Citigroup (C.US) reported Q4 2022 and full-2022 earnings today ahead of the Wall Street session open. Results turned out to be mixed. Revenue came out to be slightly better-than-expected while earnings missed. Bank reports a solid beat in fixed income trading revenue. Full-year fixed income revenue increased 13% YoY. Situation did not look so rosy in the case of equity trading as Q4 2022 revenue dropped 14% YoY and full-year revenue dropped 9% YoY. Nevertheless, Citigroup said that it is on track to meet its medium-term return targets. However, investors do not seem to be convinced as Citigroup's shares trade almost 3% lower in premarket.

Q4 2022 results

-

Revenue: $18.0 billion vs $17.96 billion expected (+6% YoY)

-

Net income: $2.5 billion (-21% YoY)

-

EPS: $1.16 vs $1.21 expected

-

Fixed income trading revenue: $3.16 billion vs $2.81 billion expected (+31% YoY)

-

Equity trading revenue: $0.79 billion (-14%)

-

Return on equity: 5.0%

Full 2022 results

-

Revenue: $75.3 billion (+5% YoY)

-

Net Income: $14.8 billion (-32% YoY)

-

EPS: $7.00

-

Fixed income trading revenue: $14.55 billion (+13% YoY)

-

Equity trading revenue: $4.56 billion (-9% YoY)

-

Return on Equity: 7.7%

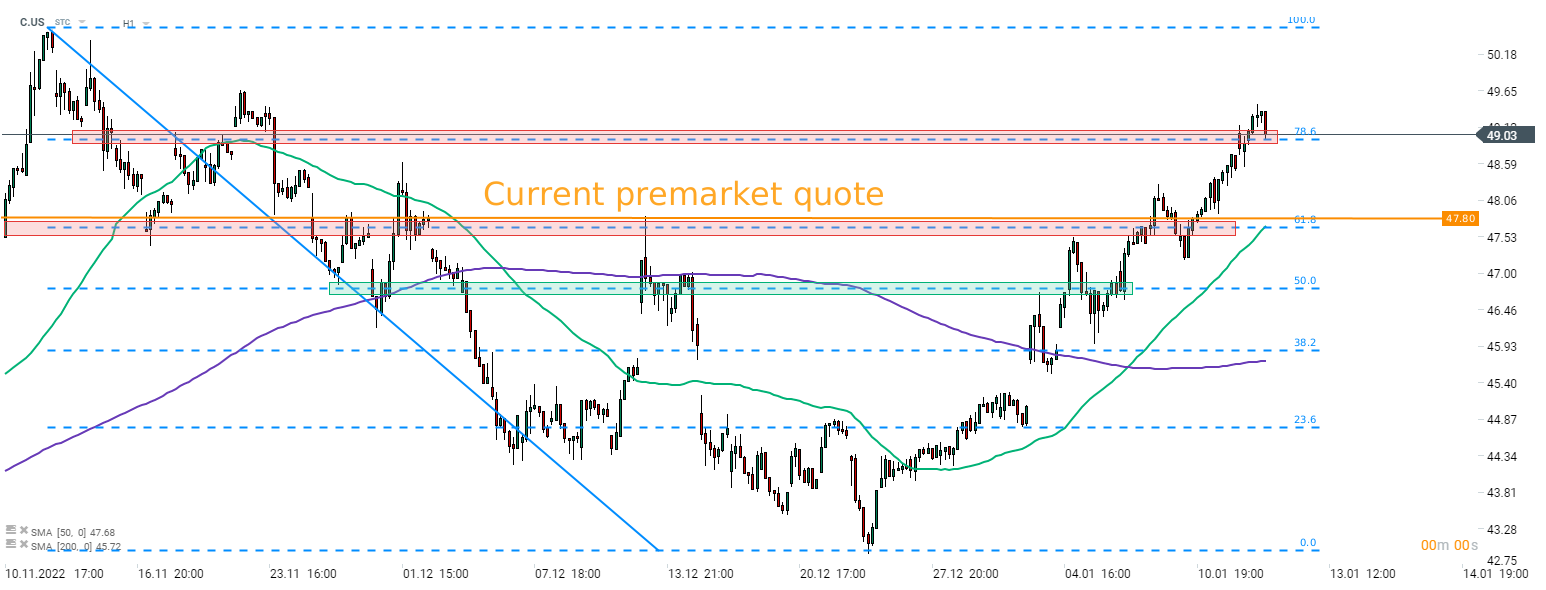

Citigroup stock (C.US) is currently trading around 3% lower in pre-market, around $47.80. A short-term price zone ranging around 61.8% retracement of the downward impulse started in early-November 2022 can be found slightly below this price level. A break back below this area would pave the way for a drop towards the next support in line - 50% retracement in the $46.80 area.

Citigroup (C.US) at H1 interval. Source: xStation5

Rivian Automotive: Rising star or a meteorite?

US OPEN: Valuations under pressure amid deregulation spree

DE40: DAX gains 0.5%📈Lufthansa surges almost 5% amid Kepler recommendation

UK GDP disappointment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.