Swiss bank Credit Suisse (CSGN.CH) is constantly under downward pressure. Today, the shares are losing more than 5.0% following the announcement that the publication of annual results has been postponed in the face of a call by the US SEC, which is demanding an explanation for certain inaccuracies in earlier financial statements.

Back in February, the Bank communicated that 2022 had been the most difficult year in the corporation's history to date. The annual loss is expected to reach levels not seen since 2008, primarily related to massive withdrawals by the richest clients and the massive scandals in which the Bank has been involved (including the collapse of the private firm Archegos Capital, which managed the funds of Sung Kook Hwang, linked to Tiger Management).

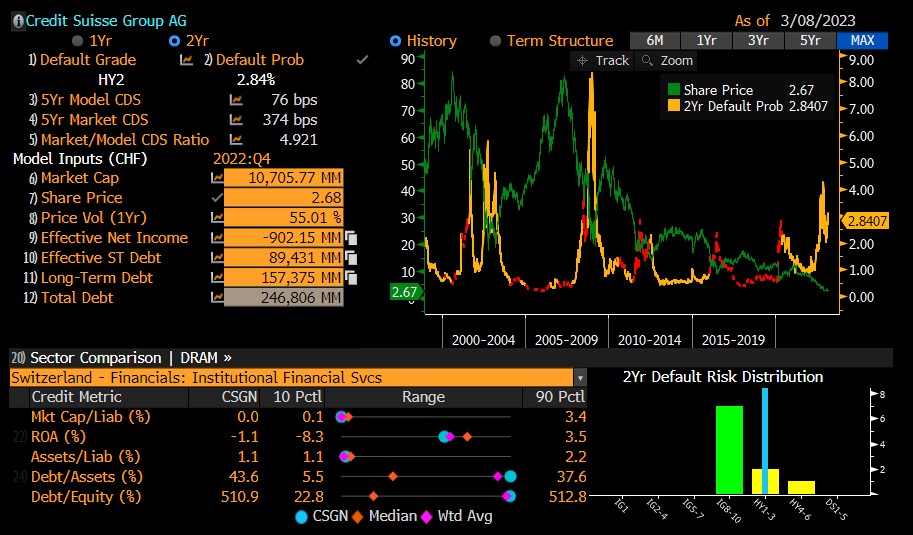

The risk profile around the Bank does not inspire optimism. Most rating agencies have assessed the company's situation as negative, and continued pressure and incoming news are dragging share prices down. All this increases the probability of the Bank's collapse, which is currently close to 2.84%. Source: Bloomberg

The risk profile around the Bank does not inspire optimism. Most rating agencies have assessed the company's situation as negative, and continued pressure and incoming news are dragging share prices down. All this increases the probability of the Bank's collapse, which is currently close to 2.84%. Source: Bloomberg

Credit Suisse is trying to rectify the bank's situation and continues to review its operations. The bank is cutting costs and jobs and spinning off parts of its business, including its core IB unit, by reactivating the Credit Suisse First Boston entity.

Source: xStation 5

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.