OIL:

- Oil reacts with declines after reaching the vicinity of the 200-day average (on WTI yes, on Brent very close).

- Oil extends the declines from the end of last week into the beginning of next week due to mixed economic growth data in China

- It is worth mentioning that China was expected to account for around 50% of global oil demand growth this year. A weaker economic recovery could spell trouble for the oil market

- At the same time, we are seeing an extremely weak US dollar, which offers prospects for further increases in commodity prices

- We have a very large backwardation in the oil market, which indicates strong short-term demand in the oil market

- Bank of America's report indicates that investors have the least positioning on crude since 2020

- US crude oil inventories fell to a five-month low in May. A weaker production outlook could lead to a further decline in inventories this year. Data according to JODI

- JODI also indicates that May 2023 recorded the second highest level of demand for oil and its products ever in China, which may conflict with the narrative indicating weakness in Chinese demand this year. On the other hand, more growth was also expected. Demand stood at 17.37 million brk on the day

- Replacement of Permian production in the US via new wells is becoming increasingly difficult

The forward curve is even steeper than a month ago, although no large anomalies are visible at the beginning of the curve. Backwardation in the short term implies upward pressure on prices. Source: Bloomberg

Oil retreated on Friday and Monday, but stopped at the important level of USD 78.5 per barrel. Key support is USD 77 per barrel. Seasonality suggests that oil may behave weakly until the end of July. On the other hand, it is worth noting that we are about to have a rollover, which could be used to get the bulls back into the market. Source: Bloomberg

Oil retreated on Friday and Monday, but stopped at the important level of USD 78.5 per barrel. Key support is USD 77 per barrel. Seasonality suggests that oil may behave weakly until the end of July. On the other hand, it is worth noting that we are about to have a rollover, which could be used to get the bulls back into the market. Source: Bloomberg

Gold:

- Fed members such as Daly and Kashkari, who were rather in favour of two hikes, are starting to question the sense of such a far-reaching statement

- The market has quite clearly reduced its expectations for further hikes. At the moment it is pointing to a July decision and then the first reductions even early next year

- S&P indicates that there will be no rate hike in July and the Fed will keep rates unchanged until next June

- Gold tested the area around USD 1970 per ounce, with the realisation of a reversed head and shoulders trend reversal formation. However, we believe that further declines in yields could extend gold's positive streak, which could lead to a test of the midpoint of this year's downtrend near USD 1990/2000 per ounce

- Seasonality suggests that rises in gold should begin this week and last at least until the end of the month

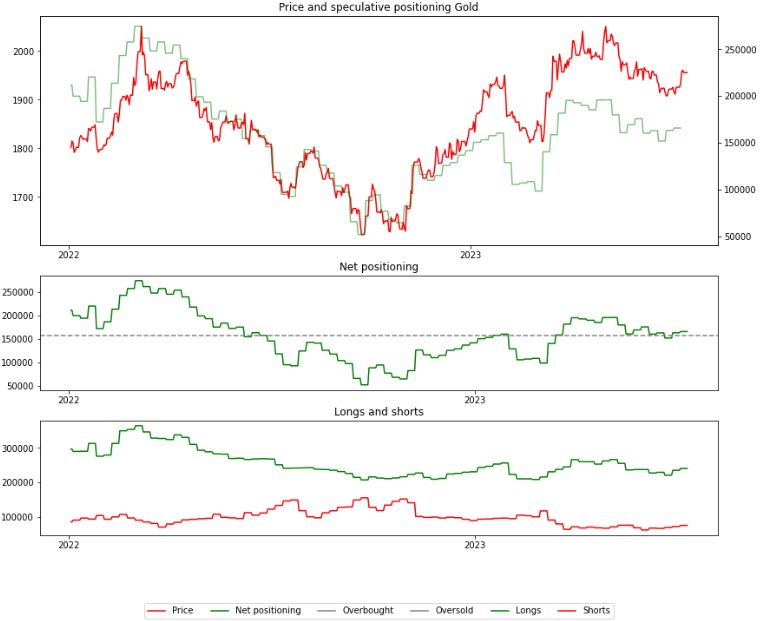

- No clearer signals on positioning among speculators. ETFs are still rather on the selling side of gold. The signal for speculators and ETFs can only be given by a more dovish tone from the Fed.

