Futures on Chinese Hang Seng China Enterprises Index (CHN.cash) are rising today above 6000 points after a very strong session in China. Fitch Ratings revised outlook on China economy to negative, with affirmed 'A+' rating. Another agency, Moody’s in December slapped a downgrade warning on China’s credit rating. Moody's cited the costs to bail out local governments and state firms, while controlling a property crisis. However, Fitch doesn't expect further deflation in the country, which may be seen as quite 'bullish', despite the lowered overall outlook. China’s factory output and retail sales topped forecasts in January-February period,

- Outlook revision reflects increasing risks to China's public finance The agency believes that fiscal policy is likely to play an important role in supporting growth in coming years

- Fitch forecasts general China government deficit to rise to 7.1% of GDP in 2024. What's more 2024 deficit will be highest since 8.6% of GDP deficit in 2020

- General government debt (local and central government debt) to rise to 61.3% of GDP in 2024 (54.0% 'A' median) from 56.1% in 2023. It's deterioration from 38.5% in 2019, when Chinese debt was well below the peer median, due primarily to sustained fiscal support to counter economic pressures.

- Debt as a share of revenue is forecast to be 234% in 2024, well above the 145% 'A' median. Fitch forecasts the debt ratio to rise to 64.2% in 2025 and nearly 70% by 2028 vs < 60% in our previous review

- The degree to which fiscal support reignites underlying GDP growth is a key uncertainty for our debt path. Risks from higher government debt are mitigated by a high domestic savings rate, which supports debt affordability and financing flexibility.

- China GDP growth to moderate to 4.5% in 2024, from 5.2% in 2023. Fitch doesn't forecast a prolonged period of deflation. Inflation outlook is set at 0.7% by end-2024 and 1.3% by end-2025

- According to Fich, the revision reflects increasing risks to China’s public finance outlook as the country contends with more uncertain economic prospects amid a transition away from property-reliant growth to a more 'sustainable' growth model, supported by government.

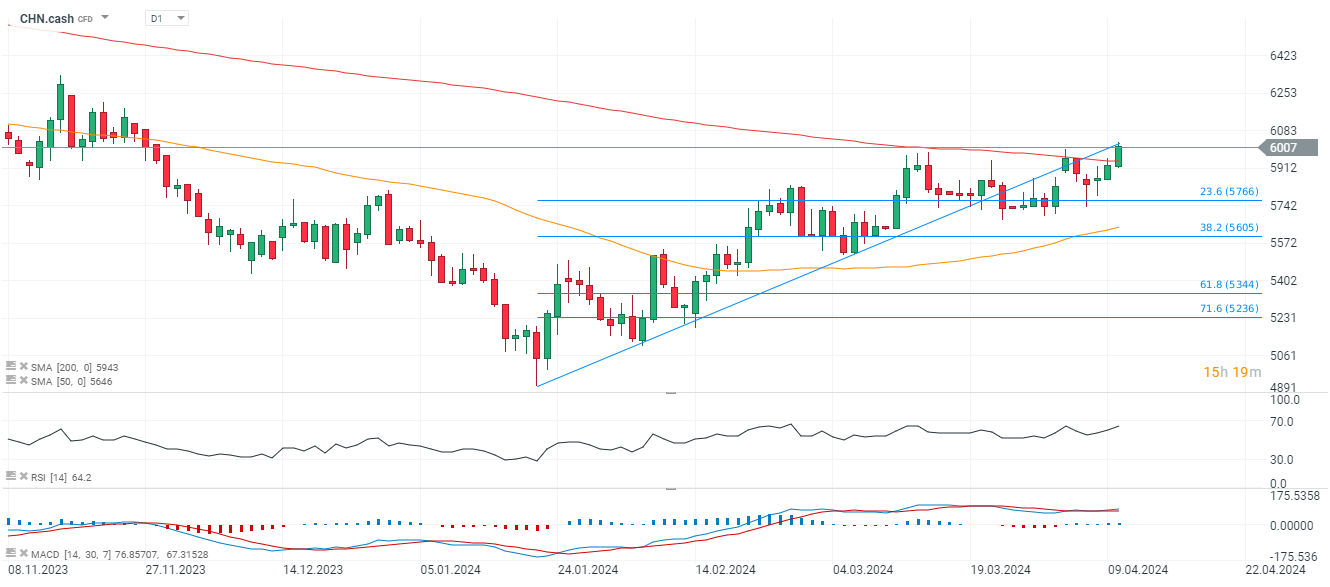

CHN.cash (D1)

Futures on Hang Seng Index (CHN.cash) increased today above major resistance level of SMA200 (red line) near 6000 points.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.