggling to surpass $16,900. Among altcoins, Cardano, Filecoin, Waves are the best performers. The uptick among Sandbox and Decentraland Metaverse-related cryptocurrencies followed news of Meta Platforms' acquisition of a company that 3D prints lenses for use in so-called smart glasses and AR/VR technology:

The most active cryptocurrencies today. Source: xStation5

The 'Fear and Greed' chart shows the market's persistent 'fear', stemming primarily from uncertainty about the cryptocurrency sector's events in the new year. Source: alternative.me

The 'Fear and Greed' chart shows the market's persistent 'fear', stemming primarily from uncertainty about the cryptocurrency sector's events in the new year. Source: alternative.me

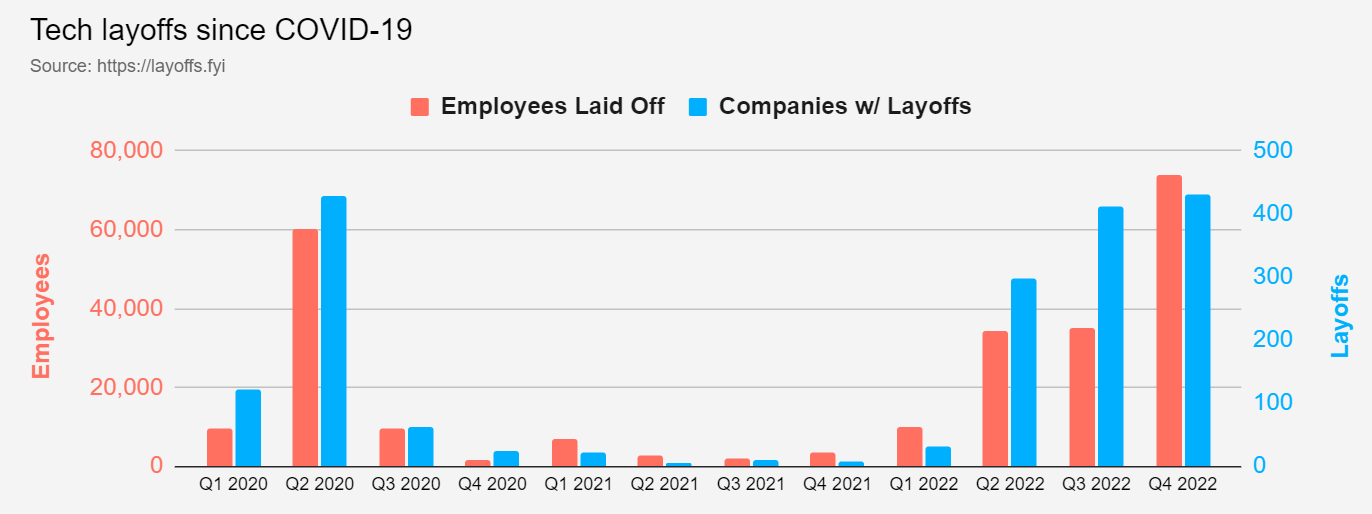

According to Reuters reports, employees laid off from tech giants are opening new startups en masse, mainly in AI and gaming. Although venture capital funding in 2022 fell 33% year-on-year amid a change in monetary policy and higher funding costs, the number of new VC funds, for startups, is still at record levels and has not fallen below 2021 levels. Some industry analysts have already begun to speculate about the potential migration of laid-off tech workers to the blockchain sector and fueling the so-called Web 3.0 revolution. source: layoffs.fyi

According to Reuters reports, employees laid off from tech giants are opening new startups en masse, mainly in AI and gaming. Although venture capital funding in 2022 fell 33% year-on-year amid a change in monetary policy and higher funding costs, the number of new VC funds, for startups, is still at record levels and has not fallen below 2021 levels. Some industry analysts have already begun to speculate about the potential migration of laid-off tech workers to the blockchain sector and fueling the so-called Web 3.0 revolution. source: layoffs.fyi

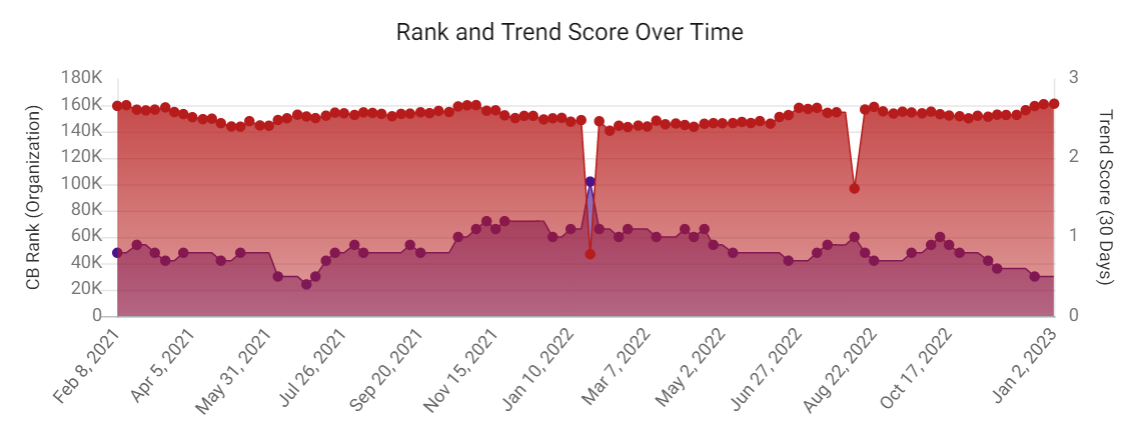

Although interest in blockchain startups still exists we see that the trend in this market in 2022 remains clearly downward. Source: crunchbase.com

Although interest in blockchain startups still exists we see that the trend in this market in 2022 remains clearly downward. Source: crunchbase.com

News

- Cryptopotato reports that Binance is finalizing the acquisition of a 41.2% stake in South Korea's Gopax exchange, one of the most popular in the region;

- Meta Platforms has acquired Luxexcel, a company that manufactures lenses used in augmented reality glasses. This is another step by the giant into the Metaverse;

- The Federal Reserve, FDIC and the Office of the Comptroller of the Currency (OCC) issued a joint statement Tuesday warning of the "significant" risks that cryptocurrency assets could pose to the broader banking system;

- Bankman-Fried himself faces up to 115 years in prison for his alleged role in one of the largest cryptocurrency scandals in history to date. The former billionaire pleads not guilty.

U.S. institutions have again warned against cryptocurrencies, and this time the statement was directed primarily at banks. The Federal Reserve, FDIC and Office of the Comptroller of the Currency (OCC) on Tuesday, in a joint statement, warned of the "significant" risks that cryptocurrency assets could pose to the broader banking system. The regulators warned banks pointing to fraud, volatility, poor risk management and contagion in the cryptocurrency sector. They also pointed to legal uncertainty when it comes to redemptions, ownership rights and cryptocurrency asset management practices. A chart of Bitcoin (red-green), Ethereum (blue-white) and US100 (yellow-white), on the M15 interval. We can see that cryptocurrencies, despite relatively low volatility and declining liquidity, are following the US index, known for its large share of technology companies. Source: xStation5

A chart of Bitcoin (red-green), Ethereum (blue-white) and US100 (yellow-white), on the M15 interval. We can see that cryptocurrencies, despite relatively low volatility and declining liquidity, are following the US index, known for its large share of technology companies. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.