Oil

-

Oil prices dropped at the beginning of this week amid a wave of anti-Covid protests in China

-

Market hopes that in spite of a higher number of new Covid cases than in spring, Chinese economy will be reopened

-

According to Rigzone, global oil stockpiles increased by 70 million barrels (around 2.5 million barrels per week) as nations build up reserves ahead of introduction of embargo on Russian oil

-

In spite of the increase in global stockpiles being quite impressive, it may only offset the lack of Russian crude for a few months. Moreover, it was the highest average weekly inventory build since September 2021

-

Embargo on Russian oil is set to go live on December 5, 2022. Oil stockpiles in Europe sit at the highest level since July 2021

-

Stockpiles in the United States also climbed to the highest level since July 2021 but have dropped over the past 2 weeks. US Strategic Petroleum Reserves dropped below 400 million barrels

WTI prices dropped to the lowest level since December 2021. Prices bounced on hopes that the Chinese economy is heading for a reopening. However, the future outlook for oil will depend on how stable demand is, how the Russian oil embargo is implemented and whether OPEC+ will decide to cut output further. Source: xStation5

WTI prices dropped to the lowest level since December 2021. Prices bounced on hopes that the Chinese economy is heading for a reopening. However, the future outlook for oil will depend on how stable demand is, how the Russian oil embargo is implemented and whether OPEC+ will decide to cut output further. Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appNatural Gas

-

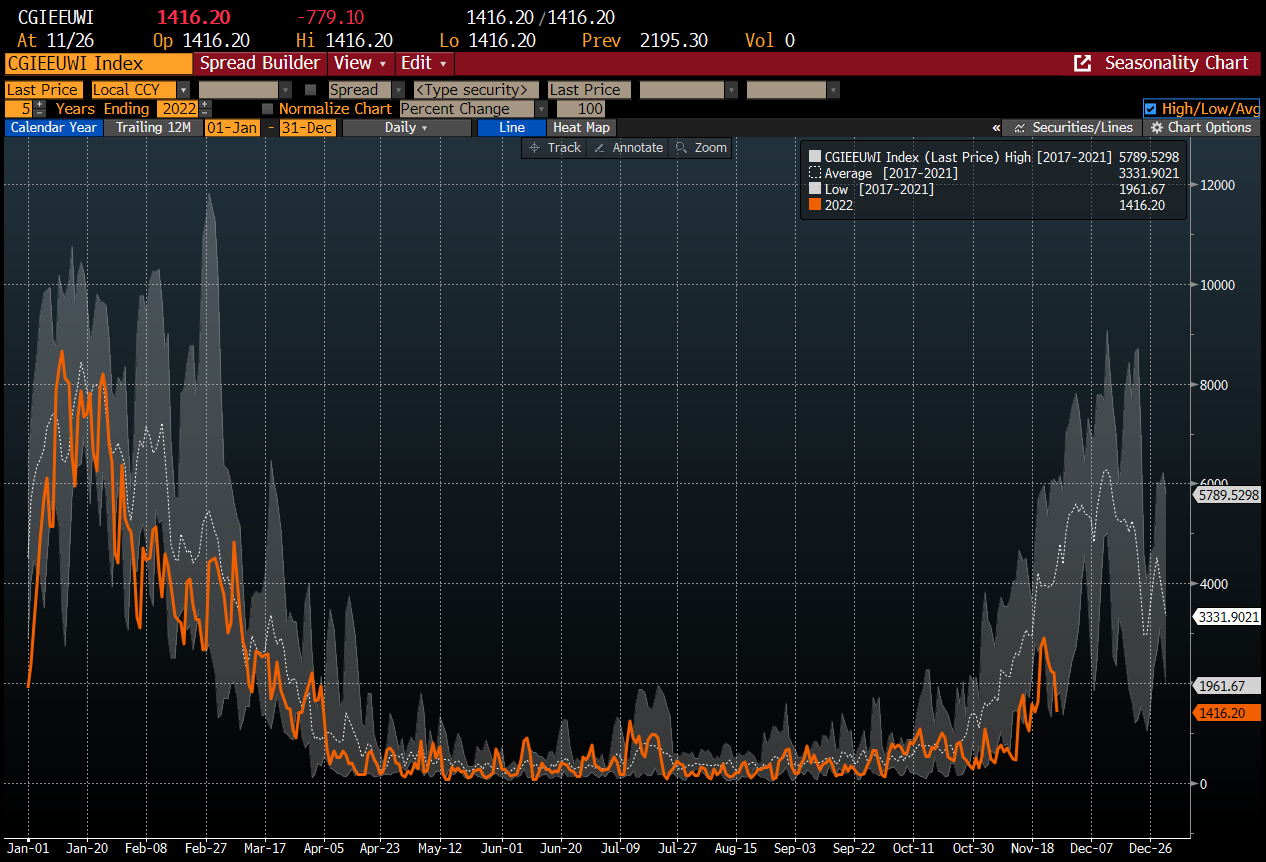

Natural gas prices in Europe are holding steady, slightly below €130 per MWh

-

However, it should be noted that two strong upward impulses occur near the end of the year in 2021 - in October and in December

-

Temperature in Europe is expected to drop in the coming days, what may boost demand for natural gas. EU is withdrawing relatively small amounts of gas from its inventories, which are currently over-93% full

-

Of course, whether Europe will be able to refill stockpiles after upcoming heating season remains a key question

-

Germany signed a 15-year LNG supply agreement with Qatar. However, deliveries will not begin until 2026

-

Freeport LNG terminal in the United States is expected to resume operations in mid-December. Its exports capacity will climb to 2 bcf per day at the beginning of January 2023

