Coinbase (COIN.US) is gaining over 9.0% following a remarkable fourth-quarter performance that surpassed Wall Street's expectations. The cryptocurrency broker reported earnings of $1.04 per share on a revenue of $954 million, notably exceeding analysts' forecasts of 2 cents per share on revenue of $826 million. This positive earnings report led to an increase in Coinbase stock, even though the stock is down almost 5% this year. However, it has more than doubled in the past six months, outpacing gains in Bitcoin and other digital assets.

Company earnings and management commentary

Coinbase's rebound in the digital-asset market significantly boosted its trading revenue, leading to a 51% jump in revenue to $953.8 million, far above the expected $826 million. The net income stood at $273 million, a sharp contrast to the $557 million loss a year earlier. The company’s transaction revenue surged to $529 million, with consumer transaction revenue almost doubling and institutional transaction revenue more than doubling quarter-over-quarter. Coinbase attributed this profitability to strong market conditions and strategic initiatives, although the company urged caution in extrapolating these results for future performance.

Forecasts for the coming years

However, looking ahead, Coinbase is optimistic, with forecasts indicating continued momentum. The company anticipates first-quarter subscription and services revenue to be between $410 million and $480 million, significantly higher than the $367.3 million estimate. Analysts have adjusted their views on Coinbase, with upgrades and positive revisions in revenue estimates for 2024 and 2025. However, the challenges concerning competitive market and legal issues remain valid. The company expects sales and marketing expenses in the first quarter to be between $85 million and $100 million and projects a modest increase in headcount to support product growth, reflecting an overall positive outlook for the near future.

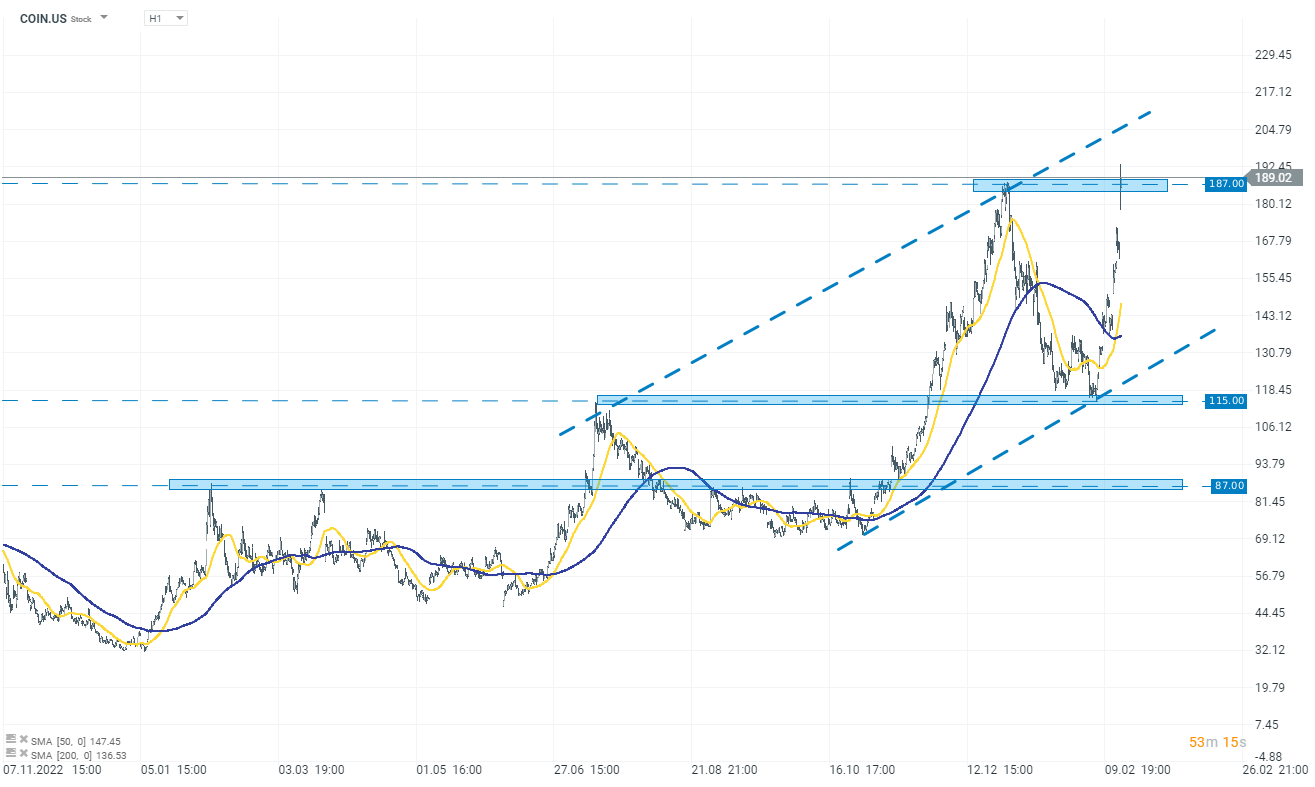

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.