Chinese inflation data was released during the Asian trading session today. Both CPI and PPI inflation data came in much below market expectations.

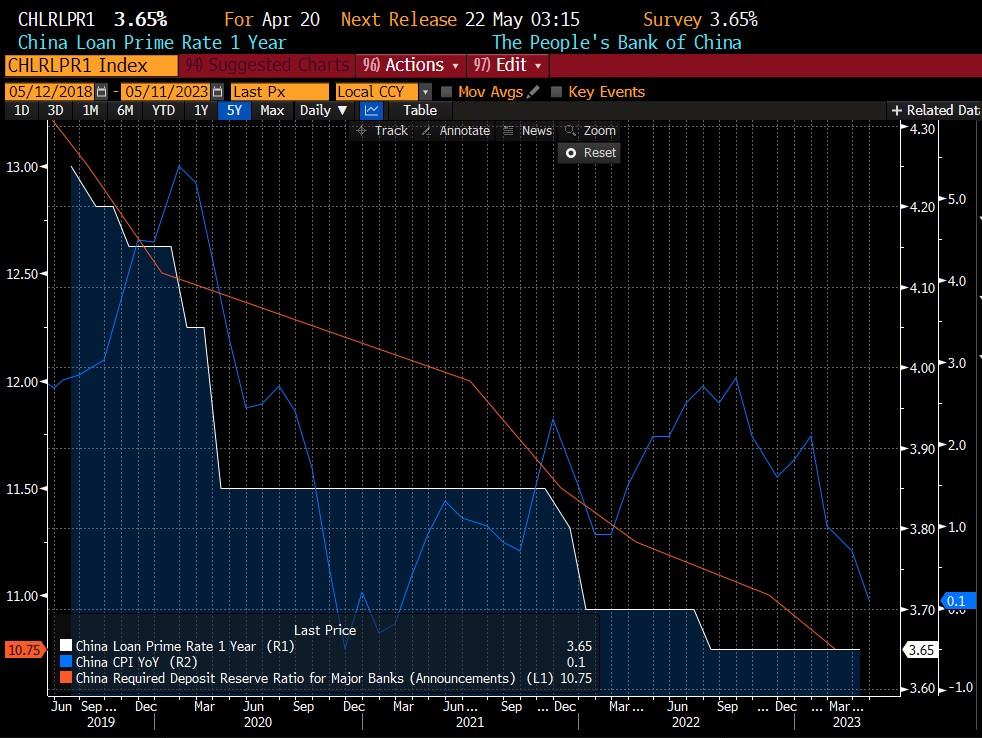

Headline CPI slowed from 0.7% to 0.1% YoY while the market expected it to drop to 0.3% YoY. Meanwhile, PPI inflation dropped further into negative territory, moving from -2.5% to -3.6% YoY (exp. -3.3% YoY).

Such a low price growth give People's Bank of China reasons to ease its policy. PBoC could do so by either lowering the main interest rate or by cutting reserve requirement ratio. While the main interest rate in China sits at 3.65% currently, reserve requirement ratio is at 10.75%, which is very high compared to RRR in developed countries.

In theory, today's Chinese inflation reading is positive news for commodities.

Inflation and interest rates in China. Source: Bloomberg

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.