-

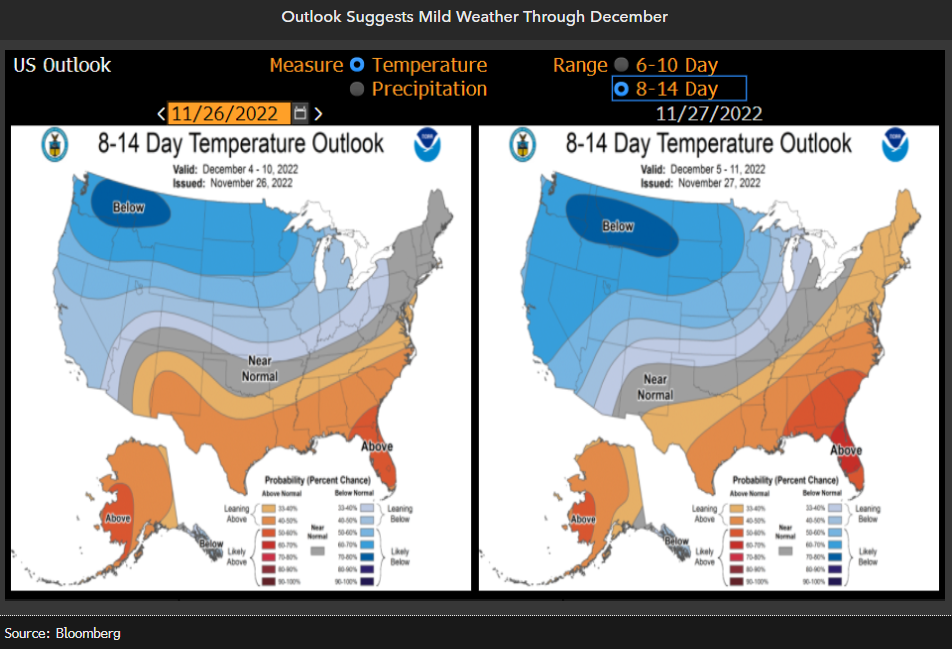

Outlook for US natural gas prices in the next weeks is more or less neutral. However, a lot will depend on weather conditions

-

Current relatively high temperatures in the United States cause US natural gas production to remain at extremely high level of above 100 bcf

Temperature in Europe should drop below average in the coming days. Meanwhile, temperature in the United States remains relatively mild. Source: xStation5

Withdrawals from European natural gas inventories remain below 5-year average for the current period. However, a lot may change with an expected arrival of lower temperatures. Source: Bloomberg

Withdrawals from European natural gas inventories remain below 5-year average for the current period. However, a lot may change with an expected arrival of lower temperatures. Source: Bloomberg

NATGAS pulled back at the end of a previous week amid forecasts of mild weather in the US in the coming days. On the other hand, price found support in the $7 per MMBTu area. Should temperatures drop significantly, one cannot rule out the possibility of prices spiking back above $8 per MMBTu. Source: xStation5

NATGAS pulled back at the end of a previous week amid forecasts of mild weather in the US in the coming days. On the other hand, price found support in the $7 per MMBTu area. Should temperatures drop significantly, one cannot rule out the possibility of prices spiking back above $8 per MMBTu. Source: xStation5

Gold

-

Gold traded near the $1,750 area in recent days amid uncertainty related to the future of Chinese pandemic restrictions

-

A drop in US yields and strengthening of Japanese yen could also be spotted

-

On the other hand, drop in yields is relatively small and it may not be until December's Fed meeting until we see a larger volatility on the gold market

-

Central banks have been significant buyers of psychical gold in Q3 2022 and this trend is most likely being continued in Q4 2022

-

Interestingly, ETFs stopped selling out their gold holdings

-

Number of open short positions on gold was reduced significantly

Gold price bounced amid pick-up in net speculative positioning. However, increase in net position was driven mostly by reduction in short positions, rather than increase in longs. Source: Bloomberg

Gold price bounced amid pick-up in net speculative positioning. However, increase in net position was driven mostly by reduction in short positions, rather than increase in longs. Source: Bloomberg

Copper

-

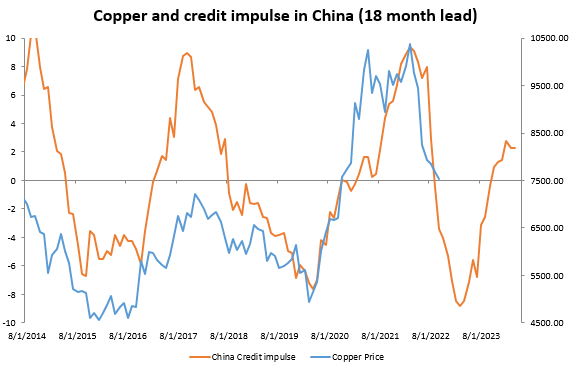

Copper once again dropped to the $8,000 per tonne area amid uncertainty over Chinese economic activity

-

On the other hand, state support for property developers may prevent copper demand from collapsing

-

Chinese credit impulse continues to rebound and is in positive territory already. However, as data is an 18-month leading indicator, copper price may be set for some weakness before situation improves

-

Market still hopes that Chinese authorities will abandon Covid-zero policy, what could support economic activity in the next year

Chinese credit impulse improved significantly recently but the 18-month lead means that cyclical low in copper prices may still be ahead of us. Source: Bloomberg, XTB

Chinese credit impulse improved significantly recently but the 18-month lead means that cyclical low in copper prices may still be ahead of us. Source: Bloomberg, XTB

Copper trades near in the $8,000 area. Interestingly, there was no material improvement on the yuan market. Source: xStation5

Copper trades near in the $8,000 area. Interestingly, there was no material improvement on the yuan market. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.