In this week’s commodity wrap we present you 4 markets that look interesting or/and have posted some major price moves: Oil, Gold, Sugar, Wheat.

Oil:

-

Russian oil production averaged at 11.42 mbd in December so far, what is an absolute record

-

Russia conformed to reducing output by 228 kbd from 11.41 mbd

-

EIA expects the US shale production to grow to 12 mbd in 2019

-

Permian basin production seen surpassing 4 mbd

-

Oil trades at new multi-month lows, Brent is testing the 50% retracement level of the upward impulse started in 2016

-

Iran threatens to resume nuclear research programme

Oil approaches year’s end at valuations lower than average from the past 5 years. Source: Bloomberg, XTB Research

Oil approaches year’s end at valuations lower than average from the past 5 years. Source: Bloomberg, XTB Research

Oil returns resumed declines. Current sell-off should be just a temporary one, although technical outlook does not bode well for buyers. Source: xStation5

Oil returns resumed declines. Current sell-off should be just a temporary one, although technical outlook does not bode well for buyers. Source: xStation5

Gold:

-

FED guidance for 2019 crucial for gold prices

-

Net positioning begins to favor bulls

-

ETF holdings of gold at the highest level since mid-July

-

Gold added almost 5% during this quarter in comparison to 13% decline achieved by S&P 500

The latest monetary tightening cycle did not harm gold prices. In theory, further acceleration of price growth could support gold prices even if Fed maintains current pace of rate hikes. Source: TradingEconomics

The latest monetary tightening cycle did not harm gold prices. In theory, further acceleration of price growth could support gold prices even if Fed maintains current pace of rate hikes. Source: TradingEconomics

Institutional investors are turning into net buyers of gold. Source: Bloomberg

Institutional investors are turning into net buyers of gold. Source: Bloomberg

Gold trades at relatively low levels when we compare it with the scale of S&P 500 decline. Source: xStation5

Gold trades at relatively low levels when we compare it with the scale of S&P 500 decline. Source: xStation5

Sugar:

-

Rabobank slashed global surplus forecast for the 2018/2019 season from 4,5 million tonnes to 0,5 million tonnes

-

Sugar prices dropped over 15% YTD, second consecutive year of declines

-

Further downside limited by increase ethanol demand in Brazil, further declines on the oil market could theoretically support correction on the sugar market

Sugar prices are quite significantly correlated with oil prices. Further declines on the oil market may drag sugar prices lower as demand for ethanol would drop. Source: TradingEconomics

Sugar prices are quite significantly correlated with oil prices. Further declines on the oil market may drag sugar prices lower as demand for ethanol would drop. Source: TradingEconomics

Supply side starts to dominate USDBRL trading (inverted axis). In theory, it could halt the ongoing sell-off on the sugar market. Source: xStation5

Supply side starts to dominate USDBRL trading (inverted axis). In theory, it could halt the ongoing sell-off on the sugar market. Source: xStation5

Wheat:

-

Rising US wheat prices make Russia grain more attractive

-

Russia decreases exports of its own wheat

-

US wheat exports increased recently

-

China may increase purchases of the US wheat

-

Outlook for wheat market in the latest USDA report remained unchanged

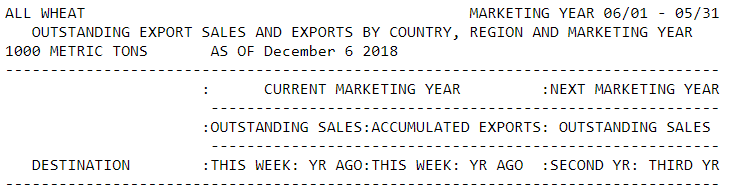

Wheat exports looked quite optimistic recently. Source: USDA

Wheat exports looked quite optimistic recently. Source: USDA

December saw no revision to the global wheat crop or demand outlook. Nevertheless, current trends hint at further output decline and consumption increase. Source: USDA

December saw no revision to the global wheat crop or demand outlook. Nevertheless, current trends hint at further output decline and consumption increase. Source: USDA

Wheat found support in the vicinity of 515 cents per bushel handle. 600 cents area is the first relevant resistance zone to watch. Source: xStation5

Wheat found support in the vicinity of 515 cents per bushel handle. 600 cents area is the first relevant resistance zone to watch. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.