Shares of Crowdstrike (CRWD.US) shares plunged nearly 20.0% on Wednesday as weak financial outlook overshadowed upbeat quarterly results.

-

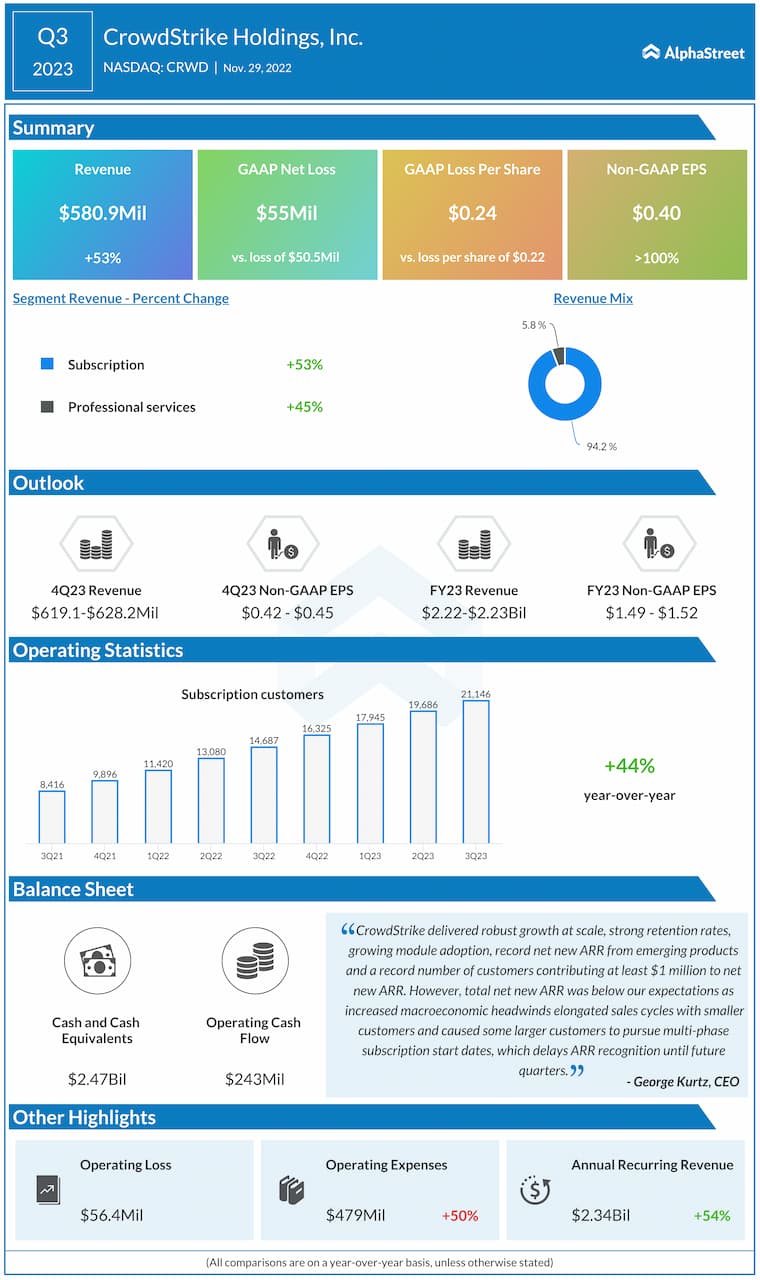

Company earned 40 cents per share, beating FactSet estimates of 32 cents.

-

Revenue increased 52.8% YoY to $580.9 million and topped market projections of $575.1 million.

-

However the cybersecurity company said that due to longer sales cycles to its budget-focused customer base its Q4 revenues would likely range between $619.1 million to $628.2 million, well below the $633.9 million consensus call.

-

Crowdstrike warned of “increased macroeconomic headwinds” for the sector in the coming year.

-

"Organizations are responding to macroeconomic conditions by adding extra layers of required approvals and extending the time it took to close some deals," said company's CEO George Kurtz.

Crowdstrike key quarterly figures. Source: AlphaStreet

Crowdstrike key quarterly figures. Source: AlphaStreet

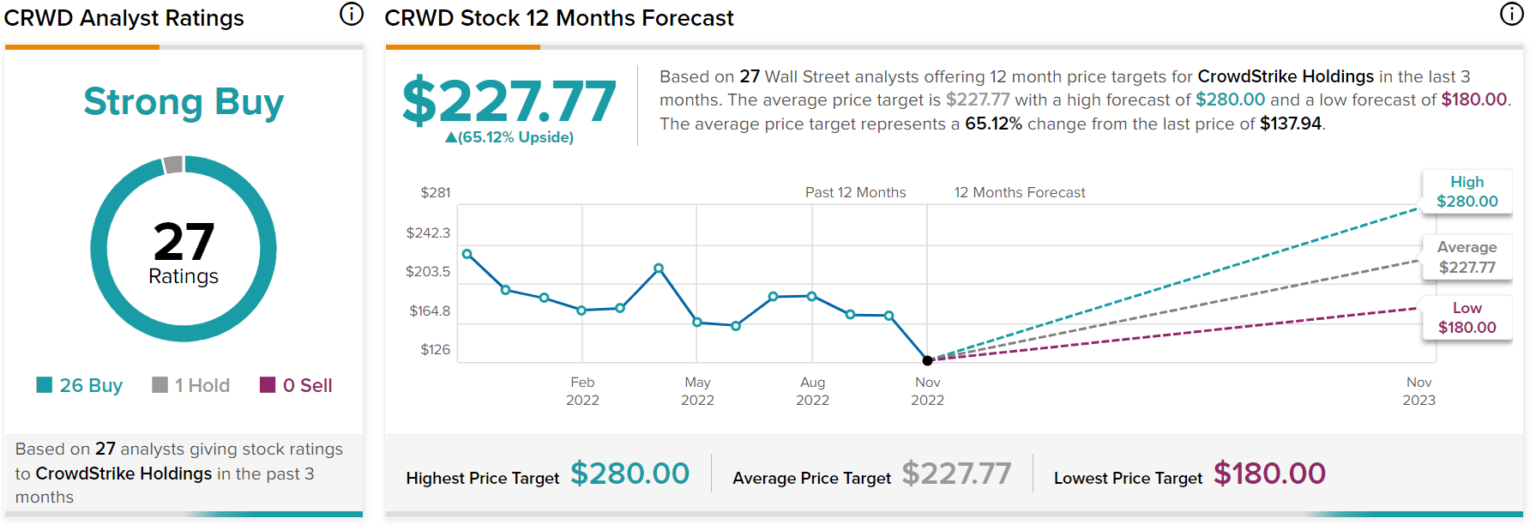

Before earnings announcement Crowdstrike stock had a strong buy rating based on 27 analysts recommendation with a price target of $227.77, which implies over 107.00% upside potential from current price levels. Source: Tipranks

Before earnings announcement Crowdstrike stock had a strong buy rating based on 27 analysts recommendation with a price target of $227.77, which implies over 107.00% upside potential from current price levels. Source: Tipranks

Crowdstrike (CRWD.US) stock launched today’s session with a massive bearish price gap and is trading below recent lows at $120.00. If current sentiment prevails, support at $89.20 may be at risk. This level is marked with 78.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Crowdstrike (CRWD.US) stock launched today’s session with a massive bearish price gap and is trading below recent lows at $120.00. If current sentiment prevails, support at $89.20 may be at risk. This level is marked with 78.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.