Oil

- Many ships have been rerouted due to a recent increase in pirate activity off the Somalia coast as well as more frequent attacks on commercial vessels by Yemen-based Houthi rebels

- More than 8 million barrels of oil are passing daily through the Suez Canal. Rerouting ships trough Cape of Good Hope will result in delivery delays that may push goods prices higher (pro-inflationary factor)

- Goldman Sachs is revising its forecast for oil in 2024 to a range of $70-90 per barrel. Citigroup, on the other hand, points to an average price of $75 per barrel, citing slower demand growth and expectations of further production growth in the US

- Previously, Goldman Sachs expected a range of $80-100 for oil. The median forecast of American banks for Brent crude oil next year is $85 per barrel

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appRecent upward correction on WTI market (OIL.WTI) has been similar in size to the one from November. Price reacted to the 25-session moving average. Simultaneously, speculative positioning and seasonality patterns suggest that ongoing upward move may be extended. On the other hand, technical setup hints that a return to the downtrend is also an option. Source: xStation5

Natural Gas

- NOAA reports that October and November were among the warmest in history, dating back to the beginning of observations over 100 years ago. The high temperatures and forecasts indicating the persistence of high temperatures in the coming weeks suggest limited natural gas consumption in the US, despite near-record production

- Additionally, the fairly strong El Niño this year may lead to a milder winter in the United States. El Niño often brings abundant rainfall to South America, though if it is not a strong phenomenon, it is positive for crops in that region. On the flip side, it can bring droughts to the United States (increasing gas consumption in the summer due to air conditioning)

- Natural gas inventories in the USA remain significantly above the 5-year average and above last year's levels

- The recent spike in gas prices was associated with increase in tensions in the Middle East and the potential delay to LNG deliveries to European countries. Even with an increased willingness to use American gas in such a situation, the United States is currently exporting over 14 bcf/d, which is almost the maximum export level

- If there are no weather changes, gas price increases may be limited. The difference between the January and March contracts (currently lower than the April contract) is less than 10% of the current gas price

Weather forecasts suggest that above-average temperatures in the majority of the United States will continue, what may limit natural gas demand. Moreover, we are also observing a near-record production, what may fuel pick-up in comparative inventories. Source: Bloomberg Finance LP

Coffee

- We still have mixed expectations regarding coffee production in Brazil for the upcoming season, although historically, El Niño has had a positive impact on coffee production

- However, there are noticeable issues in Robusta production, where upward pressure is significantly stronger than in the case of Arabica prices