Positioning does not give any clear signal for gold. Source: Bloomberg, XTB

Positioning does not give any clear signal for gold. Source: Bloomberg, XTB

The gold price has realised a reversed head and shoulders formation, but at the same time there has been a clear signal of a reversal of the recent downtrend. Source: xStation5

Wheat:

- The price of wheat rose to almost 700 cents per bushel in response to the failure to extend the agreement on Ukrainian grain exports across the Black Sea

- A year ago, an agreement was signed and extended several times, which allowed the export of Ukrainian agricultural products, mainly to supply emerging countries

- According to Russia, there has been no fulfilment of the UN's conditions to increase export assistance for Russian products. Prior to the weekend, the UN had indicated that it wanted to make available the possibility for Russian agriculture-related banks to participate in the SWIFT system

- Russia indicates that the attack on the bridge in Crimea was not the immediate reason for the failure to extend the agreement

- At the same time, Ukraine has indicated that it intends to continue some exports by sea and to take advantage of other opportunities. In July alone, the amount of exported grain was very low due to slow grain inspections

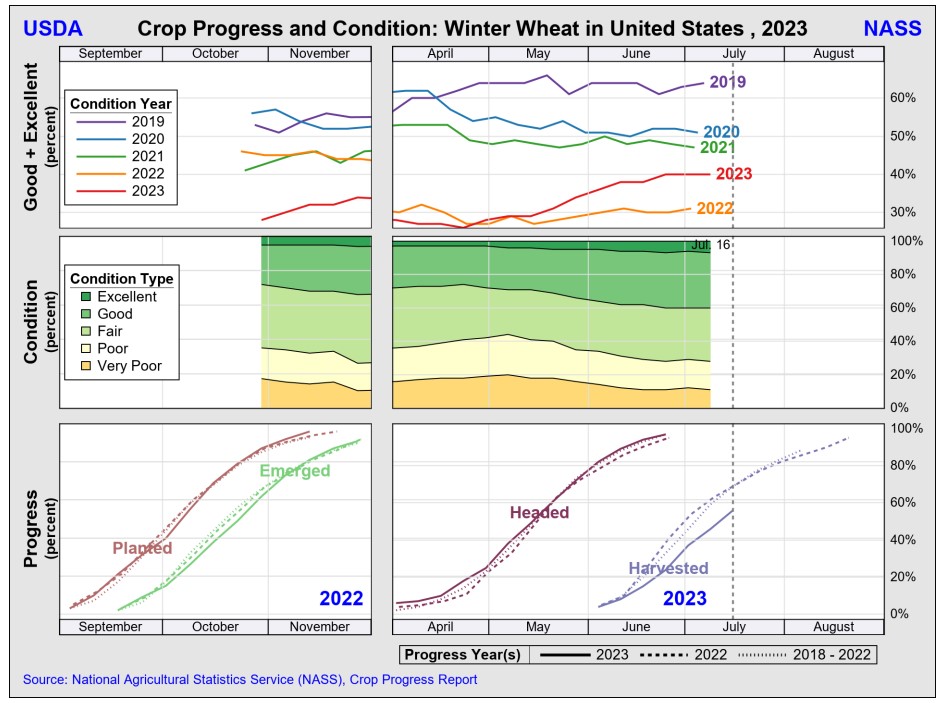

- Meanwhile, in the US, the winter wheat harvest continues, but at the slowest pace since the 1960s. The quality of the crop was little higher than last year

