Cocoa pries surge to record, as China sales adds to Apple’s woes, and US economic data is mixed.

By Kathleen Brooks, research director at XTB

Cocoa has surged to $10,000 per tonne for the first time, after a staggering price rally since the start of the year. The price of cocoa futures has risen by more than 130% so far this year, which is more than Nvidia, which is higher by more than 90% so far this year. It now costs more for a tonne of cocoa than a tonne of copper!

Investors ditch chocolate makers as input prices surge

Chocolate is the new luxury good in town, and we expect that sweet treats will see their prices surge in response to this massive price rise. This has also pummeled chocolate makers around the world. The Hershey company in the US is down more than 1.2% on Tuesday, the owner of Cadbury’s, Mondelez International, has seen its share price fall 1.7%.

What’s driving cocoa prices to record highs?

Supply and demand fundamentals have driven the price of cocoa higher this year. Reduced supply from West Africa, the main cocoa growing region, along with a boost in demand is putting upward pressure on the price of cocoa. However, the massive $1,500 rally since Friday suggests that momentum and something other than fundamentals are also driving the cocoa price.

Margin calls also adding to upward price pressure

There is a concern that the financial dynamics of the cocoa market is also putting upward pressure on the price. Cocoa traders who hold long physical positions tend to hedge in the financial markets with short positions. The hope is that any losses made from the hedge is covered by the price increase in the physical position. However, if the cocoa traders are buying their cocoa to hold, and the market is going up almost vertically and setting record highs on a daily basis, then margin calls on the short market positions start to add up. For those who can’t service their margin calls, they need to close their short cocoa positions, which adds further upward pressure to cocoa prices.

Thus, agricultural trading firms that trade in cocoa could also be struggling on the back of this massive rally. According to Bloomberg, the largest cocoa traders include Touton, Cargill and Olam. We will be watching the news closely for any sign that trading houses are in trouble, as this could exacerbate the price action in cocoa even more.

When an asset’s price diverges from fundamentals like this, then there is usually always fallout. This happened after Russia invaded Ukraine, causing the downfall for multiple energy providers. Usually, the smaller players are cleared out first, and we may also see it in this instance.

Chocolate could become a lucky-to-have, not a must-have product in future

Although cocoa had pulled back from the $10,000 level by mid-afternoon UK time on Tuesday, there is a chance that this is a structural shift higher in the price of cocoa, and one that will not be alleviated quickly. For example, although a weak crop yield in west Africa has lowered supply, EU regulations that ban the use of commodities that cause deforestation means that the key European chocolate market now needs to find compliant sources of cocoa, which could add costs to the system. This regulation comes at the same time as the supply deficit has reached a record high of more than 400,000 tonnes. Thus, the high price of cocoa could be here to stay, and chocolate treats in the future may be considered a luxury and a lucky-to-have, rather than an affordable must-have product. For some of us chocoholics, that is a very depressing thought.

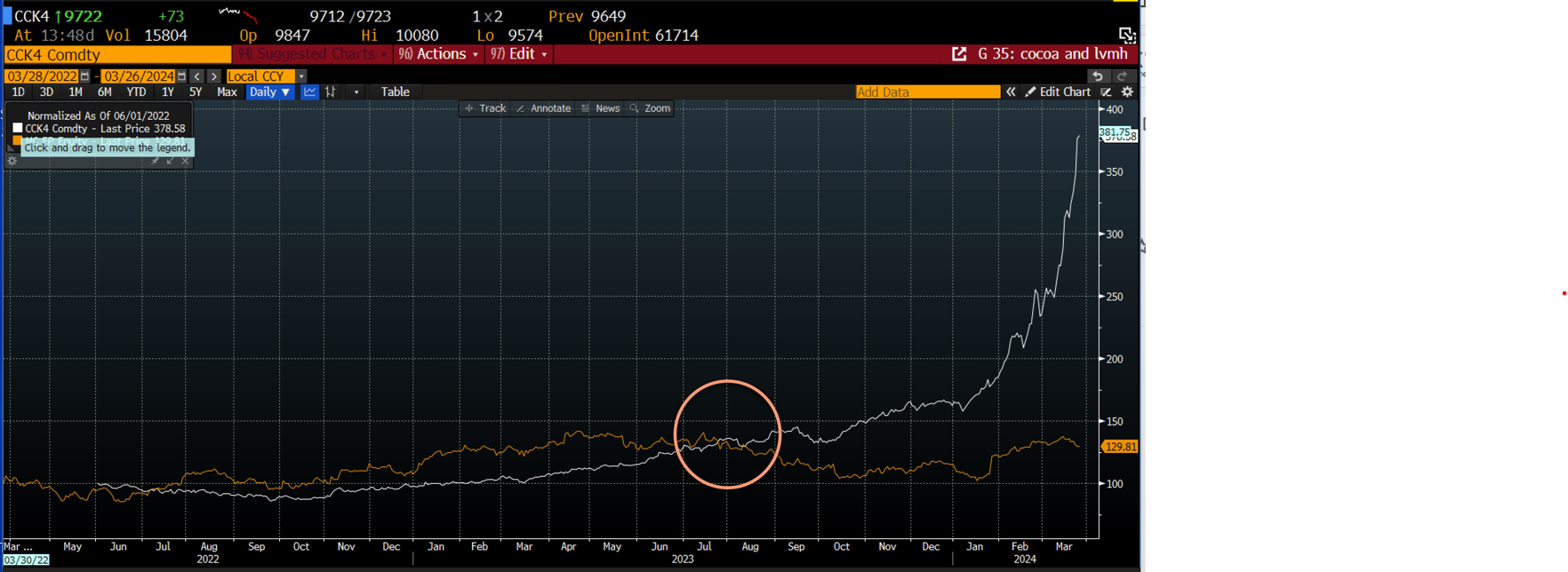

As you can see in the chart below, the price of cocoa is rising at a much faster rate than the price of Louis Vuitton handbags and champagne aka, the LVMH share price. Thus, the future of luxury could be chocolaty!

Chart 1: The diverging fortunes of cocoa and luxury goods stocks

Source: Bloomberg and XTB

Source: Bloomberg and XTB

US economic data fails to give markets direction

Elsewhere, US economic data has been mixed so far this week. New home sales were worse than expected in February, dropping 14.4% on a YoY basis. The Philadelphia Fed non-manufacturing index was weaker than expected, the Dallas Fed manufacturing index was also weaker for March. However, durable goods were stronger for February, with core durable goods rising by 0.5% on the month. S&P CoreLogic house prices for January were slightly weaker than expected, although house prices in the top 20 US cities saw an increase of 6.59% YoY in January. Overall, the US data is not painting a clear picture of the US economy, and this data is unlikely to move the dial for the Fed. Instead, we will need to wait until Friday’s core PCE data to judge whether the three rate cuts from the Fed this year remains reasonable.

Slow grind higher for US equities, as China sours for Apple

US equities have opened slightly higher on Tuesday, although there are few drivers for markets so far this week, which may limit the movement of stocks. However, the small upside means that the S&P 500 is ending the quarter on a high, and the S&P 500 is close to registering a 10% increase in the first quarter of this year.

One major underperformer is Apple, which is lower on Tuesday after reports that shipments to China fell 33% in February YoY. The sharp decrease in Apple’s China sales has weighed heavily on its stock price, which is down nearly 10% YTD, highlighting the diverging fortunes of the Magnificent 7 US tech stocks.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Politics batter the UK bond market once more, as Starmer remains under pressure

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.