- "Phase One" trade agreement may be signed in early January

- Key issues to be discussed in "Phase Two" negotations

- Trump may prefer to wait with next stage agreement until after US elections

- Chinese index (CHNComp) tests upper limit of trading range

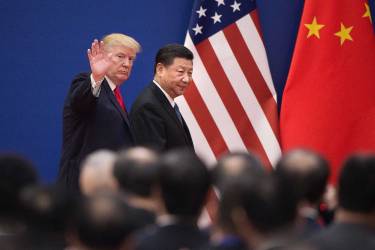

United States and China has been wrestling over trade for nearly two years and the topic dominated financial markets throughout 2019. However, just as the year was nearing an end, both countries announced that they have reached a “Phase One” deal, that the market was awaiting. Below we provide a quick recap of what’s going on in Sino-US relations and when the deal could be signed.

What is included in “Phase One” deal?

The main provision of the “Phase One” trade agreement is cancellation of retaliatory tariffs that were set to go live in mid-December. Moreover, the United States will halve tariffs imposed on the 1st of September. China has agreed to substantially increase purchases of US goods and services. Total increase is said to amount to at least $200 billion over the next two years. Purchases of US agricultural products will increase by $32 billion over the next two years, bringing annual purchases to around $40 billion. China will also bolster legal protections for patents, trademarks and copyrights and will refrain from competitive currency devaluations.

When “Phase One” deal could be signed?

Specific date for signing of the “Phase One” deal has not been set yet. However, when could it happen? Donald Trump keeps repeating that the deal will be signed “very soon” and he might have a point. The World Economic Forum in Davos that will take place between 21st and 24th of January 2020 was named as an opportunity to sign the agreement. Nevertheless, recent reports suggest that Xi Jinping will not attend the event. However, it is said that Vice Premier Liu He will travel to Washington in early January to sign the deal. This view was also confirmed by the US Trade Representative, Robert Lighthizer.

What is at stake?

While Trump keeps saying that it is China who desperately needs the deal, the truth is that both sides need it. China wants to maintain annual pace of economic growth above the 6% mark and, in order to this, it needs healthy trade with the world’s largest economy. Meanwhile, election year is just around the corner in the United States and Trump will do everything he can to secure re-election. It is not a secret that trade war has caused damage to the US economy and Trump needs to assure voters that the best is yet to come and his policy are working. Currently polls are showing more or less equal support for either Republican or Democrat candidate and failure to win more concessions from China could cost Trump his White House job.

Is reaching ‘Phase Two’ agreement possible anytime soon?

“Phase One” deal does not fully address some of the key US complaints, for example theft of intellectual property. Harder issues were left for the “Phase Two” negotiations. These are expected to begin once the “Phase One” is completed. However, it seems unlikely that any “Phase Two” agreement will be signed ahead of the US elections. First of all, given how slowly “Phase One” talks progressed it is unlikely that resolving key issues is possible within less than a year. Moreover, Trump will not be willing to sign any deal at any cost. Why? Because it could be risky for him. Signing a ‘weak’ deal would harm Trump’s support as it would be a sign of weakness. Pressuring China too much could result in China withdrawing from its agriculture purchase commitments, what also would harm Trump’s support in key states. Meanwhile, China seems to be fine with current tariff reductions and, given Trump’s turbulent character, may stay passive not to trigger any tariff action. Summing up, it seems likely that trade talks will continue next year and investors will be offered numerous “optimistic” comments but it seems unlikely that any deal other than “Phase One” will be signed anytime soon.

The Chinese index (CHNComp) jumped over 8% during the past 20 or so sessions and is trading at the highest level since early-May 2019. Should the upbeat moods prevail, the index could finally break above the resistance zone ranging above the 11000 pts mark and leave months-long trading range. Such a move would pave the way towards 2019 highs at around 11800 pts. Source: xStation5

The Chinese index (CHNComp) jumped over 8% during the past 20 or so sessions and is trading at the highest level since early-May 2019. Should the upbeat moods prevail, the index could finally break above the resistance zone ranging above the 11000 pts mark and leave months-long trading range. Such a move would pave the way towards 2019 highs at around 11800 pts. Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Markets attempt to rally on positive news from Iran

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.