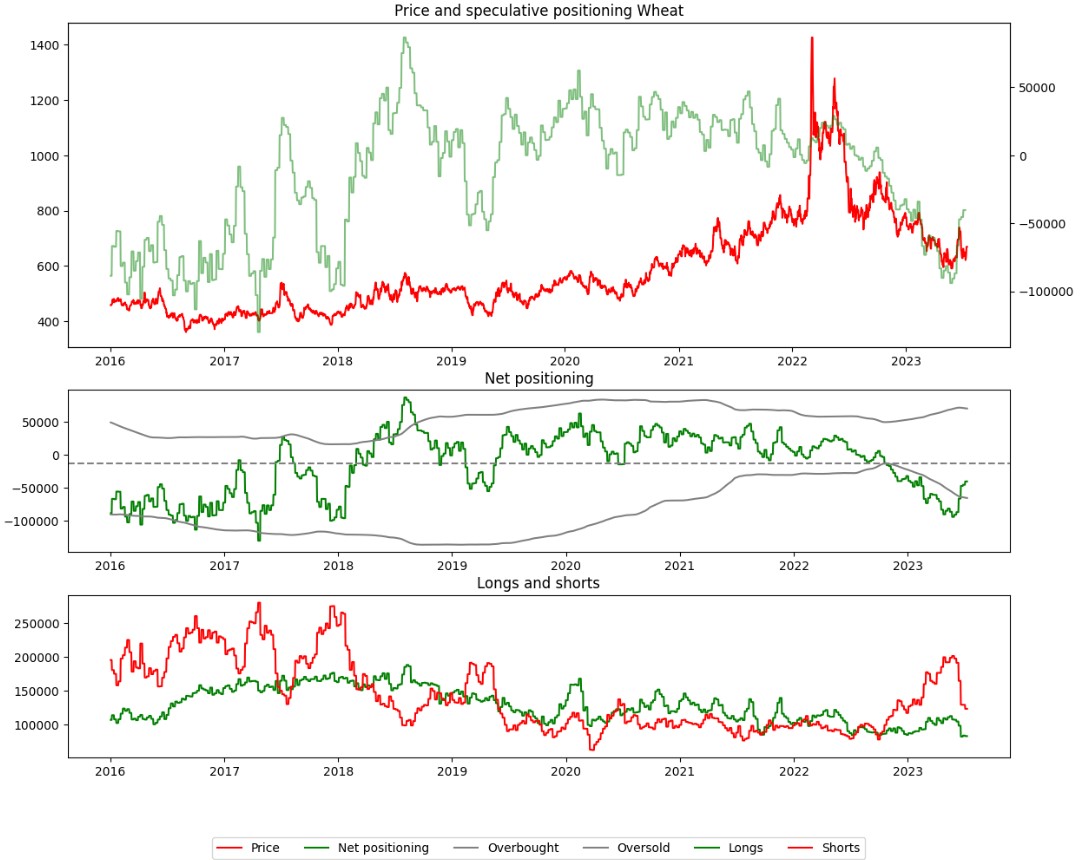

- Speculators clearly closing short positions

Speculators continue to close short positions. The lack of Ukrainian wheat exports by sea could again lead to increased demand for US or South American wheat. Source: Bloomberg, XTB

The harvest is progressing very slowly in the USA. Source: USDA

The price has realised gains at the opening this week, but today the increases have continued. Seasonality points to increases in the coming weeks. Source: xStation5

The price has realised gains at the opening this week, but today the increases have continued. Seasonality points to increases in the coming weeks. Source: xStation5

Gas:

- The growth rate of US stocks is slowing down, but still remains too high to lead to a decline in comparative stocks

- However, the long-term future for gas appears brighter due to the large number of planned export terminals in the US, particularly from 2025 onwards

- Gas is rebounding from around $2.5/MMBTU, as indicated by seasonality

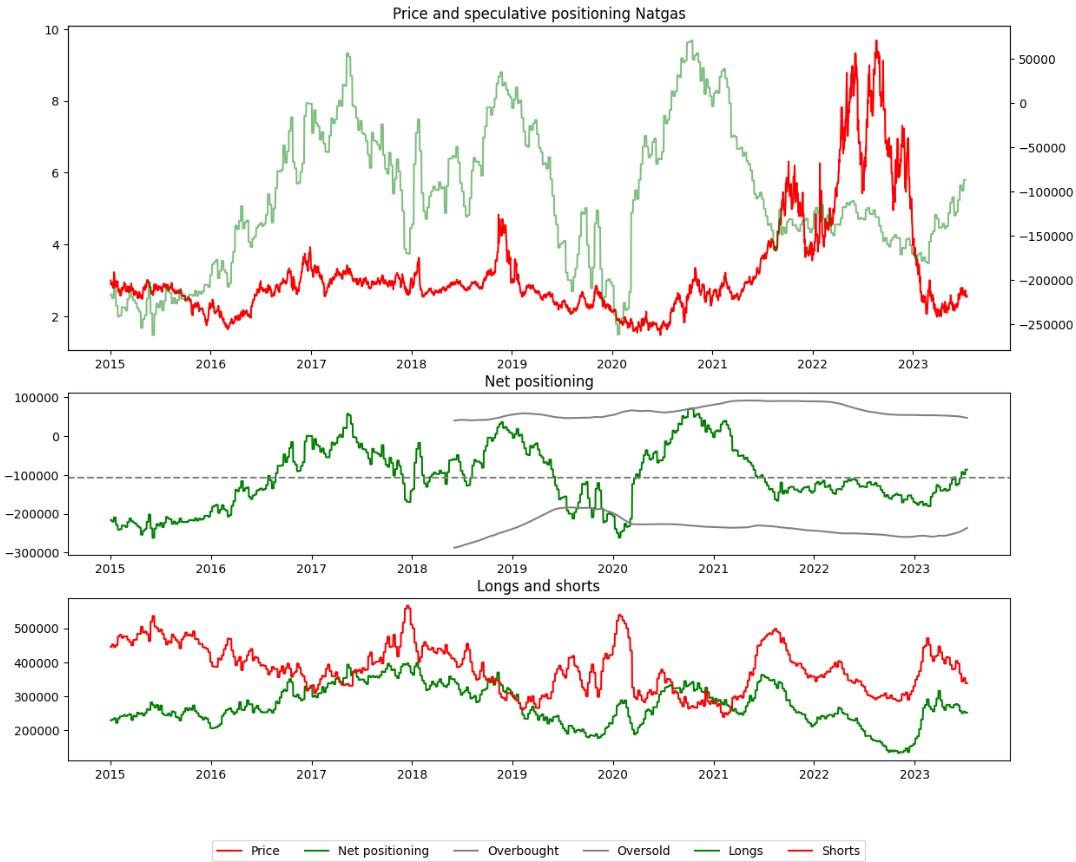

- Positioning continues to increase, mainly due to a reduction in short positions. As the past has shown, only by building a clear positive positioning can stronger later appreciation be achieved

Positioning on gas continues to grow. Source: Bloomberg, XTB

Positioning on gas continues to grow. Source: Bloomberg, XTB

Gas is rebounding from around USD 2.5/MMBTU, with the potential for a morning star formation to be realised. Source: xStation5

Gas is rebounding from around USD 2.5/MMBTU, with the potential for a morning star formation to be realised. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.