Chilean peso is gaining today, with the move being triggered by release of a quarterly monetary policy report by Chile's central bank. To be more precise, a new set of economic forecasts can be named as a reason behind the move. Inflation forecast for end-2024 was boosted from previous 3.8% to 4.2%, while forecast for end-2025 was boosted from 3.0% to 3.6%. GDP forecast for 2024 was narrowed from 2.00-3.00% to 2.25-3.00%, while 2025 forecast was left unchanged at 1.50-2.50%. Domestic demand as well as investment and consumer spending forecasts for 2024 and 2025 were improved as well.

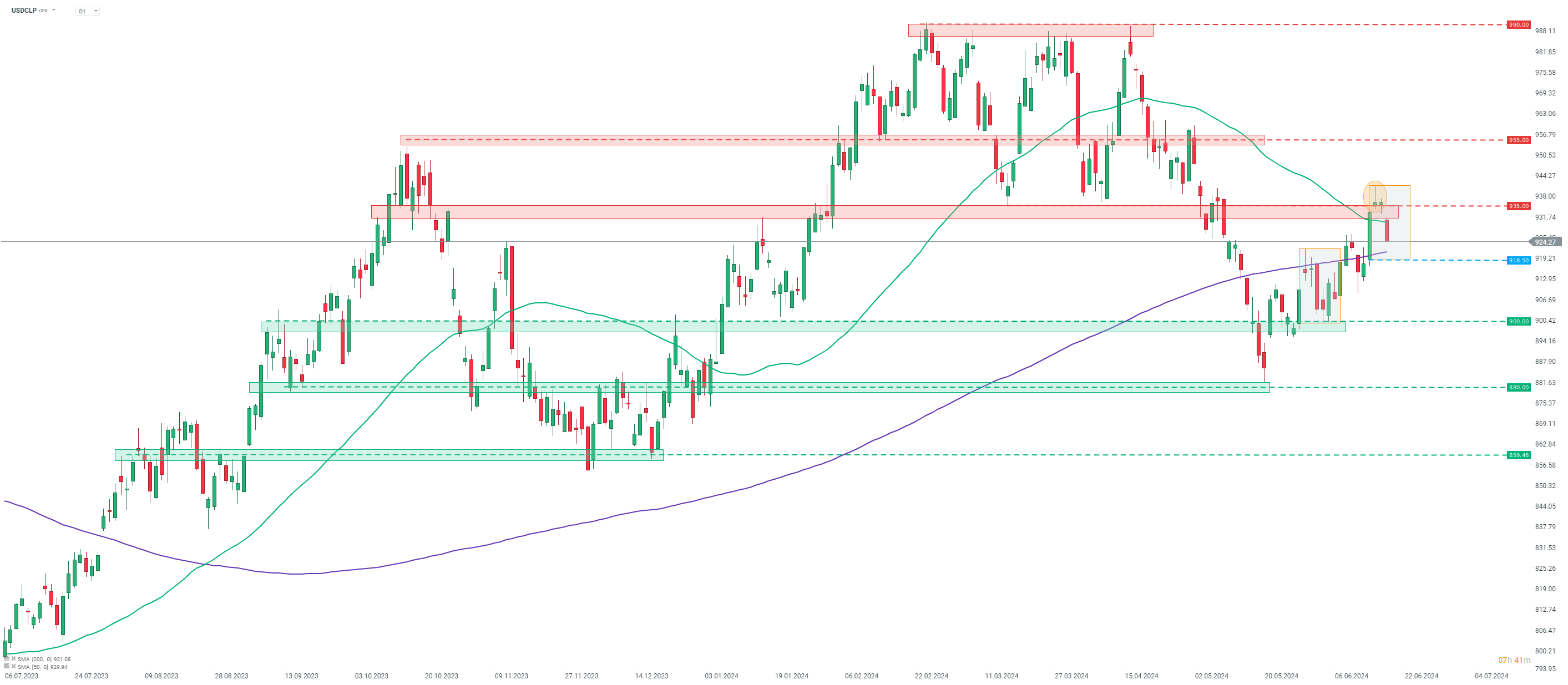

USDCLP is dropping over 1%, with the move likely being supported by limited USD-liquidity due to US holiday today. Taking a look at USDCLP chart at D1 interval, we can see that the pair has recently attempted to break above the 935 resistance zone, but failed to do so, painting a potentially bearish candlestick pattern (orange circle). Pair is dropping back below 50-session moving average today. However, it is too soon to be talking about the end of the ongoing upward correction and a potential short-term trend reversal, as a break below the lower limit of a local market geometry at around 918.50 would be needed.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.