Summary:

- China is reportedly increasingly reluctant to agree to a broad trade deal with the US

- A Chinese offer to Washington, which will be submitted later this week, will not include commitments on reforming Chinese industrial policy or the government subsidies

- Equities begin the week in rather dismal mood, yen and gold trade slightly higher

Although US indices finished the last week with solid gains exceeding 1.4% in the aftermath of the robust employment report, bullish sentiment has been trimmed at the beginning of another week following somewhat worrisome comments from Chinese officials. They signalled they were increasingly reluctant to agree to a broad trade agreement with the United States. As a result, its offer to Washington, which will be put forward later this week, will not include commitments on reforming Chinese industrial policy or the government subsidies - one of the Trump administration’s core demands.

On top of that, people being close to the Trump administration said the impeachment inquiry was not affecting trade talks with China. In response to these revelations SP500 futures have moved down along with indices in Japan and South Korea. At the same time, the Japanese yen and gold have advanced to some extent. In our view these comments have lowered odds for any trade agreement in the foreseeable future between the two feuding countries. On the other hand, markets should have already got accustomed to ups and downs in terms of trade negotiations, hence a bearish reaction across financial markets could be temporary.

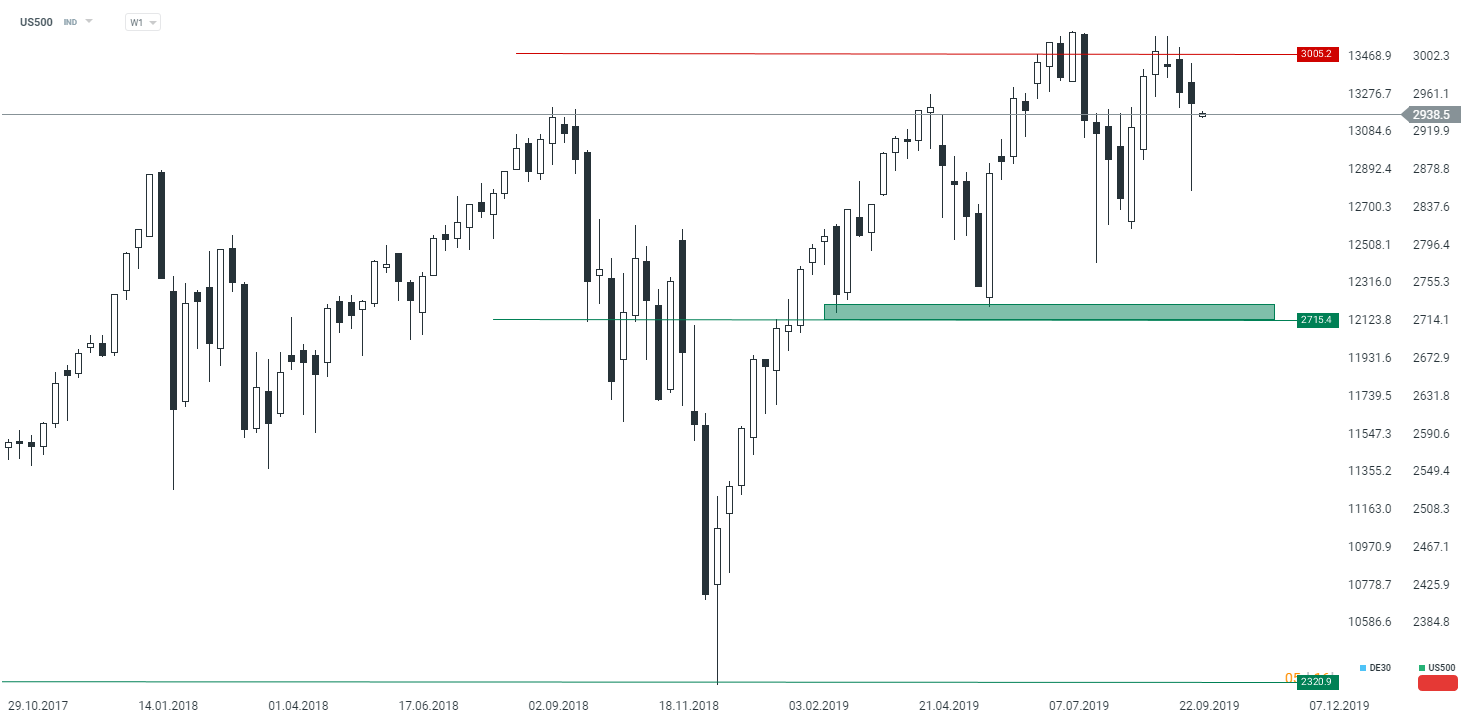

US500 has begun the new trading week lower following the declines registered in the past two weeks. Source: xStation5

US500 has begun the new trading week lower following the declines registered in the past two weeks. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.