Citigroup (C.US) stock plunged nearly 4.0% after Bloomberg reported that one of the top investment banking companies warned of rising costs and declining revenue. Chief financial officer Mark Mason announced that he expected second-quarter expenses to increase to somewhere between $11.2 billion and $11.6 billion, according to Bloomberg. Meanwhile trading revenue is expected to decline by about 30% compared to previous year’s levels. Today's Fed meeting may turn out to be crucial for Citigroup and other financial companies in the short term. If the central bank maintains its dovish message, treasury yields may fall, which will be negative for financial stocks.

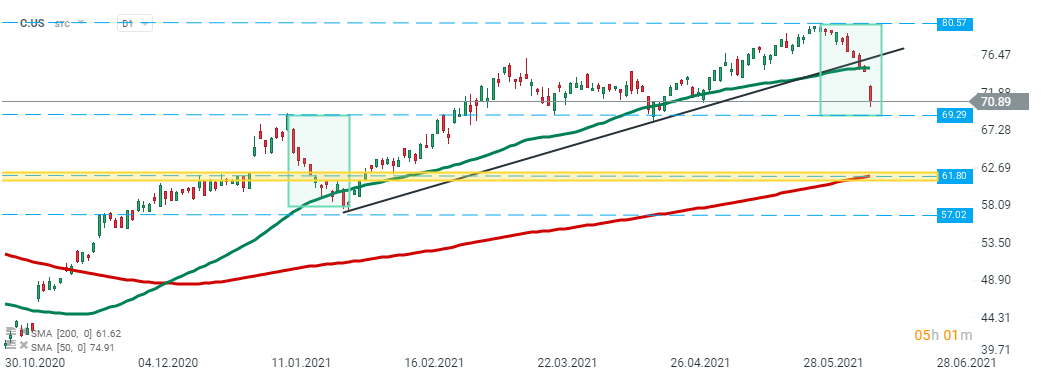

Citigroup (C.US) stock broke below upward trendline and 50 SMA (green line) this week and downward move is being continued today. Stock launched today's session with a bearish price gap and is currently approaching the lower limit of the 1:1 structure at $69.29. Should break lower occur, then downward move may accelerate towards major support at $61.80. Source: xStation5

Citigroup (C.US) stock broke below upward trendline and 50 SMA (green line) this week and downward move is being continued today. Stock launched today's session with a bearish price gap and is currently approaching the lower limit of the 1:1 structure at $69.29. Should break lower occur, then downward move may accelerate towards major support at $61.80. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.