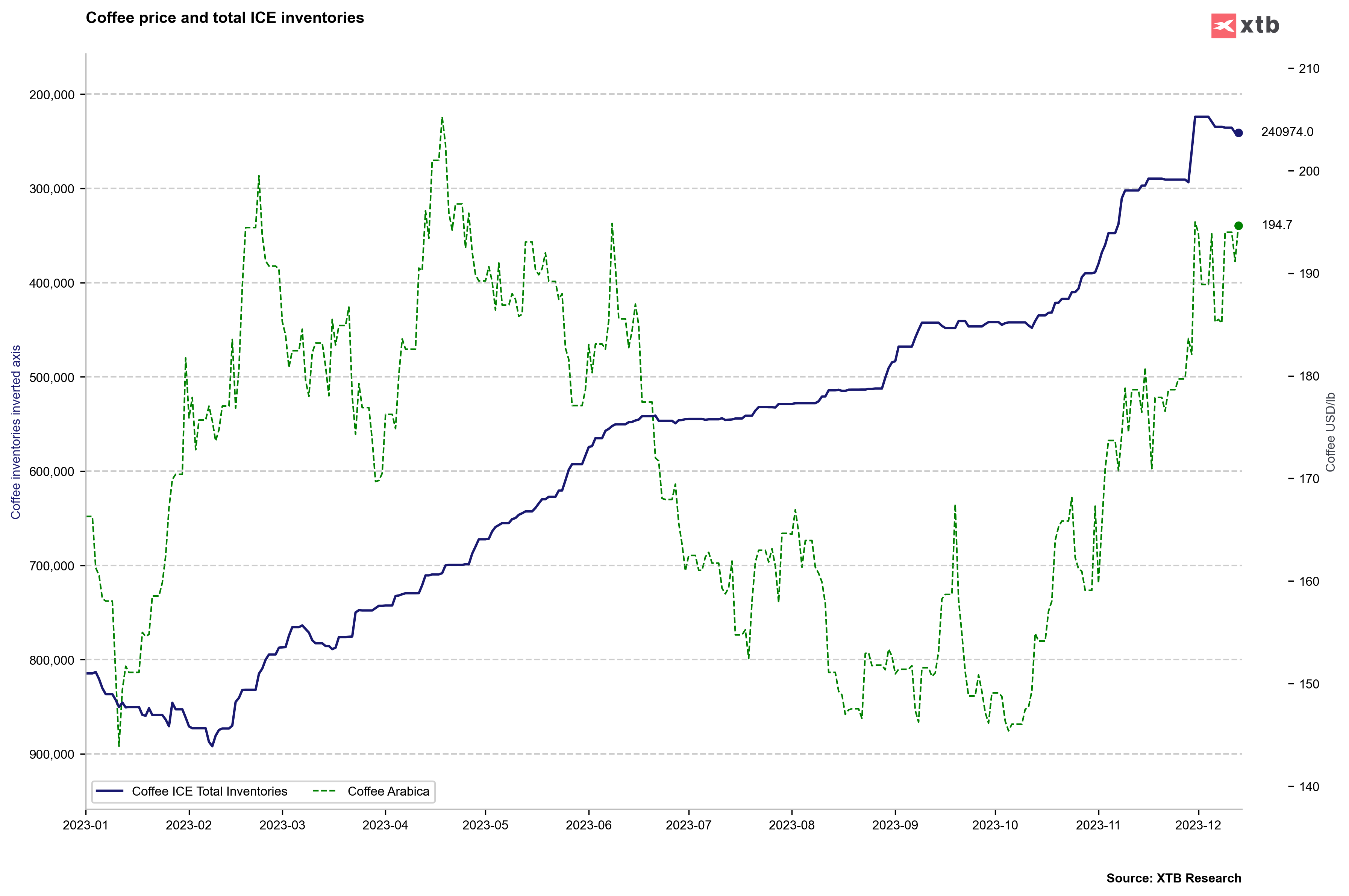

- Stocks have been increasing since the beginning of December, although it's a limited growth at the moment. Stocks clearly rebounded from early November to the end of December last year

- Seasonality currently suggests a local peak may have been reached. Speculative positioning has risen to local peak levels from May

Inventories increase slightly but it was not a big enough increase to trigger a sell-off on the coffee market, as it was the case on the sugar market. Nevertheless, one should remember that those two commodities are correlated in the long-term. Source: Bloomberg Finance LP, XTB

Seasonality suggests that a local peak may have been reached. On top of that, positioning near local highs from May is also a potential contrarian signal. Source: xStation5

Arabica and Robusta prices have been moving in tandem since the beginning of 2020 until the end of Q1 2023. A significant drop in Robusta production led to a strong jump in prices. Shortage of Robusta would also boost Arabica prices. Source: Bloomberg Finance LP, XTB

