Erdogan and his administration decided on a set of measures aimed at stabilizing the situation on TRY this week. This resulted in a strong strengthening of the Turkish currency. The recent sell-off on the USDTRY currency pair reached more than 40%, however, it should be noted that the pair is trading at over 50% higher year to date. Despite the measures taken, the fundamental factors are negative for the lira and speculators may soon return to shorting Turkish lira and testing limits of central bank and government ability to defend the TRY rate.

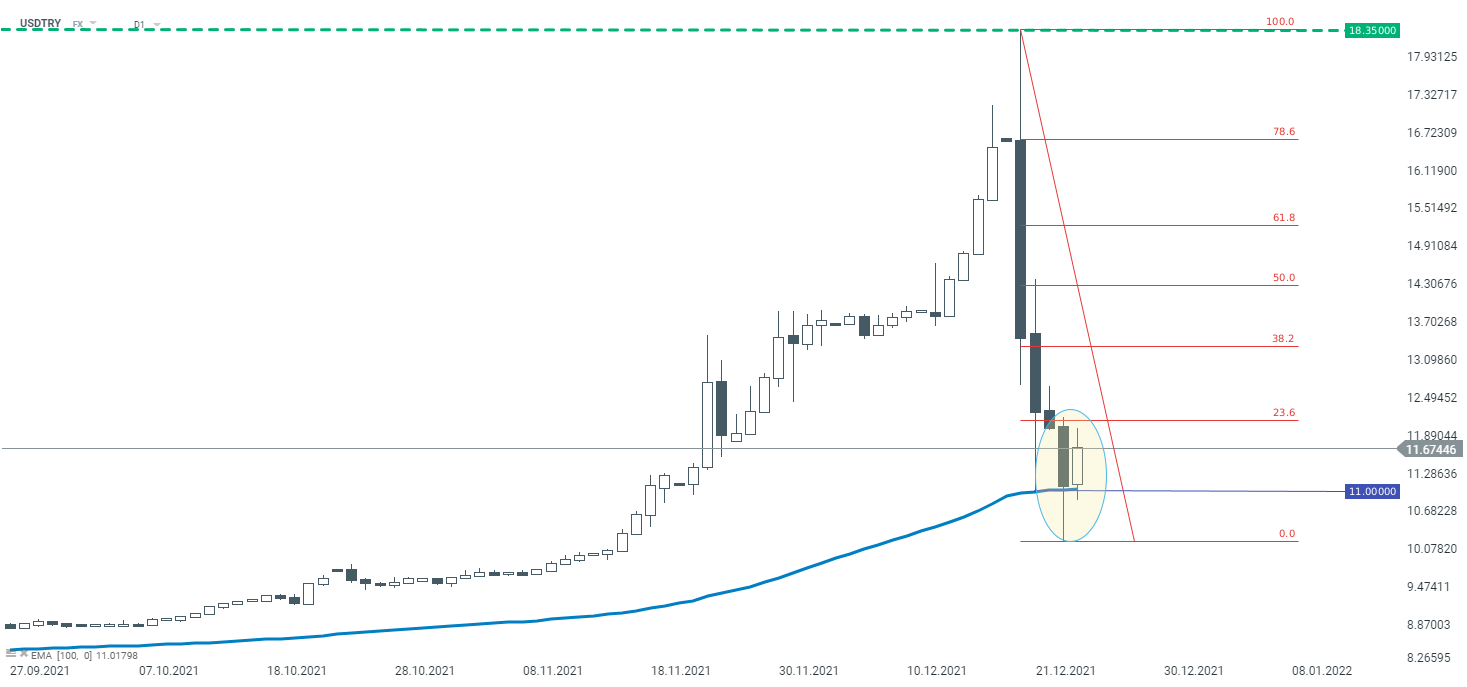

Looking at the D1 chart, if the today's bullish sentiment continues until the end of the day, there is a chance for painting a bullish engulfing pattern, which usually heralds an upward move. In addition, one should see, the rebound occurred at the height of the important support - the 100 -period moving average (11.00), which may encourage the market bulls to be more active. In case of an upward movement happen, the internal Fibonacci retracements should be considered as nearest resistances.

USDTRY D1 interval. Source: xStation5

USDTRY D1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.