- Recently, markets have seen deflation risks in China - the forecast of a CPI rebound in August has somewhat alleviated these concerns

- PBoC pledged to reduce systemic real estate market risks, announced more favorable credit conditions to stimulate demand

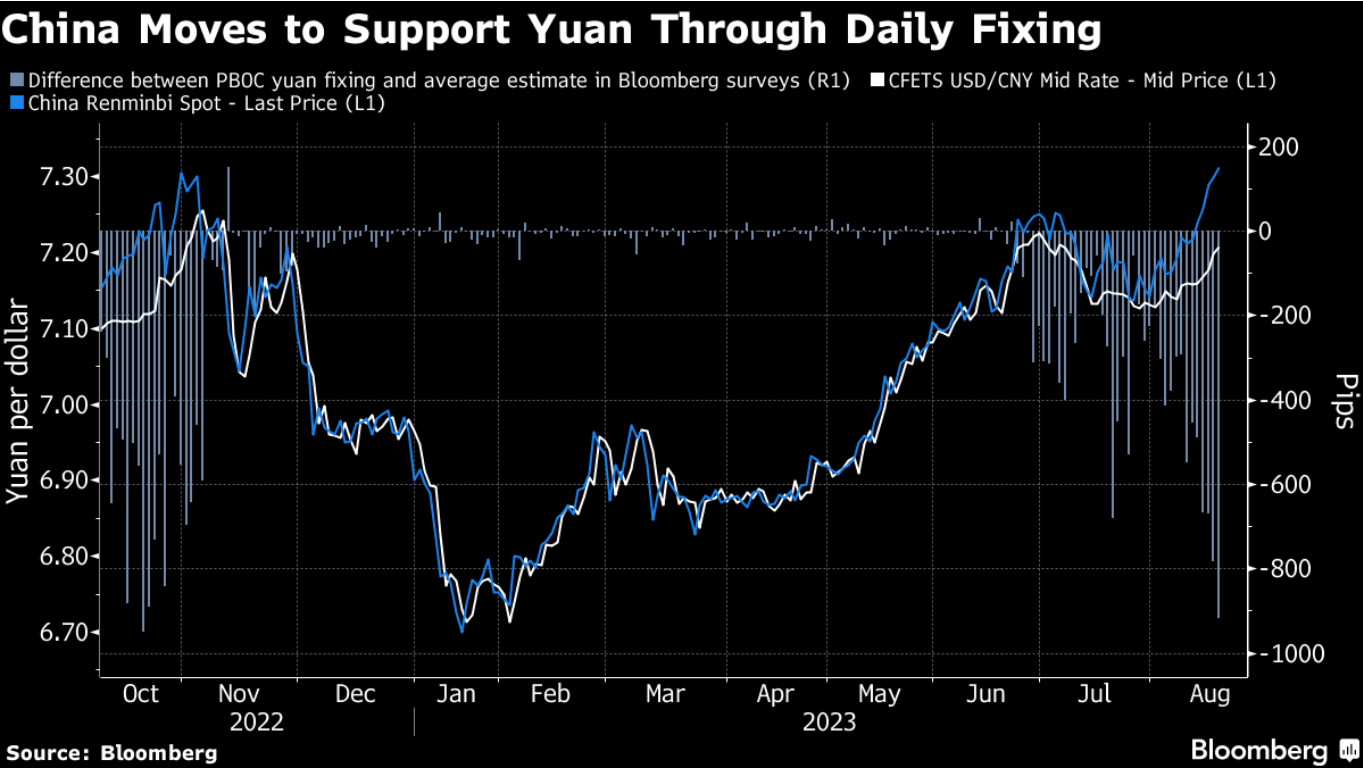

- The Bank of China will defend the yuan exchange rate through targeted monetary policy, foreign exchange interventions and a reduction in foreign exchange reserve requirements

In the PBoC statement, we can read that China's GDP grew by 5.5% y/y, which bankers believe bodes well for the second part of the year. The CPI inflation rate rose by 0.7% y/y . Yuan loans in H1 2023 increased by 2 trillion yuan y/y, to 15.7 trillion (about $2.17 billion). In a statement, the PBoC underscored its commitment to further stimulate domestic consumption to meet the expansion targets of China's economy. Currently, mortgage and corporate lending rates are near historic lows at 3.95 and 4.11%.

While the statement and the bank's stance are not surprising, they came at a time of considerable sell-off in Chinese index contracts and supported the bulls. Shares of e-commerce and technology giants JD.com (JD.US) and Alibaba Holdings (BABA.US) performed well during the Asian stock market session. Shares of systemically important, financially troubled developer Country Garden failed to recover from declines and retreated another 7%. However Chinese market bulls ignored that.

Moreover, the improved sentiment in the Chinese market is due to the strength of the yuan, which is gaining on the wave of massive interventions by Chinese banks in the FX market and the USDCNH pair. Chinese authorities have ordered state-owned banks to step up interventions in the foreign exchange market to prevent a surge in the yuan's volatility, according to people familiar with the matter. Officials are also considering using other tools, such as lowering banks' foreign exchange reserve requirements, to prevent the currency from depreciating sharply. All of this comes on the heels of the PBoC's lower-than-forecast fixing, which has been taking a magnitude of a turn for the worse in recent weeks. Source: Bloomberg Finance L.P.

Moreover, the improved sentiment in the Chinese market is due to the strength of the yuan, which is gaining on the wave of massive interventions by Chinese banks in the FX market and the USDCNH pair. Chinese authorities have ordered state-owned banks to step up interventions in the foreign exchange market to prevent a surge in the yuan's volatility, according to people familiar with the matter. Officials are also considering using other tools, such as lowering banks' foreign exchange reserve requirements, to prevent the currency from depreciating sharply. All of this comes on the heels of the PBoC's lower-than-forecast fixing, which has been taking a magnitude of a turn for the worse in recent weeks. Source: Bloomberg Finance L.P.

Looking at CHNComp at H4 interval, the index has bounced off the important psychological support of 6100 points set by previous price reactions. If the current upward momentum won't be maintained, the base scenario will become a retest of the 61.8 and 71.6 Fibonacci abolition of the upward wave from the fall of 2022. Source: xStation5

Looking at CHNComp at H4 interval, the index has bounced off the important psychological support of 6100 points set by previous price reactions. If the current upward momentum won't be maintained, the base scenario will become a retest of the 61.8 and 71.6 Fibonacci abolition of the upward wave from the fall of 2022. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market update: recovery takes hold, but investors remain on edge

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.