Gold

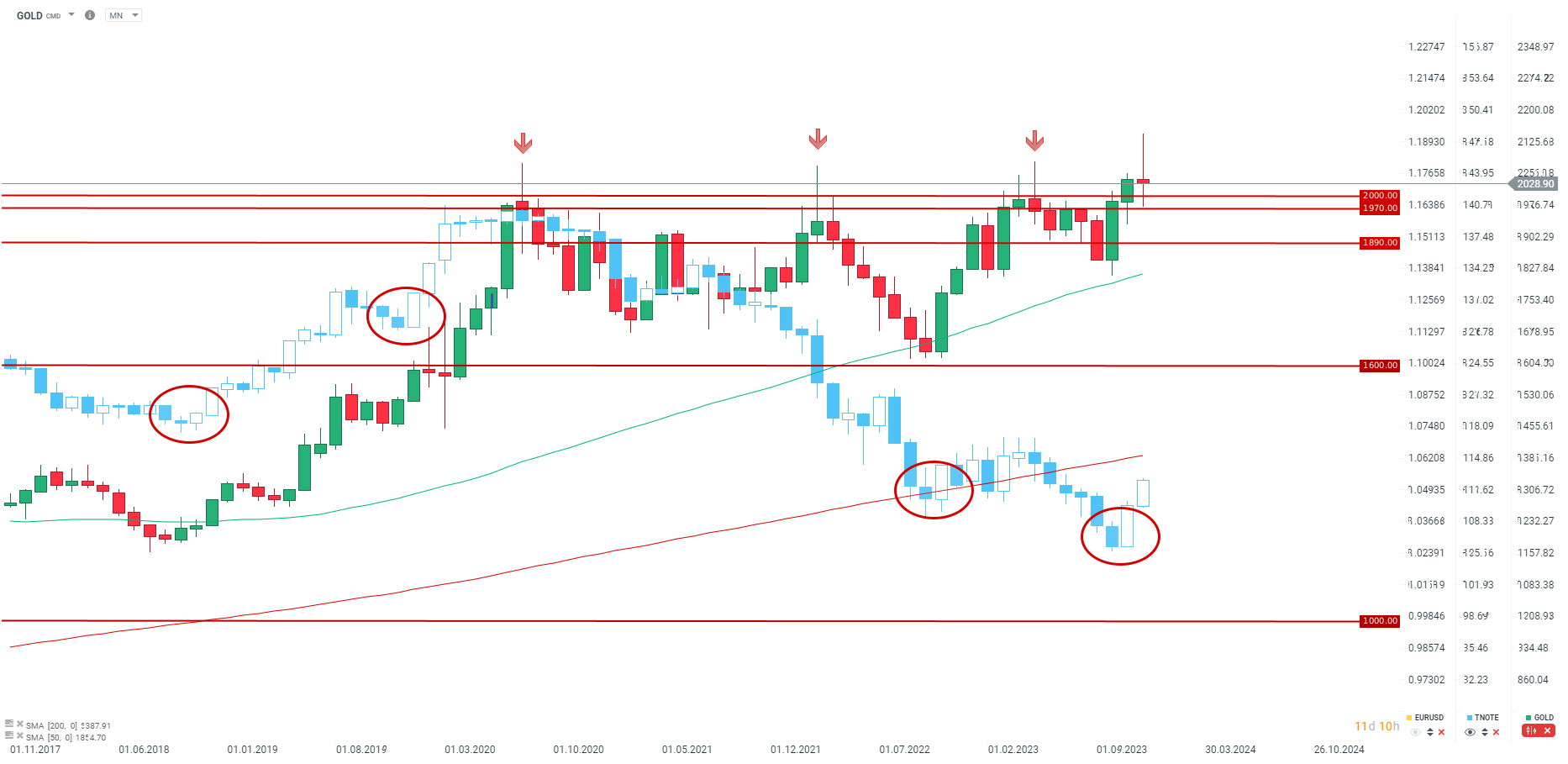

- Gold remains minimally overvalued when considering the deviation from the 5-year average. The current deviation from the 5-year average is 1.8 standard deviations. On the other hand, in 2019 and 2020, there were times when the deviation from the average reached even 4 standard deviations

- Gold inventories on COMEX have stopped declining. If an accumulation phase occurs, it may indicate that gold is being purchased again by investors, similar to what happened in 2020

- There has been an increase in central bank gold balances worldwide since October. However, it's important to note that starting from the middle of next year, the ECB (European Central Bank) will reduce the amount of reinvestment in the PEPP (Pandemic Emergency Purchase Programme), so the second half of the year may be mixed in terms of increased liquidity

- On the other hand, the first interest rate cuts are expected from the Fed (Federal Reserve), ECB, or BoE (Bank of England) in the second half of next year

Gold price compared to key average. Source: Bloomberg Finance LP, XTB

Gold inventories at COMEX stopped declining, what may mean that investors begin to accumulate gold in the nearby future. This could, in turn, support gold price as it was the case in 2019 and 2020. Source: Bloomberg Finance LP, XTB

December's monthly candlestick on GOLD points to an indecisiveness of inventors. Should gold finish the move below $2,000 per ounce, it could be a bearish signal for January. Simultaneously, we are observing strong gains on TNOTE market, the biggest since 2019. Back then, gold was struggling for direction over the next 2 months and ultimately launched a $400 upward move. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.