Credit Agricole (ACA.FR) stock rose over 3% after its Italian unit launched a voluntary public tender offer of €10.50 per share in cash for Italian bank Credito Valtellinese (CVAL.IT), corresponding to a total investment of €737 million. As a result of this transaction, Credit Agricole will acquire 100% of Credito Valtellinese shares. The acquisition is expected to generate a return on investment for Credit Agricole Italia's shareholders of more than 10% by the third year, Credit Agricole said. Should the transaction be concluded, then Credit Agricole Italia SpA would become the sixth largest retail bank in Italy.

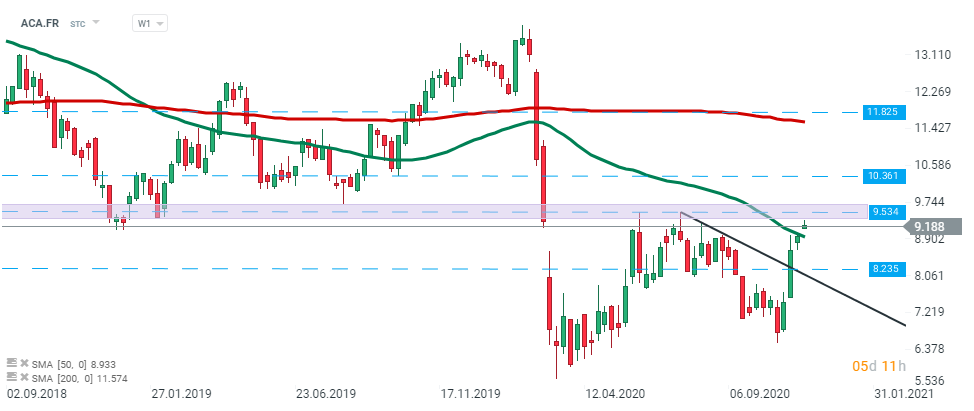

Credit Agricole (ACA.FR) stock managed to break above 50 SMA (green line) last week, however price bounced off the resistance zone located around €9.53 level. Should buyers fail to break above it, a near-term support lies at €8.23. Source: xStation5

Credit Agricole (ACA.FR) stock managed to break above 50 SMA (green line) last week, however price bounced off the resistance zone located around €9.53 level. Should buyers fail to break above it, a near-term support lies at €8.23. Source: xStation5

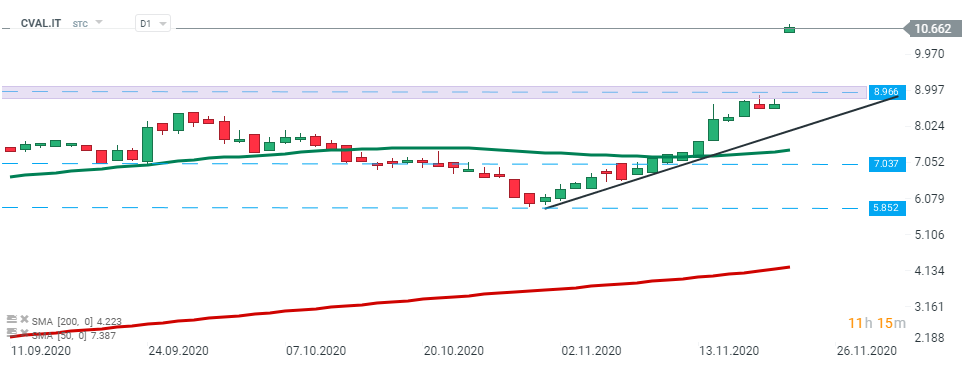

Credito Valtellinese (CVAL.IT) stock launched today's session with a massive bullish price gap and painted a fresh all-time high. However if the current market sentiment changes, then the nearest support lies at €8.96. Source: xStation5

Credito Valtellinese (CVAL.IT) stock launched today's session with a massive bullish price gap and painted a fresh all-time high. However if the current market sentiment changes, then the nearest support lies at €8.96. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.